“Something is rotten in the state of Denmark.”

It’s one of the most famous lines from Shakespeare’s Hamlet, right up there with “Get thee to a nunnery” and “To be or not to be.”

The funny thing is that, while the latter two are made by Hamlet himself, the “rotten” comment, to quote Spark Notes, “is spoken by Marcellus in Act I, scene iv (67),” a minor character. It’s while:

“… he and Horatio debate whether or not to follow Hamlet and the ghost [of his father] into the dark night. The line refers both to the idea that the ghost is an ominous omen for Denmark and to the larger theme of the connection between the moral legitimacy of a ruler and the health of the state as a whole. The ghost is a visible symptom of the rottenness created by Claudius’s crime.”

Something was rotten indeed.

Now, that early in the play, it’s not clear exactly what’s the matter behind the matter. It’s not until the next scene when we realize that Claudius, the new king of Denmark, is in fact the worst of the worst: a man who would (and did) kill his own brother to steal his crown and wife.

Now, I’m not accusing the following three real estate investment trusts, or REITs, of anything so “foul,” as Hamlet’s father calls it. But there’s something rotten nonetheless about the following REITs that need to be recognized.

Recognize the Warning Signs

Personally, I’m happy there’s not a 100% correlation between the two. Because that would mean I was one very unhappy ghost.

As it is, I’m very alive and pretty pleased with my current situation. My brother isn’t after my head or my wife. I have five wonderful children, two sons-in-law, and a grandson I’m insanely proud of. I own a house, a business, and income-producing rental properties, not to mention a portfolio full of dividend-paying REITs.

I know last year was a rough one for REITs on the short-term stock-price appreciation scale. But I expect this year to be much more positive in that regard.

And even if it isn’t, the positions I have are overwhelmingly in strong companies with solid management. Therefore, they promise long-term stock gains and steady, growing dividend payments.

This is very important.

Like any other investor out there, I don’t want to own just any old shares. I want to own the best of the best that drive up my profits in the most meaningfully sustainable ways possible.

That’s everyone’s goal, though we admittedly all have different takes on what those “meaningfully sustainable ways” look like.

This is okay to some degree. We all have our different personalities, wants, needs, responsibilities, income levels, etc. that need to be considered.

But those diverse considerations only need to be considered so far. There are certain risks that are just never worth taking, no matter your specific situation.

When something is rotten, it’s rotten.

And it would be foolish to try to shrug off those warning signs. Ignoring them will only put you and your profits in peril.

A Wise Choice for Investors

“But, Brad,” you might be saying, “Hamlet didn’t ignore the rottenness in Denmark, and he still ended up dead. So why not dance with the devil?”

That’s true, but remember that this isn’t a perfect analogy at all. In this case, not only am I not a very unhappy ghost… you’re also not expected to avenge anything or anyone.

You only need to recognize what’s very, very wrong and avoid it.

Don’t be swayed by the chance of recovery. It’s too slim to take seriously.

Don’t be swayed by high dividend yields. They’re high because they’re unsustainable. And once the company in question finally admits as much, that dividend will come crashing down.

The stock price will suffer, too. This is inevitable. It’s never “priced into the stock already,” as too many investors tell themselves too many times.

In the same vein, don’t tell yourself that “this time is different.” It almost never is. So you’re much, much, much better off avoiding these kinds of companies altogether and putting your capital into the kind of strong, solid, steady assets I already mentioned.

Did you get lucky before? That’s great. I’m happy you didn’t get burned. But you can’t base your long-term success on getting lucky again.

Personally, I wouldn’t recommend basing your short-term success on it again, either.

Take a page from Hamlet in remembering “that one may smile and smile and be a villain” still.

Though, with all due respect to that play, character, and the author behind them… I don’t think the real question is “to be or not to be.” It should actually be, “to be wise or not to be wise.”

My recommendation is to choose the former every time. In which case, just say no to the following three REITs.

Industrial Logistics Properties Trust (ILPT)

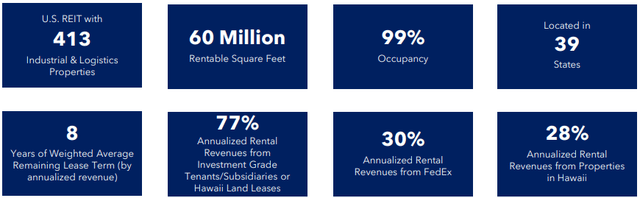

ILPT is an industrial REIT that is externally managed by The RMR Group and specializes in the ownership and leasing of industrial and logistics properties.

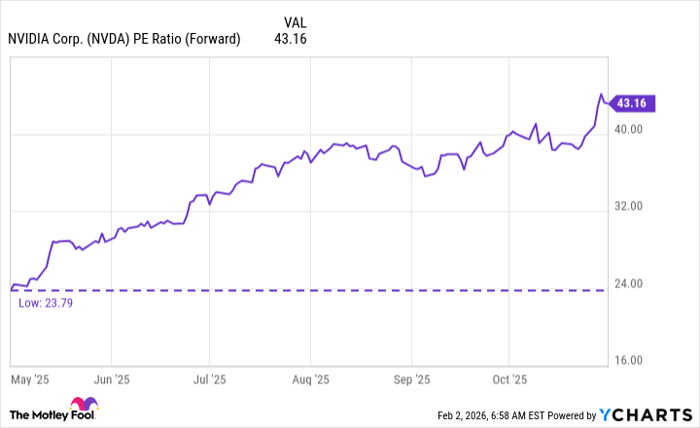

The externally managed REIT has a market cap of approximately $268.0 million and a 60.0 million SF portfolio comprised of 413 properties located across 38 mainland states and the island of Oahu, Hawaii.

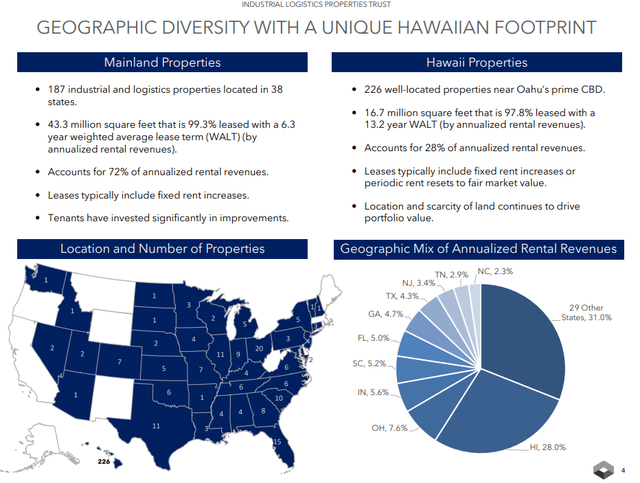

226 of their properties are located on the island of Oahu, Hawaii and consist of buildings, land parcels for lease, and easements. As of their most recent update, almost a third of their annualized rental revenues (“ARR”) came from their Hawaii properties, with their Hawaii properties generating

Industrial Logistics Properties Trust: A Closer Examination

Lease and Property Overview

At the end of the third quarter, ILPT properties were 98.9% leased, serving 304 tenants, and achieving a weighted average lease term (“WALT”) of 8.2 years. The REIT’s mainland portfolio spans 38 states, encompassing 187 properties totaling 43.3 million SF with a 99.3% lease rate and a WALT of 6.3 years, contributing 72% of the REIT’s total ARR. The Hawaiian portfolio, comprising 226 properties near Oahu’s central business district, covers 16.7 million SF, maintains a 97.8% lease rate, and boasts a WALT of 13.2 years, accounting for approximately 28% of ILPT’s ARR.

One noteworthy facet that distinguishes ILPT from its industrial peers is its extensive footprint in Hawaii. The REIT prides itself on its commitment to its Hawaiian properties, standing out among its competitors in this respect.

External Management Concerns

ILPT is externally managed by The RMR Group (RMR), boasting a substantial $36 billion in assets under management and a 35-year track record in the real estate industry. However, a critical point of contention lies in RMR’s management approach, as shareholders have expressed reservations about the inherent misalignment of interests between the external manager and the REIT’s stakeholders. This misalignment often results in enriching the management team at the expense of shareholders, a widely recognized issue in the REIT landscape.

One common bone of contention is the fee structure, with some shareholders noting that external managers are incentivized to prioritize increasing assets under management, potentially at the cost of diluting per-share earnings. This phenomenon, referred to as “growing for growth’s sake,” sets off alarms for investors and serves as a substantial red flag.

Furthermore, concerns have been raised regarding RMR’s substantial base management fees, which are independent of the REIT’s financial performance. These fees stand to incentivize RMR to pursue acquisitions, capital transactions, and tenancies, potentially at the expense of the shareholders’ best interests and returns.

Terms of Agreement and Termination Fees

Another area of contention encompasses the terms of the management agreement between ILPT and RMR. Shareholders have expressed concerns about the prohibitive nature of potential termination fees, emphasizing the detrimental impact such barriers could have on the REIT’s ability to exit or internalize its management. Notably, the automatic renewal of the management agreement at the end of each year for a fresh set of 20 years further exacerbates these concerns, effectively perpetuating the REIT’s entrenchment in the existing management structure.

“The termination of our management agreements with RMR may require us to pay a substantial termination fee, including in the case of a termination for unsatisfactory performance, which may limit our ability to end our relationship with RMR.”

“The terms of our management agreements with RMR automatically extend on December 31 of each year so that such terms thereafter end on the 20th anniversary of the date of the extension.”

“However, if we terminate a management agreement for convenience, or if RMR terminates an agreement with us for good reason, as defined in such agreement, we are obligated to pay RMR a termination fee in an amount equal to the sum of the present values of the monthly future fees, as defined in the applicable agreement, payable to RMR for the term that was remaining before such termination, which, depending on the time of termination, would be between 19 and 20 years.”

These contractual dynamics have raised eyebrows among ILPT shareholders, with many calling for a reassessment of the REIT’s management structure to ensure greater alignment with investor interests and improved transparency in its fee arrangements.

The RMR Group’s Gross Mishandling of REITs

The management agreements signed by The RMR Group have pundits raising their eyebrows – and with good reason. External management has left these REITs spoiled to the core.

Industrial Logistics Properties Trust (ILPT)

Describing ILPT as having high tenant concentration would be an understatement. Nearly 30% of their total annualized rental revenues come from FedEx – a perilous dependency that shakes the ground beneath ILPT’s feet.

Furthermore, ILPT’s weighty $4.3 billion debt overshadows its equity market cap of roughly $268.0 million, failing them miserably like a heavyweight anchor dragging a ship to the ocean floor.

With a consolidated debt to adjusted EBITDAre of 12.3x, a staggering long-term debt to capital ratio of 85.85%, and a limp EBITDA that can barely cover interest expense, it’s no wonder ILPT finds itself sinking.

A track record as dismal as ILPT’s reflects its negative average AFFO growth rate of -24.87% since 2019, a plunge accelerated by a -38% drop in AFFO per share in 2022, and an estimated decrease of -22% in 2023. These catastrophic figures cast a long shadow over the future of ILPT.

ILPT’s blundering management further compounded their miseries, slashing the dividend by a staggering -48.48% in 2022, and a jaw-dropping -94.12% in 2023, leaving investors reeling from the one-two punch of disappointment.

Although ILPT’s stock appears cheap with a 0.98% dividend yield and a P/AFFO of 5.18x, it comes with the stench of poor management and the dangerous potential of falling further into ruin.

We rate Industrial Logistics Properties Trust “AVOID.”

Office Properties Income Trust (OPI)

In a harsh office environment, OPI is another victim of the RMR Group’s mismanagement. Their approximately $177 million market cap and a sprawling 20.7 million SF portfolio across 30 states and Washington D.C. epitomize their grandeur.

OPI’s portfolio includes top-tier tenants like Google, Bank of America, and Northrop Grumman, and yet, their credit rating stands at a bleak CCC+ (junk rated), weighed down by approximately $2.6 billion of debt against a market capitalization of a meager $178 million.

Their high leverage ratio along with 21% of their debt maturing in 2024 and a further 25% the following year paints a grim picture for OPI. Refinancing their upcoming maturities could prove to be a costly affair, leaving them like a fish out of water.

The grisly tale continues with OPI being forced to slash their quarterly dividend to a mere $0.01 per share, signifying a dire -96.0% reduction from the previous quarter. This is not OPI’s first encounter with dividend slashes, as history echoes the pain of their previous 68.02% cut.

OPI’s agonizing journey is mirrored in their staggering 10 falls in AFFO per share since 2010, with growth only seen in 3 of those years. As their earnings performance dwindles, the mirror reflects a distorted image of their dwindling value.

Pitfalls of Office Properties Income Trust and Service Properties Trust

Office Properties Income Trust (OPI) has experienced a significant reduction in its Adjusted Funds from Operations (AFFO) over the years, with a negative average growth rate of -5.84% since 2010. Similarly, Service Properties Trust (SVC), managed by The RMR Group, has faced challenges, including a history of negative AFFO growth and substantial dividend cuts. Let’s delve into the details of these two Real Estate Investment Trusts (REITs) to unravel their underlying weaknesses and implications for potential investors.

Office Properties Income Trust (OPI)

OPI, an office REIT managed by RMR, has seen its AFFO plummet from $4.56 per share to $2.62 per share by 2022, sparking concerns about its future earnings potential. Although analysts anticipate a 60% increase in AFFO per share for 2023, pessimism lingers as projections indicate a subsequent -11% drop in 2024 and another -10% decrease in 2025. Furthermore, OPI is currently paying a 1.13% dividend yield, trading at a P/AFFO of 0.85x, significantly lower than its historical average AFFO multiple of 10.39x. These indicators, combined with the management structure overseen by RMR, cast a shadow over the stock’s potential, warranting cautious consideration from prospective investors. Consequently, the company has been rated as “AVOID” by analysts, reflective of the substantial headwinds it faces in the near term.

Service Properties Trust (SVC)

SVC, another REIT under the management of The RMR Group, focuses on hotels and service-oriented retail net lease properties. With a market cap of approximately $1.33 billion, SVC’s portfolio encompasses 221 hotels and 761 service-oriented net lease retail properties spread across the United States, Canada, and Puerto Rico. The REIT’s assets, spanning various hotel categories, have showcased varied performance, with full-service, extended-stay, and select-service hotels contributing significantly to its overall hotel earnings before interest, taxes, depreciation, and amortization (EBITDA). Moreover, SVC’s service-oriented net lease properties exhibit promising metrics, including a solid rent coverage, a weighted average lease term (WALT) of 9.1 years, and high occupancy rates.

However, despite these positive aspects, SVC faces significant challenges, including a B+ credit rating and suboptimal debt metrics. The REIT’s debt burden, amounting to approximately $5.7 billion against a total market cap of $1.33 billion, raises concerns about its financial leverage. With a historical average AFFO growth rate of negative -3.97% and a drastic reduction in AFFO, from $3.23 per share in 2019 to an expected $0.30 per share in 2023, SVC’s financial outlook remains precarious. Additionally, substantial dividend cuts, leading to an unsustainable AFFO payout ratio of 266.67% in 2023, further underscore the challenges faced by the company. Despite a high dividend yield and a current P/AFFO multiple above its historical average, SVC’s fundamental weaknesses have led analysts to recommend the stock as one to “AVOID.”

In Closing

Reflecting on the complexities of REIT analysis, it’s apparent that both OPI and SVC present substantial risks for investors. As we navigate the intricacies of financial markets, it’s crucial to heed Shakespeare’s timeless wisdom: “All that glisters is not gold” – a poignant reminder of the deceptive allure of seemingly attractive investments. As the Bard once said, “My pride fell with my fortunes,” serving as a humbling testimony to the unpredictable nature of financial endeavors. In conclusion, it’s prudent for investors to exercise caution and consider the underlying dynamics before delving into these tempestuous waters, for as Shakespeare astutely observed, “Something is rotten in the state of Denmark.”