Intellia Therapeutics, Inc. NTLA is a clinical-stage genome editing company that focuses on developing CRISPR/Cas9-based therapeutics. The company’s pipeline includes NTLA-2001 for treating transthyretin (ATTR) amyloidosis, NTLA-2002 for treating hereditary angioedema (HAE), and NTLA-3001 for the treatment of alpha-1 antitrypsin deficiency (AATD)-associated lung disease.

Strategic Priorities and Milestones

Earlier this month, Intellia outlined key strategic priorities and milestones targeted through 2026. NTLA-2001, the company’s flagship candidate, has entered pivotal phase III MAGNITUDE study for the treatment of ATTR amyloidosis with cardiomyopathy (ATTR-CM), with the first patient likely to be dosed later in the first quarter of 2024.

The company is also preparing for a phase III study to evaluate NTLA-2001 for the treatment of ATTR amyloidosis with polyneuropathy (ATTRv-PN). Furthermore, NTLA-2001 is part of Intellia’s co-development and co-promotion agreement with Regeneron Pharmaceuticals REGN. While Intellia leads the deal, both companies share development costs and commercial profits.

Stock Performance and Market Position

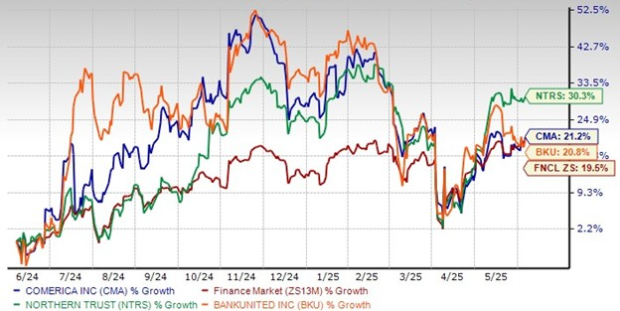

Despite these advancements, Intellia’s stock has seen a 22.7% decline in the past year, compared with a 12.5% industry decline. This underperformance poses a concern for investors, and the company needs to address this issue effectively.

Prospects for Other Stocks in the Healthcare Sector

Intellia currently holds a Zacks Rank #2 (Buy). In addition to this, there are other promising stocks in the healthcare sector such as CytomX Therapeutics, Inc. CTMX and Puma Biotechnology, Inc. PBYI, each with a Zacks Rank #1 (Strong Buy) at present.

Future Direction and Industry Impact

Beyond its financial prospects, Intellia remains focused on launching several studies, including in vivo and ex vivo programs targeting an expanded range of diseases over the next couple of years.

Conclusion

Is Intellia (NTLA) stock a smart investment at this moment? As the company implements its strategic priorities and progresses with its clinical studies, investors are likely to keep close tabs on Intellia, waiting to see the impact of its genomic medicine development.

While the stock’s recent performance raises concerns, it could present a buying opportunity for investors with a long-term horizon. As always, cautious optimism, patience, and keen analysis will be the key to making informed investment decisions.