Investing in Growth and Stability

Investors often seek out companies with strong growth potential, aiming for above-average earnings and revenue expansion. While this strategy can be quite volatile, identifying firms with positive earnings estimates, robust management, and solid liquidity can offer a stable footing in an unpredictable market.

NVIDIA: A Graphic Vision for Growth

Renowned among investors, NVIDIA continues to shine as a beacon for growth-seekers. Projections for its current fiscal year indicate an extraordinary 270% surge in earnings and a 120% rise in revenue. Looking further ahead to FY25, even more growth is on the horizon, with earnings estimated to climb 63% and revenue to surge by 53%.

Consistently rising analyst expectations have earned NVIDIA a favorable Zacks Rank #2 (Buy). The company’s focus on Data Center sales, including revenue from AI chips, has propelled its year-over-year sales by a staggering 280%, reaching a record $14.5 billion in the latest quarterly report.

The remarkable share performance mirrors this growth, with NVIDIA’s stock soaring by 240% in the last year, dwarfing the S&P 500’s modest 25% climb.

FirstCash Holdings: Pawning a Promising Future

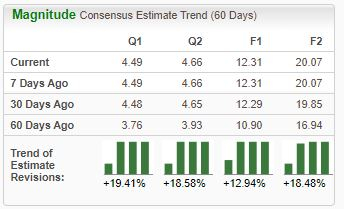

FirstCash (Ticker: FCFS) stands as one of the globe’s largest pawn shop operators, also providing advanced point-of-sale payment solutions. The company’s earnings are predicted to grow by 13%, with a 15% rise in revenues for the current year (FY23). Expectations for FY24 indicate a further 21% earnings leap alongside an 8% sales upswing.

Adding to its appeal, the stock offers a solid dividend, currently yielding 1.3% annually. Furthermore, the company has impressively increased its dividend payout, boasting a 7.6% five-year annualized growth rate.

FirstCash has expanded its footprint significantly, opening 104 new pawn stores in the latest quarter. Continuously surpassing earnings estimates for 17 consecutive quarters, the company’s sustained growth trajectory is undeniable.

OneSpaWorld: Setting Sail for Prosperity

OneSpaWorld leads the charge as a pioneer in wellness, beauty, and rejuvenation both at sea and on land. The stock, sporting a Zacks Rank #2 (Buy), has witnessed a bullish trend in earnings revisions, spiking by 40% over the past year to $0.67 per share for the current fiscal year. This translates to a remarkable 140% year-over-year earnings surge, paired with a 45% expansion in revenue.

The latest quarterly report showcased robust results, with revenues climbing 33% year-over-year to reach a record $216 million. Furthermore, the company consistently surpassed EPS estimates, exceeding expectations by an average of 20% across the last four quarters.

With the stock gaining momentum following the latest report, investors eagerly anticipate the next update scheduled for late February.

The Road to Alpha

Above-average sales and earnings growth often pave the way for share outperformance, a welcome prospect for any investor. While growth investing can be tumultuous, selecting companies with effective management and strong liquidity can help mitigate concerns.

All three stocks – FirstCash FCFS, OneSpaWorld OSW, and NVIDIA NVDA – stand as fitting candidates for those seeking growth with a touch of stability.

Zacks Reveals ChatGPT “Sleeper” Stock

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

FirstCash Holdings, Inc. (FCFS) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.