Bucking the industry trends, Ralph Lauren Corporation RL is positioning itself dominantly amidst the ebb and flow of the fashion world. The company’s digital initiatives and robust strategies have set the stage for it to capitalize on favorable market trends. With a keen focus on fortifying its digital capabilities, strengthening customer relationships through targeted marketing, and expanding globally while maintaining cost efficiency, the Company is poised for significant growth.

Riding the Upward Momentum

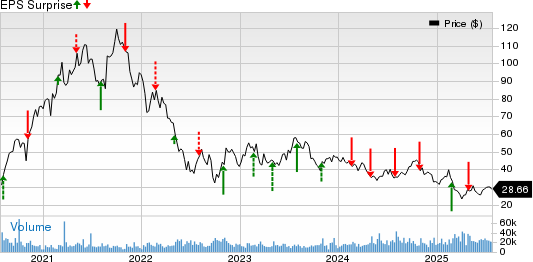

Amidst the challenging landscape, the company has surged ahead, with a notable 16.6% increase in its share value over the past year compared to the overall industry growth of 8.9%. Adding to its allure is a Value Score of B, further bolstering its current Zacks Rank #3 (Hold) standing.

Exploring Further

The success of Ralph Lauren’s “Next Great Chapter” plan is particularly encouraging. The completion of the transition of Chaps to a licensed business marks the conclusion of its portfolio realignment announced the previous year. This move positions the company to concentrate on its core brands, aligning with the overarching “Next Great Chapter” elevation strategy. Additionally, the company’s focus on product advancement, customized and targeted promotion, disciplined inventory management, and a favorable channel and geographic mix has set the stage for further success.

Moreover, the company’s investment in expanding its digital and omnichannel capabilities, including mobile, omnichannel, and fulfillment, has been a significant driver of its progress. The launch of the Ralph Lauren mobile app, the company’s very first comprehensive catalog app, underscores its commitment to personalized, content-rich experiences for its customers.

The company’s ambitious “Next Great Chapter” plan announced in June 2018 has continued to yield positive results. Through a series of measures designed to simplify its global organizational structure and enhance its technological capabilities, Ralph Lauren is on track to surpass its top and bottom-line targets.

Investor Confidence

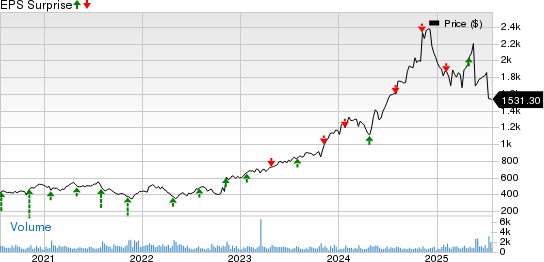

Market analysts are bullish on Ralph Lauren’s future, with the Zacks Consensus Estimate for fiscal 2024 sales and earnings per share (EPS) projecting year-over-year growth of 1.4% and 13.1%, respectively. Looking further ahead, the consensus estimate for fiscal 2025 sales and EPS anticipates increases of 4.4% and 10.9%, respectively.

In light of these indicators, Ralph Lauren presents itself as an attractive investment prospect, with its well-rounded strengths.

Exploring Alternatives

In addition to Ralph Lauren, some other standout companies in the sector include GIII Apparel (GIII), lululemon athletica (LULU), and Royal Caribbean (RCL).

Notably, GIII Apparel, with a Zacks Rank #1 (Strong Buy), has demonstrated solid performance, boasting a trailing four-quarter earnings surprise of 541.8%, on average. Similarly, LULU has been a significant player, with a Zacks Rank #2 (Buy) and a trailing four-quarter earnings surprise of 9.2%, on average. Meanwhile, Royal Caribbean, carrying a Zacks Rank of 2, has also shown resilience, with a trailing four-quarter earnings surprise of 28.3%, on average.

The Zacks Consensus Estimate for these companies also reflects their growth potential, emphasizing the positive sentiment surrounding them.

Zacks Investment Research has identified a “Sleeper” stock positioned at the forefront of the burgeoning Artificial Intelligence sector. The potential impact of this sector, estimated at $15.7 Trillion by 2030, underscores the significance of this company’s presence. As an added bonus, Zacks offers a comprehensive report detailing this stock and four other compelling options.

Download Free ChatGPT Stock Report Right Now >>

In conclusion, Ralph Lauren stands out as a formidable player in the fashion industry, riding the wave of success while positioning itself for sustained growth and profitability.

Read the original article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.