As the quarterly earnings season approaches, investors are deliberating on stocks with the potential to surpass expectations, and one such company in the spotlight is NextEra Energy, Inc. (NEE). The company’s upcoming earnings report appears promising as recent events have set an encouraging stage for its performance.

The firm’s positive earnings estimate revision activity indicates a possible earnings beat. Analysts’ upsurge in estimates just before the earnings release, with the most updated information at hand, signals favorable underlying trends for NEE in this report.

Specifically, the Most Accurate Estimate for the current quarter stands at 51 cents per share for NEE, compared to a broader Zacks Consensus Estimate of 49 cents per share. This indicates that analysts have recently raised their estimates for NEE, resulting in a Zacks Earnings ESP of +4.79% heading into the earnings season.

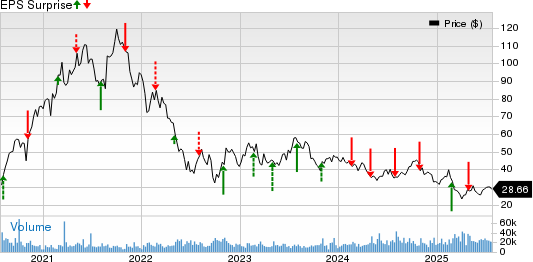

NextEra Energy, Inc. Price and EPS Surprise

NextEra Energy, Inc. price-eps-surprise | NextEra Energy, Inc. Quote

Why Might This be Important?

Historical data demonstrates that a positive Zacks Earnings ESP tends to generate both positive surprises and outperformance in the market. A 10-year backtest shows that stocks with a positive Earnings ESP and a Zacks Rank #3 (Hold) or better historically yield a positive surprise nearly 70% of the time, with average annual returns exceeding 28% (see more Top Earnings ESP stocks here).

Considering NEE’s Zacks Rank #3 and positive ESP, investors may find it prudent to contemplate this stock before the earnings release. You can peruse the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Clearly, the recent upturn in earnings estimate revisions heralds positive prospects for NextEra Energy, hinting at a potential earnings beat in the upcoming report.

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.