Market Performance and Industry Standings

Honda Motor Co. (HMC) has established itself as a stalwart in the manufacturing sector, crafting not only automobiles but also motorcycles and a spectrum of high-performing engines. Their influence isn’t merely national, but global, captivating a wide audience with their diverse product offerings.

Image Source: Zacks Investment Research

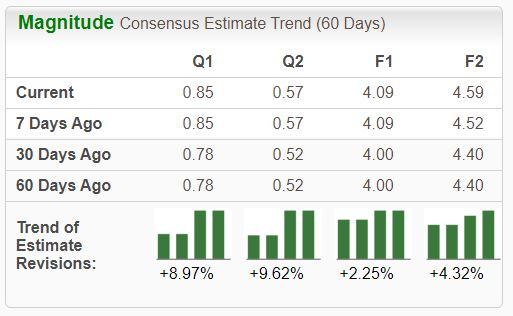

The company’s stock currently boasts a Zacks Rank #1 (Strong Buy), a testament to the market’s faith in its potential. Analysts have raised their expectations across all timelines, cementing Honda’s positive trajectory in the eyes of investors and industry insiders alike.

In addition to its improved earnings outlook, Honda Motor Company is part of the Zacks Automotive – Foreign industry, currently basking in the top 25% of all Zacks industries. This positioning signifies a strong foothold that bolsters investor confidence in the brand’s long-term viability.

Stock Price and Dividend Yield

Honda Motor shares have been on a tear recently, showcasing remarkable resilience as they surged nearly 6% in the past month, effortlessly outshining the S&P 500. The company’s shares are poised to shatter the confines of a multi-year consolidation period, fueled by optimistic revisions in the earnings estimate.

Image Source: Zacks Investment Research

Investors can also relish a steady income from their Honda Motor shares, with the current annual yield standing at a robust 2.8%. The sustainable payout ratio, resting at a modest 21% of the company’s earnings, attests to the stability of this lucrative investment. Moreover, the company has seen a commendable 3.3% five-year annualized dividend growth rate.

Financial Projections and Valuation

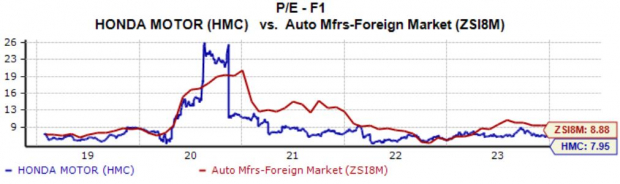

From a valuation standpoint, shares of Honda Motor present a compelling proposition. With earnings projected to surge by 35% in the current fiscal year on the back of nearly 15% higher sales, the stock appears attractively priced at a 7.9X forward earnings multiple. This figure compares favorably with the respective Zacks industry average of 8.9X.

Image Source: Zacks Investment Research

The stock also garners a Style Score of ‘A’ for Value, further underlining its attractiveness to discerning investors.

Anticipated Quarterly Release and Analyst Predictions

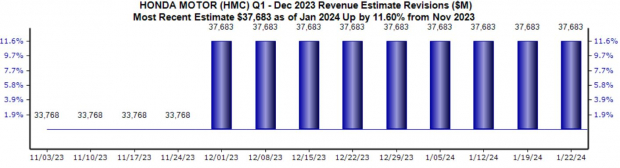

The upcoming quarterly release scheduled for February 9 will undoubtedly draw significant interest, especially considering the 20% surge in the Zacks Consensus EPS Estimate to $0.85 since November. Analysts have also manifested bullish sentiment regarding the top line, with the $37.7 billion quarterly revenue estimate representing an impressive 11% uptick over the same timeframe.

Earnings are expected to dip by 16% from the year-ago period, yet revenue is projected to ascend by nearly 20% year-over-year, marking a notable milestone for the company.

Image Source: Zacks Investment Research

In Conclusion

Amidst the plethora of investment options, Honda Motor Company (HMC) stands out as a stellar choice, underscored by its Zacks Rank #1 (Strong Buy) designation. With its promising outlook and favorable industry positioning, Honda Motor Company is primed to be a top performer, offering investors a compelling opportunity for substantial returns.

Access the Free Stock Analysis Report for Honda Motor Co., Ltd. (HMC)

Read the full article on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.