Qorvo, Inc. (NASDAQ:QRVO) is a leading provider of microchips and related technologies for smartphones, laptops, and numerous other devices. Based in North Carolina, the company operates 50 engineering, manufacturing, and sales facilities across North America (12), the Asia Pacific (18), and Europe (12).

The rise of the S&P 500, Dow Jones, and NASDAQ 100 to new record highs last week reflects the tech industry’s momentum, particularly the major semiconductor stocks, driven by the surge in demand for generative AI applications following Taiwan Semiconductor Manufacturing’s (TSM) projection of revenue growth in the low-to-mid 20% range.

Last Week’s Tech and Semiconductor Stocks Surge

In November, the Semiconductor Industry Association reported the industry’s first year-over-year increase in chip sales in over a year. Qorvo’s growth is closely tied to trends in the technology sector and the projected increase in smartphone demand, as well as the earnings expectations set by Wall Street analysts.

Qorvo, Inc. Stock

-

Market Capitalization: $10.49B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 1/24/2024): 34 out of 551

-

Quant Industry Ranking (as of 1/24/2024): 1 out of 65

Qorvo holds the top Quant rating in the semiconductor industry, boasting an overall rating of 4.75. Despite a decline in its stock over the past year, the company experienced gains last week, parallel to the surge in the tech and microchip stocks market.

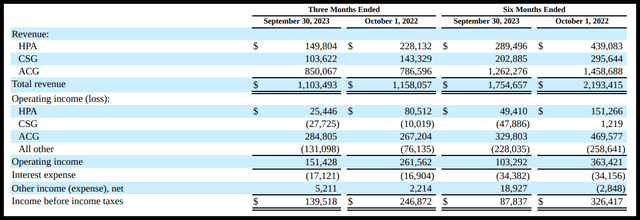

In Q2 of FY24, over 75% of Qorvo’s $1.1 billion in sales came from its Advanced Cellular Group (ACG), with the remaining revenue split between High-Performance Analog (HPA) and Connectivity and Sensors Group (CSG). Notably, nearly 50% of Qorvo sales were tied to Apple (AAPL) and Samsung (OTCPK:SSNLF) – two key players in the smartphone market.

Qorvo stands to benefit from the upturn in the smartphone market, which saw an 8% year-over-year rise in worldwide shipments in Q423, marking the end of seven consecutive quarters of decline, as reported by the Canalys research firm.

Apple captured 24% of the market share in Q4 shipments, surpassing Samsung at 17%. The company’s industry potential is further underscored by the growth opportunities it envisions in multiple areas, as outlined below.

Growth & Profitability

Qorvo’s Growth Grade received a boost from its long-term EPS (FWD) of 20%, significantly outpacing the sector median by 55%. Growth in the ACG segment and expected returns to year-over-year growth in CSG in Q324, and HPA in Q4 further position the company for future success.

Furthermore, Qorvo’s President and CEO, Bob Bruggeworth, emphasized growth potential in the Android sector as the market makes the transition from 4G to 5G phones, offering substantial dollar content per unit, a development that Qorvo stands ready to capitalize on.

“Looking at ACG, fewer than half of the Android smartphones this year will be 5G. Android 5G units are expected to grow in the low double-digits for several years. That’s a big growth opportunity for Qorvo as we move from very little content in 4G phones to significant dollar content in 5G phones,”

Not only does Qorvo foresee opportunities in 5G advanced smartphones, it also anticipates expanding its presence in the EV and solar markets through advancements in ultra-wideband technology. Additionally, the company eyes significant growth potential in developing technologies for drones, radar systems, and low-orbit satellites. These positive forecasts are further supported by the consensus among Wall Street analysts, who have consistently raised Qorvo’s earnings estimates.

In addition to the upbeat analyst revisions, the performance of Qorvo’s CSG division played a pivotal role in driving down operating margins, with the company’s EBITDA margin (TTM) exceeding the sector median by almost 25%, contributing to a favorable B- Profitability Factor Grade. Coupled with robust growth potential, Qorvo trades at a discount relative to similar companies, as reflected in its C+ Valuation Factor Grade. The company’s forward P/E Non-GAAP is 23% lower than the sector average, and its PEG (FWD) stands at 0.93x, over 50% under the median of 2.07x.

Barclays investment firm also raised Qorvo’s price target as part of the “second wave” of AI, underscoring the positive sentiment in the industry. Despite these promising indicators, there are risks to consider.

Risks

With almost half of its sales reliant on two major customers, Qorvo faces concentration risk. In fiscal year 2023, Apple accounted for 37% of its revenue and Samsung for 12%. The company noted in its annual filing that the loss of one or both customers could significantly impact its financial standing. Additionally, Qorvo’s Quant rating is heavily contingent on optimistic Wall Street projections and upward revisions, leaving it susceptible to significant downgrades that could affect its overall rating.

Geopolitical tensions, particularly regarding the Taiwan Straits, present another risk to Qorvo, given its operations and customer base in China and Taiwan, which together account for over 20% of its revenue. The escalating trade tensions between the U.S. and China also pose a threat, as governmental restrictions have impaired the company’s ability to conduct business with certain international customers, a trend that could continue to impede its revenues.

Concluding Summary

Semiconductors are the backbone of nearly every electronic device, powering communication, computing, and various other functionalities. Qorvo’s strong ties with industry giants Apple and Samsung position it for sustained growth, amplified by their extensive networks and focus on enhancing the smartphone market. The company’s impressive Wall Street consensus growth estimates, consistent earnings beats, and robust momentum driven by technological advancements and the electrification of vehicles underscore its status as a top-rated Quant Strong Buy stock. Investors may consider exploring stocks within their preferred sectors and industries or, alternatively, explore Seeking Alpha’s top quant picks, such as Alpha Picks, for regular insights into promising stock selections.