A Game-changing Innovator in Telehealth

Hims & Hers Health (NYSE:HIMS) is not just treading water; it’s causing a tsunami in the healthcare industry. In a vast and fast-growing telehealth market, HIMS is not merely another fish in the sea; it’s a shark. It offers telehealth services, consultations, prescriptions, and personalized wellness products, all wrapped in a neat, digital bow. The stock, currently trading 29% off its 52-week high, has posted a respectable 16% gain over the past year – just slightly behind the S&P 500’s 20% surge. At a market cap of ~$1.8 billion, HIMS is not a minnow; it’s a humpback, and it’s poised to leap beyond the competition due to its robust financial performance and solid market positioning.

We have faith in HIMS and believe it’s a smart buy, setting a price target of $14. That’s over a 50% upside from current share price levels, with ample growth potential in the long run.

An Enticing Total Addressable Market

No need for cold feet in this heated competition. While the telehealth market is crowded, it’s also sprawling. The sheer size and diversity of the market indicate that the competition isn’t a stumbling block for HIMS; it’s a diving board. As the digital health platform becomes increasingly important to consumers, opportunities within the market are multiplying. HIMS, along with its peers, is set to thrive by addressing varied needs within the healthcare and wellness space. The company operates in men’s health, women’s health, dermatology, and mental health sectors – all expanding runways. Furthermore, HIMS is eyeing new markets, including weight management, pain management, fertility, and diabetes, adding steam to its growth train.

In the U.S., the Health & Wellness market, valued at $1.2 trillion in 2022, is projected to grow at a compound annual growth rate of ~6% through 2026, reaching $1.5 trillion. HIMS’ total addressable market was $285 billion in 2021, estimated to swell to $381 billion by 2026. Importantly, HIMS’ current revenue accounts for a paltry 0.1% share of the U.S. market, projected to increase to only 0.4% by 2026. This confirms that the telehealth and wellness market is capacious enough to support the growth of numerous businesses concurrently.

Impressive Financial Performance

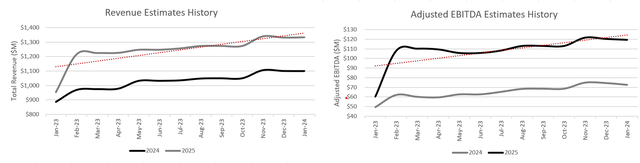

HIMS has been a paragon of financial strength despite the tempests of 2023. In the third quarter of 2023, the company’s revenue soared 57% year-on-year, hitting $227 million, with $12 million in adjusted EBITDA and an adjusted EBITDA margin of ~5%. This consistent outperformance has been a feather in HIMS’ cap, surpassing revenue estimates in eight consecutive quarters and outdoing EBITDA estimates in the past four. This track record underscores management’s acute understanding of the business and ability to manage investor expectations effectively, vital traits for a budding business.

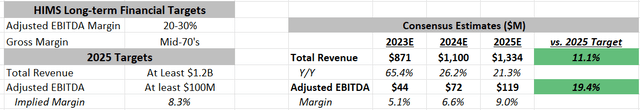

From 2020-2022, HIMS achieved a striking total revenue CAGR of 88%. Although growth is anticipated to moderate, analysts still expect a CAGR of 36% from 2022-2026, with revenue hitting $1.3 billion. On the profitability front, HIMS aims to grow adjusted EBITDA by over 800% from 2022 levels, reaching $119 million by 2025 – a ~9% margin.

With its blend of growth and profitability prospects, coupled with an immense TAM, HIMS presents investors with a tantalizing opportunity as it continues to surge ahead in the telehealth industry.

Deciphering HIMS Financial Performance: A Comprehensive Analysis

Key Performance Indicators

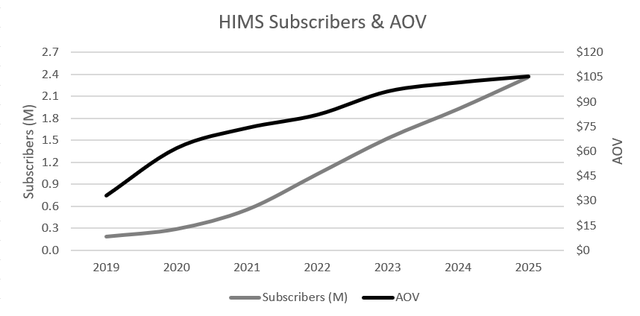

The tailwinds are strong for HIMS as it continues to showcase robust growth in its subscriber count and average order value (AOV). Exiting 3Q23 with 1.43 million subscribers, the company outstripped consensus estimates, underlining a 37% surge from its 2022 ending count. Furthermore, analysts foresee a remarkable ~32% CAGR in subscriber base, propelling it to 2.36 million by 2025. In parallel, with a 21% upsurge in AOV to $99, HIMS is evidently enhancing customer value on its platform. Analysts project AOV to grow at a ~9% CAGR, substantiating the consumers’ acknowledgment of the value provided by HIMS.

Financial Resilience

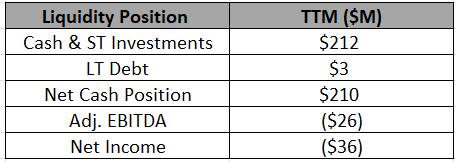

HIMS is treading the financial waters with care, with a solid net cash position of ~$210 million and an almost debt-free balance sheet. The company’s liquidity not only acts as a protective barrier but also endows it with financial maneuverability to navigate dynamic market forces effectively. Despite negative cash flows in 2021 and 2022, the company turned the tide in 3Q23, generating $19 million in free cash flow. Projections hint at a healthy $39 million in positive free cash flow for 2023, indicative of sustained growth.

Analyst Forecasts

The analyst community echoes a positive sentiment with compelling estimates for HIMS. Projected top-line growth for fiscal year 2024 and fiscal year 2025 has surged by 24% and 40%, respectively, over the past year, signifying resolute financial performance and adept management. These optimistic forecasts underscore the company’s promising prospects for attracting new customers and expanding its product range.

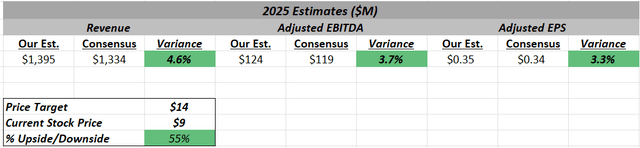

HIMS Long-term Vision

HIMS isn’t just dreaming big, it’s putting in the work to achieve its lofty long-term targets. With aspirations for adjusted EBITDA margins within the 20%-30% range and a revenue goal of $1.2 billion plus a minimum of $100 million in adjusted EBITDA by 2025, HIMS is ambitious. Although current analyst estimates slightly surpass these targets, indicating a collective belief in HIMS’ growth narrative, the company’s long-term success hinges on sustained top-line expansion and margin growth.

Valuation

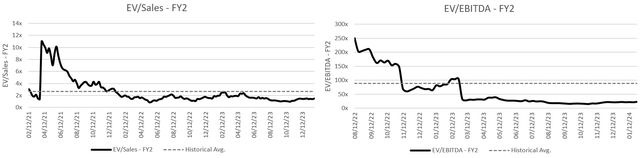

HIMS is currently trading at a discount, with its EV/revenue and EV/EBITDA at 1.5x and 22.9x, respectively. These figures exhibit a historical discount of 43% and 74%, signaling potential undervaluation. However, given its limited trading history and the pandemic-related market upheavals, some caution is advised while interpreting these discounts.

Undervalued HIMS: A Compelling Investment Opportunity

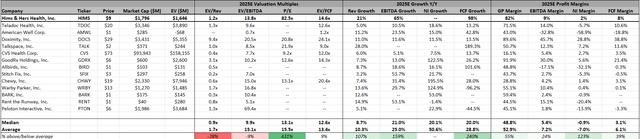

When comparing HIMS to its peers, both within the telehealth sector and other direct-to-consumer (D2C) companies, intriguing disparities emerge. HIMS is currently trading at a 28% discount to the peer average on an EV/revenue basis and a 9% discount on an EV/EBITDA basis.

Notably, despite these discounts, HIMS boasts superior top-line and EBITDA growth, coupled with a more favorable margin profile compared to the peer group average.

This, in conjunction with the fact that over 90% of its revenue is recurring, resembling a SaaS model, positions HIMS as notably undervalued.

The recurring revenue model provides a level of predictability and consistency that is akin to SaaS businesses, warranting a premium valuation.

The combination of these factors suggests that HIMS may be trading at a discount relative to its peers, in our opinion, presenting a compelling investment opportunity for those seeking growth potential and a robust business model in the telehealth and D2C space.

We estimate HIMS’ 2025 revenue to reach $1.395 billion, slightly above consensus, and, by applying an EV/revenue multiple of ~2.0x, below HIMS’ historical multiple but 17% above its peer group average, we arrive at a price target of $14, suggesting ~55% upside from current share price levels. Our premium multiple compared to the peer group reflects HIMS’ stronger top-line and EBITDA growth, a more favorable margin profile, and the recurring nature of its revenue, resembling a SaaS model.

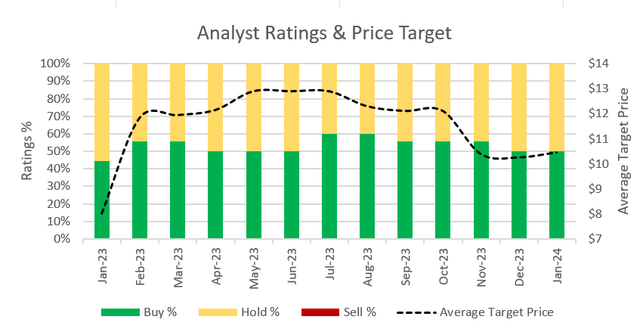

Insight into Analyst Ratings

Over the past year, analyst ratings for HIMS have been rather evenly split between Buy and Hold recommendations. Currently, ~50% of analysts have a Buy rating on the stock, accompanied by an average price target of $10, indicating a potential upside of just under 20%. Our price target of $14, reflects our belief that the market is currently overlooking HIMS, bolstered by the company’s strong balance sheet and attractive valuation.

Standalone Attributes of HIMS

There are several other aspects about HIMS that contribute to our optimistic outlook of the business. These include its impressive 85% long-term retention rate, solid unit economics, SaaS-like recurring revenue, noteworthy insider ownership, and the fact that HIMS is already adjusted EBITDA profitable.

Potential Risks

Investing in HIMS comes with inherent risks that investors should carefully consider, including further market deterioration, growing competition in the telehealth sector, the company’s path to sustained profitability, slow adoption of telehealth services, and potential regulatory changes and technological risks.

Closing Statements

We believe HIMS has emerged as a compelling investment opportunity, poised for substantial growth both in the short and long term. The company’s robust positioning within its operating market, solid financial performance, SaaS-like recurring revenue model, and its attractive valuation, make it evident that the stock offers investors an enticing blend of growth potential and stability. We rate HIMS a Buy with a price target of $14, suggesting 55% upside from today’s share price.