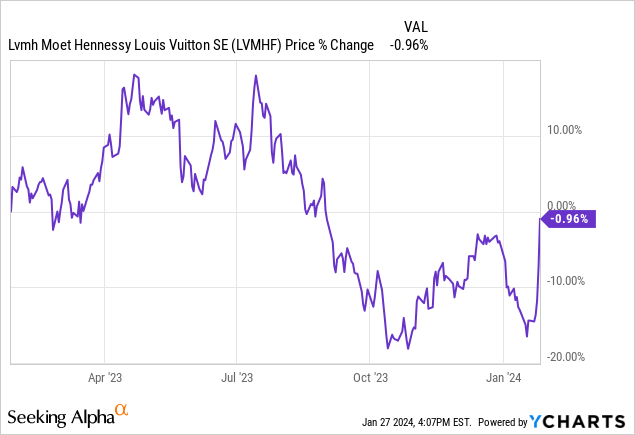

Amidst a current wave of caution in the luxury market, LVMH (OTCPK:LVMHF) has managed to shine bright. Historically known as the largest French luxury conglomerate and a favorite among investors, the company has faced declining share prices at the beginning of the year. This was driven in part by Burberry’s (OTCPK:BURBY) profit warning – a development causing the industry and media to adopt a more guarded attitude towards luxury companies moving forward. Despite this, LVMH’s recent full-year results revealed a fundamental strength that remained superb and showcased promising secular growth prospects, contrary to the prevailing sentiment. This was a clear surprise for Mr. Market as he sent the stock price up to breakeven on a one-year basis.

So amidst the full-year results celebration, it’s worth delving deeper into LVMH’s capital allocation power. This is to showcase why investors can continue to benefit from the underlying fundamental strength, even after the share price rally.

Unveiling Operating Performance

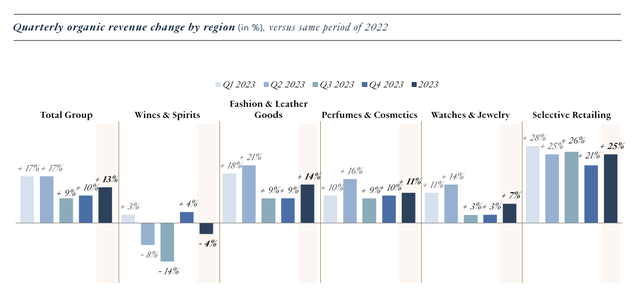

LVMH’s full-year results for 2023 displayed promising organic top-line growth of 13% YoY, totaling €86.15 billion after considering negative currency effects of 4%. A robust Asian market, which grew by 18% in 2023 and constitutes about one-third of total sales, primarily contributed to this performance. Additionally, the recovering US consumer posted an 8% growth in Q4 sales after experiencing a slowdown in Q2. Solid performances from Japan and Europe, with sales growth rates of +28% and +13% YoY respectively, further contributed to a more stable result than anticipated. CEO Bernard Arnault attributed this resilience to the presence of iconic and desired luxury brands across different segments.

Arnault emphasized, “In the soft luxury segment, we have the two strongest brands in the world with Vuitton and Dior. And we have actually good competitors without mentioning remarkable, Chanel and Hermès. And in hard luxury category that is watches and especially jewelry, we also have two outstanding brands at Tiffany and Bulgari. And in the competition, there’s a very good group that is the Richemont Group announced its two great brands, Cartier and Van Cleef, so amongst the 8 brands considered the best.”

Arnault’s strategy to maintain high quality standards and resist excessive growth rates was evident during the conference call. His emphasis on selling below actual demand, expanding brands incrementally, and focusing on “quiet luxury” captured the necessary passion for quality, marking LVMH as a true luxury brand. This dedication to quality has likely contributed to the exceptional results witnessed, even amidst a dip in some segments such as Wines & Spirits. LVMH’s ability to benefit from diversification among fashion & leather goods positions the company to thrive, regardless of any normalization in extraordinary demand seen last year.

The Selective Retailing segment, particularly Sephora, displayed strong momentum in 2023 with overall sales and EBIT growth of 25% and 76% YoY, respectively, delivering an operating margin of 7.8%. This segment’s resilience stems from perfumes and cosmetics being seen as the “affordable” entry products for luxury brands, making them accessible even in difficult economic times. Overall, Bernard Arnault has every reason to be pleased with the company’s 2023 performance, bolstering confidence going into 2024.

The Art of Capital Allocation

Beyond the operational performance, delving into LVMH’s capital allocation power helps underline the fundamental strength behind these impressive results. In evaluating this, it becomes evident that LVMH’s high-quality compounding has managed to surpass poor market sentiment and position the company for continued success.

LVMH’s Astounding ROCE and Capital Allocation in Turbulent Times

As investors sift through the tempestuous seas of the luxury goods market, LVMH stands as a beacon of stability and resilience. An in-depth look at the company’s Return on Capital Employed (ROCE) reveals an enviable performance that defies the tumultuous backdrop of economic uncertainty. Let’s dive into a comprehensive dissection of LVMH’s capital allocation strategy, gauging the efficacy of its investments across different segments through the lens of ROCE.

LVMH’s ROCE Success Story

Amidst the post-pandemic surge in demand for luxurious indulgences, LVMH has orchestrated a spectacle of capital efficiency and operational pizzazz, particularly in its Fashion & Leather Goods (F&L) division. With an eye-popping ROCE of 58% and 55% in 2022 and 2023, respectively, the F&L segment stands as a paragon of capital prowess. The exponential growth rates in this segment underscore the spectacular success of LVMH’s strategic focus on quality and exclusivity, paving the way for sustained contribution to the company’s overarching triumph. Not to be outdone, the Selective Retailing segment has witnessed a renaissance, with its ROCE climbing to a resurgent 15%, surpassing pre-pandemic levels. The potent surge in operating leverage bodes well for the segment’s profitability, setting the stage for a promising comeback.

A visual analysis of LVMH’s capital allocation strategy paints an intriguing picture. The company has deftly channeled a lion’s share of its operating investments into the F&L division, a sensible move given the stellar capital returns it has yielded. However, outliers do emerge in this distribution, notably the Watches & Jewelry and Selective Retailing segments. Both segments have notably received disproportionately higher investments compared to their capital returns, a fact that can be partly attributed to the 2021 acquisition of Tiffany & Co. As Bernard Arnault succinctly put it during a recent call, the performance of Tiffany & Co. has been stellar following its acquisition, underscoring the management’s acumen and expertise. However, the significant investments required for the renovation and reopening of the New York flagship store in 2023 serve as a stark reminder of the considerable capital entailed in elevating the exclusivity and desirability of a luxury brand.

Navigating Economic Headwinds

The historical performance of the luxury goods industry, intrinsically tied to GDP growth, heralds the potential for an economic slowdown to impact LVMH’s growth rates, especially in regions like Europe and within specific segments such as Wines & Spirits. Yet, the company’s latest full-year results stand as a resounding testament to the inherent quality of its brand portfolio and adept management. The stalwart performances of the Fashion & Leather Goods and Perfumes & Cosmetics segments, fortified by robust pricing power, augur well for sustained growth. Under the stewardship of Bernard Arnault, LVMH’s management has woven a narrative of success, one underscored by an unwavering commitment to preserving the desirability and allure of its luxury brands. As Arnault emphatically articulated, the ultimate objective lies not in achieving unbridled growth, but in nurturing and perpetuating desirability, a principle that resonates through every facet of the company’s operations.

Fluent Cash Flows

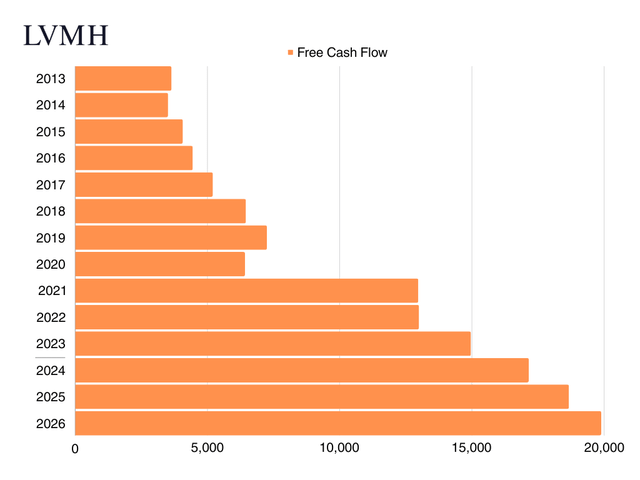

The pulse of a company’s financial health lies in its ability to unfurl a steady stream of cash, and LVMH doesn’t disappoint. A meticulous scrutiny of its free cash flow unveils a nuanced narrative. In 2023, LVMH notched up a free cash flow of approximately €12.5 billion, representing a marginal dip from the 2022 figure of €13 billion. However, this seemingly downward trajectory is tethered to significantly amplified operating investments, including some one-time effects such as the acquisition of real estate properties. As Jean-Jacques Guiony explicated, the marked increase in operating investments, particularly in real estate, engenders a nuanced interpretation of the free cash flow fluctuations, emphasizing the underlying strength of LVMH’s cash-generating capabilities.

In essence, LVMH’s stunning display of capital allocation, amplified by a resplendent ROCE and resilient cash flows, sets the stage for a compelling journey traversing the peaks and troughs of the luxury goods market. Embracing economic vagaries with fortitude, LVMH emerges as a beacon of stability and prudence, a paragon of astute management and unwavering commitment to the preservation of desirability.

Assessing LVMH’s Cash Flow and Valuation Metrics

LVMH, the luxury conglomerate behind iconic brands like Louis Vuitton and Moët & Chandon, has consistently demonstrated an impressive trajectory in its free cash flow metrics. Despite the challenges posed by the market, LVMH’s strategic investments in prime locations have undeniably fueled its growth. The company’s steadfast commitment to quality and desirability has solidified its positioning in the market, eliciting optimism among investors with its vigorous cash flow generation and reasonable valuation.

Over the last decade, LVMH has exhibited a commendable free cash flow (FCF) compound annual growth rate (CAGR) of 15%, accentuating the company’s robust financial standing. However, delving deeper into the nuances, excluding one-off investments paints an even more remarkable picture, spotlighting a striking 19% year-over-year increase in free cash flow. This intrinsic growth underscores LVMH’s resilience and agility in navigating market dynamics while consistently bolstering its financial prowess.

Forecasting future cash flows entails a prudent scrutiny of analysts’ estimates and historical FCF conversion rates. Projections reveal a prospective 10% annual growth in LVMH’s FCF, aligning closely with its current revenue growth trajectory. This anticipated growth hints at sustained profitability, harmonizing with the company’s adept showcasing of pricing power and steadfast consumer demand.

Evaluating LVMH’s Valuation

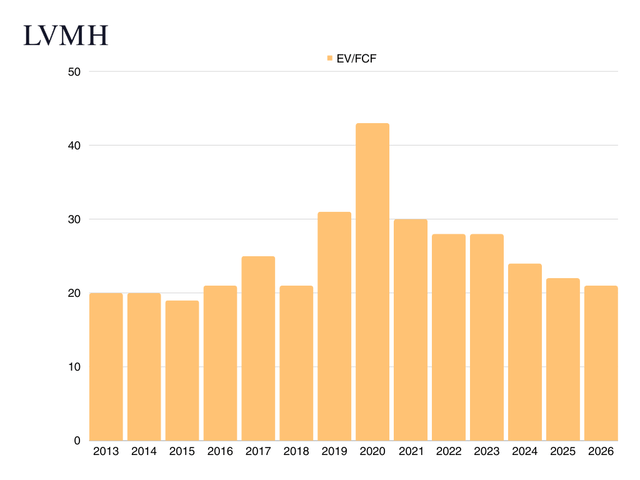

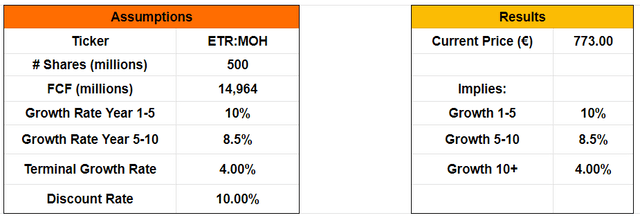

The market’s exuberant response was palpable when LVMH’s stock surged by double digits post-announcement, validating the company’s commendable performance. Appraising LVMH’s valuation involves a holistic consideration of its FCF in relation to the total enterprise value. In essence, the prevailing fair share price of €773, reflecting a market capitalization around €387 billion, coupled with the net financial debt, ascribes an enterprise value of €414 billion. With an FCF of €14.96 billion (excluding one-off investments), LVMH’s current standing at an EV/FCF multiple of 28x belies its perceived expensiveness.

This valuation is conspicuously reasonable, underpinned further by forward multiples for the years ahead—24x, 22x, and 21x for 2024, 2025, and 2026 respectively. Such estimations mirror the company’s recent performance and its promising outlook, substantiating the prevailing valuation as judicious and well-aligned with the company’s intrinsic worth.

Notably, an inverse DCF model further corroborates these sentiments, illustrating the market’s acknowledgment of LVMH’s potential growth. The current pricing encapsulates an expectation of a 10% growth rate over the next 5 years, underscoring an optimistic outlook in the market’s sentiments. This simplified valuation mechanism offers a glimpse into the prevailing optimism permeating LVMH’s valuation, evoking confidence in its future trajectory.

Key Takeaways

LVMH’s robust operating performance in 2023 across various segments and geographies signifies its unwavering prowess and resonates with the formidable desirability and pricing power of its brands. The resounding market response, evident in the share price rally exceeding 10% on the announcement day, underscores the investors’ vote of confidence in LVMH’s inherent strength and potential for sustained growth.

In essence, LVMH’s valuation ostensibly aligns with the company’s high-caliber portfolio and astute management. CEO and family-leader Bernard Arnault’s reiteration of the company’s unwavering focus on quality and desirability elucidates the trajectory ahead for this luxury powerhouse. This rationale, coupled with the promising market sentiments, substantiates the prevailing share price as equitable and emblematic of the potential encapsulated within this magnificent business, beckoning investors with a compelling opportunity for long-term growth.

As the market grapples with uncertainty, seizing the opportunity to augment one’s position in LVMH is a testament to the confidence in this distinguished enterprise’s enduring value and growth prospects.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.