Positive Momentum in Tech Sector

In the wake of last year’s exceptional performance, tech stocks continue to maintain their market dominance in the New Year, buoyed by favorable macroeconomic developments and a renewed confidence in the Federal Reserve’s policy trajectory. Investors are increasingly optimistic about the potential of artificial intelligence (AI) and, despite lingering doubts reminiscent of the late 1990s, there is a growing sense of overcoming prior obstacles in tech spending. As a result, companies across the sector are anticipated to report robust December-quarter results, shedding light on business spending trends, with a particular focus on cloud services.

The AI Debate and Market Expectations

The hotly debated potential of AI is taking center stage in the upcoming earnings reports from major players such as Alphabet, Microsoft, Meta Platforms, Amazon, and Apple. While the direct financial impact of AI, exemplified by companies like Nvidia and Microsoft, is becoming increasingly apparent, its full potential in enhancing productivity remains on the horizon. The market is eagerly awaiting viable business models that leverage AI, with substantial anticipation surrounding the stock market as it seeks validation for the excitement surrounding AI applications.

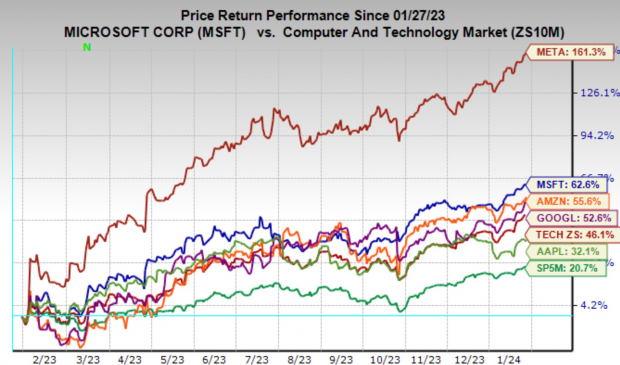

Strong Market Performances and Sector Outlook

Analysts and investors are closely watching the earnings reports of the ‘Big 7 Tech Players,’ including Microsoft and Amazon, as they prepare to disclose their financial results. The chart highlights the one-year performance of the Zacks Technology sector and select companies, reflecting a remarkable upward trajectory in stock prices. Despite variations in performance, each member of this elite group holds significant weight in the market landscape, with Apple emerging as a standout performer.

Alphabet, Meta Platforms, and Amazon have established themselves as key players in digital advertising, with the stabilization of ad spending raising curiosity about current and future trends. As the market awaits the Q4 earnings reports, the focus on AI strategies and business models is expected to take center stage, particularly in the rivalry between Microsoft and Alphabet.

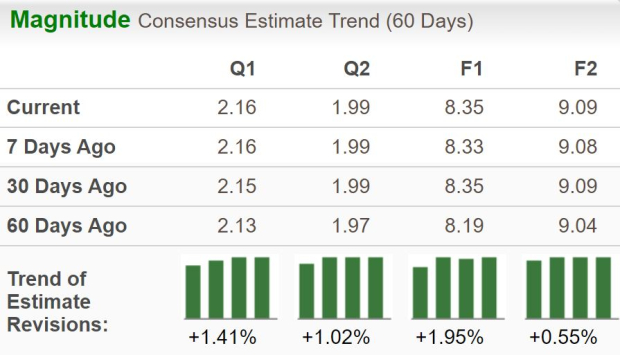

Earnings Projections and Sector Growth Trajectory

Current consensus expectations for the ‘Big 7 Tech Players’ point to substantial growth in earnings and revenues compared to the previous year, with consistent upward revisions in recent months. The financial outlook for the coming quarters remains optimistic, reflecting a steady return to ‘regular/normal’ growth patterns. However, much of this growth trajectory is contingent on the macroeconomic environment, underpinning the sector’s recovery from the challenges of the past.

The broader Technology sector is also anticipated to exhibit strong growth in Q4 earnings and revenues, indicating a positive shift from the pandemic-induced downturn. With the sector’s earnings returning to positive territory in 2023 Q2, the worst of the growth challenges seems to be receding, providing a favorable backdrop for continued recovery and market stability.

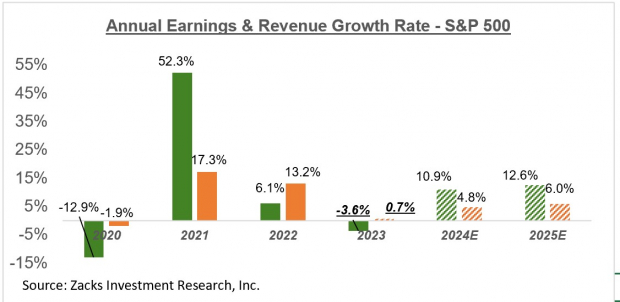

Insights into Earnings and Revenue Growth Rates

As the industry recalibrates expectations, the sector is poised to exceed its 2021 profitability levels, with significant gains projected for the current year and beyond. This upward trajectory reflects a resurgent tech landscape and a return to robust profitability, marking a pivotal turnaround from the tumultuous period during the pandemic.

The ongoing growth and enhanced financial performance of the sector, as demonstrated in the earnings and revenue projections, signify a strategic shift towards sustained stability and renewed investor confidence. The upcoming earnings reports of tech giants will offer critical insights into their AI strategies and revenue prospects, providing a nuanced understanding of the industry’s trajectory.

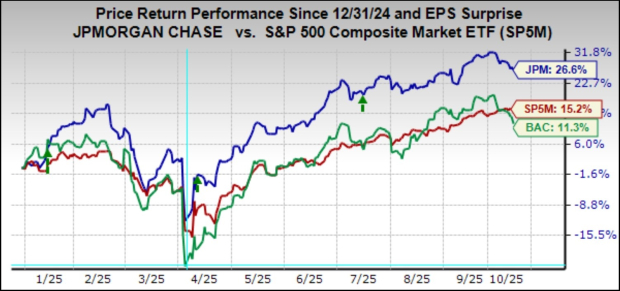

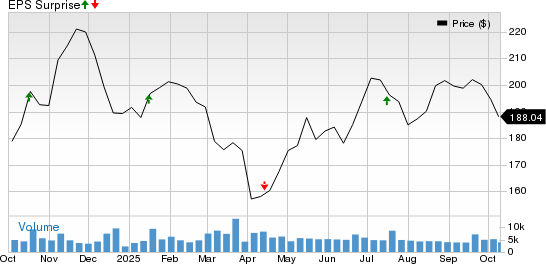

Unveiling the Q4 Earnings Season Scorecard

The Q4 earnings season is in full swing, and amidst the market frenzy, a detailed examination of the earnings scorecard is essential for investors. Let’s delve into the numbers and analyze the performance of key players as well as the overall market sentiment.

Q4 Earnings in Numbers

The latest projections for 2023 Q4 earnings indicate a promising upswing, with an expected 1.1% increase in earnings and a significant 2.4% rise in revenues. This follows a reading of 3.8% in the preceding period (2023 Q3) and a consecutive three-quarter decline in earnings growth.

The comprehensive scorecard includes results from 124 S&P 500 members, accounting for 24.8% of the index’s total membership. As over 300 companies are set to reveal their financial standings, including tech giants like Amazon, Microsoft, and Meta Platforms, the upcoming week promises to be pivotal for market observers.

Performance Overview

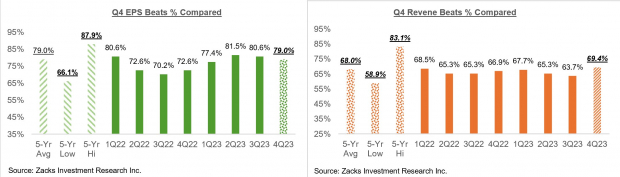

Currently, total Q4 earnings for the 124 index members that have reported show a marginal decrease of -0.4% compared to the equivalent period in the previous year. However, a bright spot emerges with a 3.4% uptick in revenues. Notably, 79% of companies have surpassed EPS estimates, while 69.4% have outperformed revenue expectations.

Historical Context

Putting the Q4 earnings and revenue growth rates in context, historical comparison charts reveal insightful trends. These trends provide a broader perspective, shedding light on the current market landscape and offering valuable insights to investors.

Exploring Potential Opportunities

Amidst the market churn, identifying promising stocks is crucial. With Zacks Investment Research pointing out five stocks set to double, the report offers valuable guidance for investors. These stocks, carefully selected by experts, present an opportunity to tap into significant growth potential, with previous recommendations showcasing remarkable gains.

For further insights and recommendations, investors can also access a detailed analysis of leading companies, such as Amazon, Microsoft, NVIDIA, Alphabet Inc., and Meta Platforms, by downloading the free stock analysis report from Zacks.

Download 7 Best Stocks for the Next 30 Days

Read Article on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.