The Vision

Atlassian (NASDAQ:TEAM) has been a trailblazer in supplying collaborative work management, ITSM, and DevOps solutions, with renowned products like Jira, Confluence, Trello, and Bitbucket. The company’s unique approach has powered its rapid expansion in recent years, while the substantial investments it’s making aim to sustain this prosperity. Despite these grand maneuvers, the company currently faces formidable challenges that could rattle its near-term outlook, without compromising its long-term strategy.

This article aims to provide a pragmatic insight into Atlassian’s future prospects and setbacks, articulating why we believe the stock should be held at its current levels. Our insights include:

- Atlassian’s growth slowdown isn’t localized but rather a consequence of macroeconomic headwinds and the general deceleration in the SaaS market.

- Alongside refurbishing its R&D and acquisitions to maintain an edge, Atlassian is grappling with fierce competition from both traditional and novel players in its sectors.

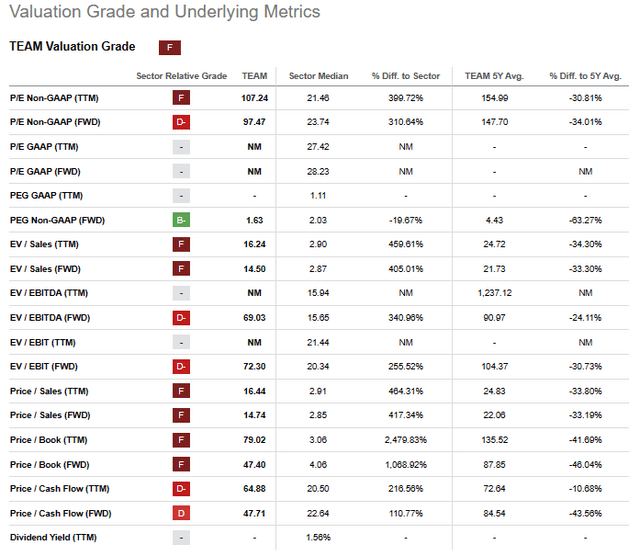

- Comparative to its performance and peer averages, Atlassian’s valuation appears overly optimistic, indicating that the market underestimates its inherent perils.

Atlassian’s Daring Growth Strategy

Atlassian’s zealous appetite for growth is evident in its risk-taking nature. Even within an arduous macro environment, the company remains proactive, persisting with investments to pursue ambitious objectives, a trait we deeply admire and believe will pave Atlassian’s path to capturing more of the market’s potential in the long haul.

Atlassian’s growth sustenance strategy revolves around three pivotal pillars:

- Cloud – Progressing the transition of its remaining Server users to Cloud offerings and continually innovating its products on a quarterly basis via its cloud platform.

- Enterprise – Forging a robust enterprise sales mechanism through a network of partners and dedicated customer success teams, while furnishing the platform with enterprise-grade features like scalability, security, and support.

- ITSM – Amplifying the ITSM business by leveraging Jira Service Management’s innovative cross-product functionalities, facilitating collaboration between development, IT, and business teams.

Assessing the progress of these three pillars, it’s noticeable that the cloud migration has hit snags, with the cloud revenue growth falling below expectations (projected at 25%-30% growth in FY24). The Enterprise pillar, deemed most pivotal, is expected to lure larger customers to the platform. Building alliances with global consulting firms such as PwC, Deloitte, and Accenture represents a significant milestone. As for ITSM, while there’s evident headway, the fierce tussle with the market leader, ServiceNow, makes the road ahead a demanding one.

Deceleration in Revenue: A Broader Issue

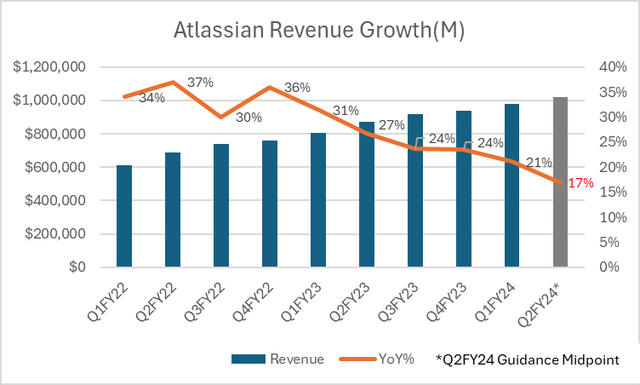

Across the past five quarters, Atlassian’s revenue growth has tapered, dwindling from a 37% year-over-year surge in Q1 2023 to a 21% upswing in Q1 2024. The company’s Q2 2024 projections hint at a further deceleration, expecting revenue to grow by a modest 17% year-over-year (see below)

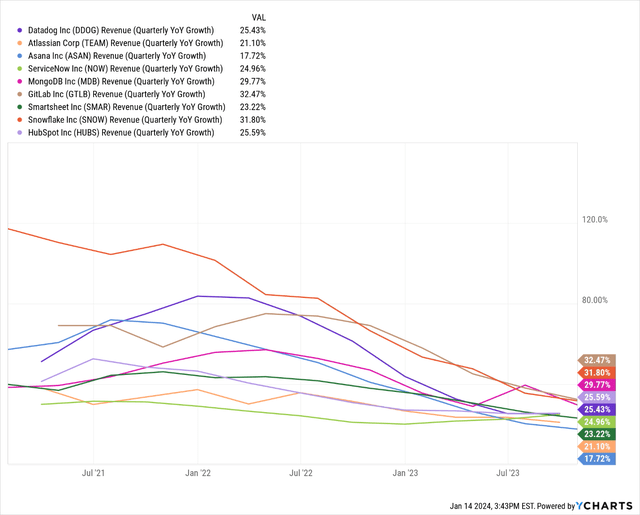

While these figures may raise alarm, signaling a loss of momentum in Atlassian’s core business, it’s crucial to recognize that this trend reflects the broader state of the SaaS market. Nearly all SaaS companies have witnessed a moderation in their growth over the past two years, a pattern anticipated to persist into 2024. For instance, Snowflake’s year-on-year revenue growth dropped from 85% to 32%. Similarly, Datadog’s figures nosedived from 37% to 21%, while direct competitors, Asana and Gitlab, saw their growth rates plummet from 72% to 17% and from 75% to 32%, respectively. Hence, this indicator isn’t unique to Atlassian but a macro issue.

Anticipated Reacceleration in the SaaS Market

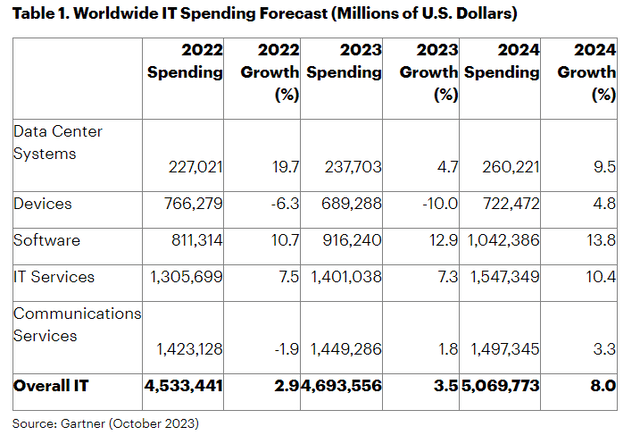

Gartner forecasts a 14% rise in global enterprise software spending in 2024, up from 13% in 2023, propelled mainly by public cloud services, AI, and cybersecurity segments, not SaaS. Moreover, organizations are evidently channeling their IT budgets into cost control, efficiencies, and automation, rather than investing in SaaS ventures with extended payback periods. This suggests that Atlassian’s revenue growth might endure deacceleration in 2024, as customers defer or curtail their spending on SaaS tools.

Expecting a resurgence in the SaaS segment post-2025, as the global economy recuperates from heightened inflation and businesses reignite their digital transformation initiatives, is well within the realm of reason. Furthermore, the rising adoption of AI, IoT, and blockchain technologies is poised to bolster the SaaS market, allowing for enhanced innovation and customization of SaaS solutions. In this light, Atlassian is well-prepared to harness these reinvigorated trends due to its innovation-first business strategy, continually unveiling new and innovative products.

Navigating Multi-Front Competition

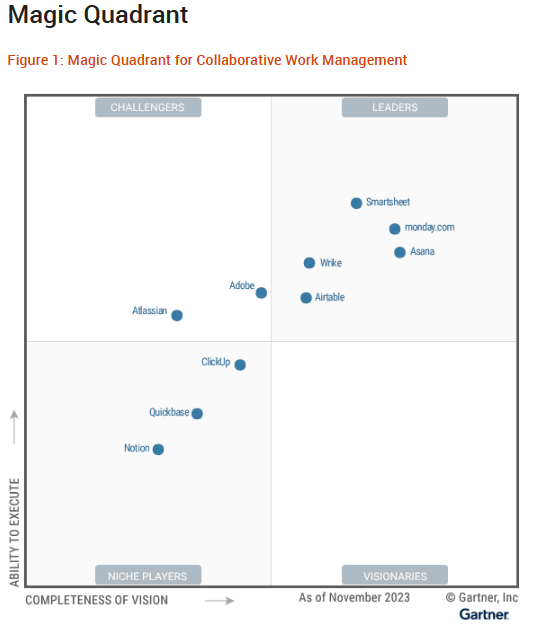

Atlassian’s foremost challenge lies in the fierce competition across its operational domains. The company contends with major players in the enterprise software arena, including Microsoft, Salesforce, Adobe, and ServiceNow, a battle where the adversaries boast larger customer bases, more diverse product portfolios, and deeper financial backing compared to Atlassian.

“`html

The Risks and Rewards of Atlassian: A Financial Deep Dive

In the intensely competitive arena where Atlassian operates, its supremacy is being challenged by formidable rivals like Microsoft and Salesforce. These giants are enhancing their platforms, encroaching into Atlassian’s territory and disrupting its market share and pricing power.

Moreover, in its dominant segments, Atlassian faces fierce competition from the likes of Asana, Smartsheet, and Monday.com, offering more functionality at lower prices, and ServiceNow, a formidable contender in the IT service management space. In the DevOps domain, Atlassian contends with the formidable presence of GitHub and GitLab; a tough battleground indeed.

Unfortunately, Atlassian’s lack of transparency in segment-wise revenue performance leaves investors in the dark about its performance in crucial areas like collaborative work management (CWM), IT service management (ITSM), and DevOps.

A Risky Bet on R&D Overspending

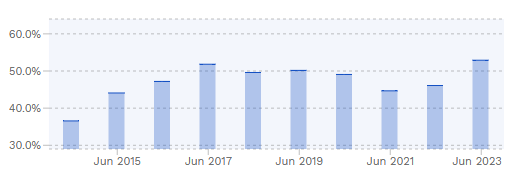

Atlassian’s heavy investment in research and development is a strategic move to keep pace with its rivals. However, the company’s high R&D allocation, hovering around 50% of its revenue, surpasses the industry norm. This striking figure raises concerns about the firm’s ability to derive commensurate returns from this outlay.

Comparatively, the average software company allocates about 20% of its revenue to R&D. Even high-growth SaaS companies earmark around 26%, making Atlassian’s expenditure seem exorbitant. The expectation of at least a 40% revenue growth for a company investing 50% of its revenue in R&D is not translating into reality for Atlassian. This is a clear indication of the challenging environment the company finds itself in.

Atlassian’s ambitious foray into new segments like ITSM and DevOps demand substantial R&D investments. Furthermore, the integration of acquired entities adds complexity and inflates R&D costs, adding an extra layer of risk to the company’s already aggressive strategy.

While Atlassian’s bold approach is commendable, the potential downside of such high R&D expenditure cannot be understated, posing a threat to shareholder value.

What Goes Up Must Come Down: Valuations Too High

Despite a remarkable surge in its stock price, reaching a lofty $242 on Jan 19, 2024, Atlassian’s valuation is being viewed as overinflated. With a P/S ratio of 16, the company’s stock appears overvalued considering its growth rate hovering around 20%.

While the market seems to anticipate robust growth from Atlassian in the upcoming years, the current valuation seems to overlook the inherent risks. Any failure to meet these lofty expectations could precipitate a drastic correction in Atlassian’s stock price, underscoring the high-stakes gamble currently at play.

In Conclusion

Atlassian’s pioneering strides in the collaborative work management space have been remarkable, reflecting its innovative business model and robust growth. The company’s strategy of venturing into new markets like ITSM is ambitious and holds promising prospects. While a resurgence in revenue growth is anticipated from 2025, the company’s future certainly carries significant risks, including macroeconomic uncertainties, competitive pressures, and an overzealous valuation. At present, caution is advised, and the current assessment warrants a ‘Hold.’

“`