Co-authored with “Hidden Opportunities.”

Investing in the financial markets is the most proven and publicly accessible way of growing wealth. Investors of a wide range of economic backgrounds and intelligence have used it to achieve their financial goals, but few have succeeded by approaching the markets with the expectation of getting rich quickly.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” – Benjamin Graham, Father of Value Investing.

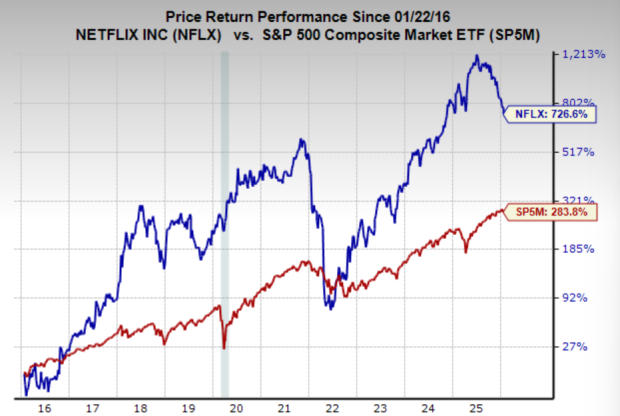

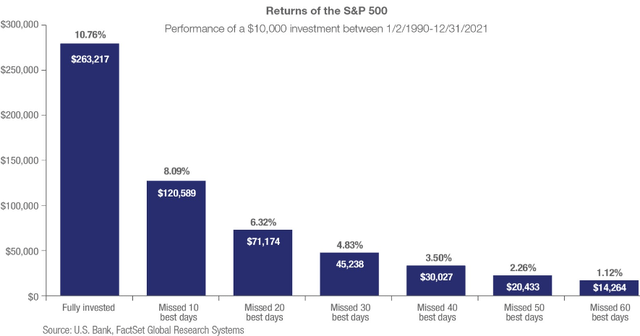

It is not unusual for stocks to drop 10% to 20% or more in value over a short period. Investors have seized the opportunity to ride out some of these highs and lows over decades to generate excellent long-term returns. A study of the past 120 years shows that those who stayed fully invested through the storm substantially outperformed those who tried to pick bottoms.

A buy-and-hold strategy can help investors avoid missing out on the market’s biggest days, and we believe dividends provide an added incentive to stay invested. It takes a second to sell, but it could take a bit more thinking to sell a holding that pays $X/month. After all, if you are selling a reliable source of income, wouldn’t it be easier to ride the ups and downs of the market while collecting those paychecks?

Let’s review two monthly payers to boost your passive income and financial stability.

UTG – A Defensive Dividend Play

As consumers of a wide range of goods and services, we stumble into many marketing campaigns offering steep and attractive discounts. Everyone loves a bargain, making businesses offer attractive deals strategically during holidays to compete in the market and grab market share effectively. But I can’t help but notice how two prominent industries rarely offer discounts or incentives to attract customers.

These industries where companies typically do not offer discounts or promotions to attract customers often fall into categories where demand is consistently high, and the products or services are considered essential or specialized. Pharmaceuticals and healthcare is one notable industry, and the second is utilities.

Utilities comprise one of the most defensive segments of the economy because households and corporations keep the lights on even when the economy is in its darkest hour. Yet, this sector pulled back in 2023 as investors shifted their favor away from defensive stocks towards CDs and money-market funds.

A decline in interest rates would be a positive for utility stocks, as it would make the dividends they pay more attractive (and competitive) in comparison, and investors will see significant capital upside. Regulated utilities have the ability to pass through incremental debt financing costs and rising prices to customers through rate-base requests with regulators. The inelasticity of demand and strong pricing power make utilities excellent to own amidst an economic slowdown.

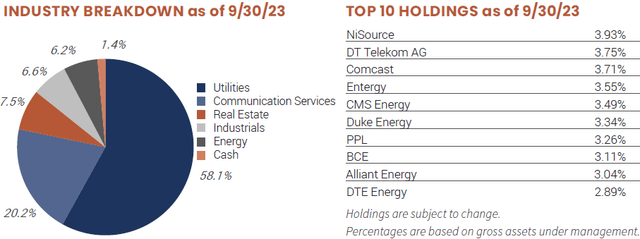

Reaves Utility Income Fund (UTG) is a CEF (Closed-End Fund) comprising 55 holdings, with its top 10 positions being some of the most prominent providers of energy and telecom services to a vast population in North America. Source.

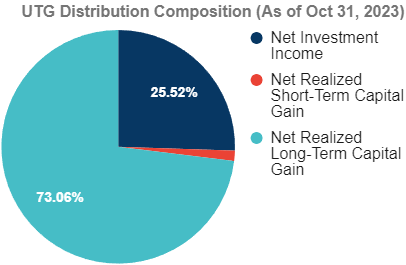

UTG‘s fiscal year runs from November 1 to October 31. As such, the CEF’s FY 2023 distributions came from net investment income and long-term capital gains, bringing notable tax benefits for income investors.

UTG pays monthly distributions; the November distribution (the first month of UTG’s FY 2024) was 85% long-term gains and 15% NII. Markets rarely move linearly, and the CEF’s ability to realize substantial capital gains during a year when the utility sector traded at one of the most significant discounts to the S&P 500 in the past 20 years emphasizes the benefit of active management.

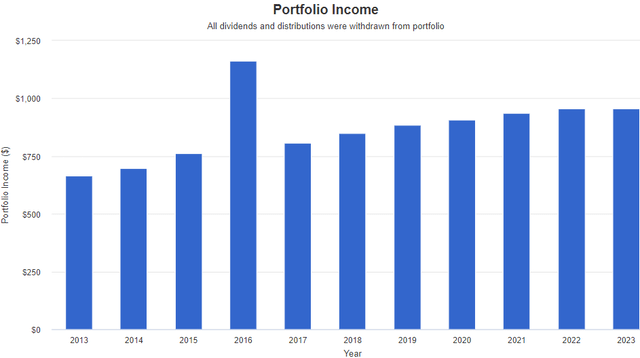

Ten years ago, $10,000 invested in UTG would have inventors sitting on an equity position worth over $11,000, and the distributions collected to date would amount to $9,425. Growing income is the outcome of UTG’s composition of stable and predictable businesses and its experienced and shareholder-friendly management. Source.

In May 2023, UTG’s semi-annual report revealed almost 1.5 years’ worth of distributions were unrealized gains, and we expect this to continue improving in the coming months. Utility sector valuations have started recovering, as seen from UTG’s NAV recovery in recent weeks, and the end of the rate cycle and declining rates will make these bond proxies loved again. At a 1% premium to NAV, UTG presents a compelling buy for its 8.6% yield paid monthly.

THW – Tapping into Healthcare Innovations

During the COVID-19 pandemic, the healthcare industry saw billions of dollars of inflows in heavy anticipation for vaccines and treatments. In this post-pandemic world, innovation is high in other areas, and this industry is entering the new year with compressed valuations.

Several areas, like medical devices, have experienced steep sell-offs due to uncertainty and doubt about the impact on their business from new anti-obesity drugs whose stocks have achieved high double-digit returns. These drugs work by mimicking gut hormones that regulate appetite and have achieved unprecedented levels (15-20%) of weight loss in patients.

Novo Nordisk’s (NVO) Wegovy demonstrated a reduced risk of heart attack, stroke, and death in people with cardiovascular disease and obesity by