Devon Energy (NYSE:DVN) operates in the oil and gas sector with a market cap of $27.22 billion.

In a previous analysis of Devon Energy, a ‘strong buy’ recommendation was given. Since the article was published on August 17, 2023, Devon Energy’s stock has declined approximately 12.15% to around $42.50 per share.

While acknowledging Devon Energy’s recent struggles from 2009 to 2021, the article highlighted that the company seemed to be on a more promising trajectory after merging with WPX Energy in January 2021. The assessment has since evolved, recognizing other oil and gas companies of similar size as relatively more attractive. Consequently, the rating for Devon Energy has been revised to a ‘Buy’, reflecting potential challenges in production growth for 2024 amidst oil price and capital expenditure dynamics.

Performance Overview

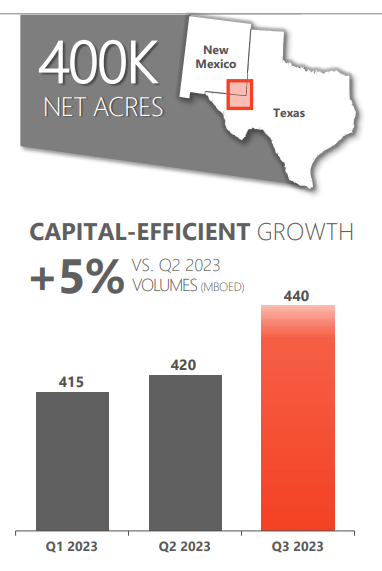

The company observed a 5 percent increase in production volume quarter-over-quarter in the Delaware Basin, its primary asset within the broader Permian Basin.

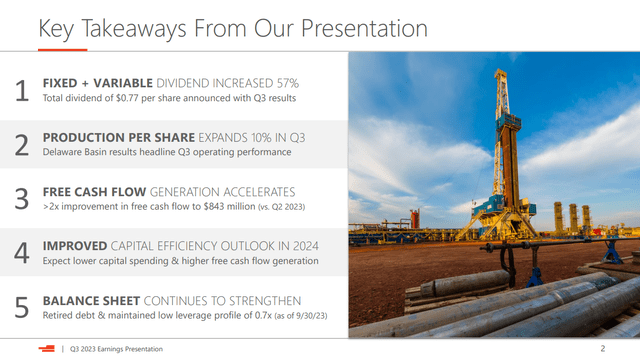

In Q3, Devon Energy exhibited capital efficiency, leading to a higher return on invested capital. Of note was the 10 percent rise in production per share, considered a positive outcome resulting from share buybacks coupled with production increases.

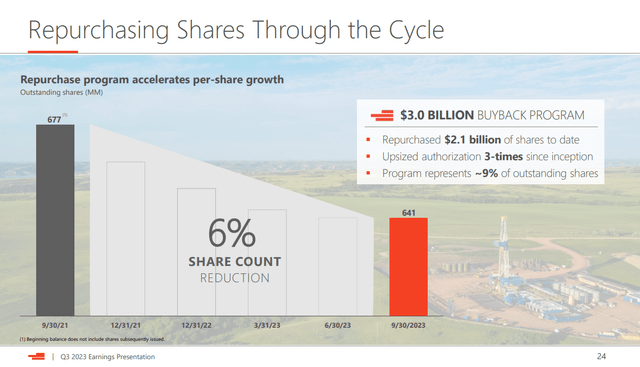

Furthermore, the company has successfully reduced outstanding shares through a $3 billion buyback program, leading to a 6 percent decrease in shares. The program has been expanded thrice since its initiation, with $900 million still available in the current program.

Financial Position

| (millions) | 2020 | 2021 | 2022 | 2023 Q3 |

|

Assets |

9,912 | 21,025 | 23,721 | 24,241 |

| Debt | 6,893 | 11,626 | 12,425 | 12,462 |

| Debt-to-Assets | .695 | .553 | .523 | .514 |

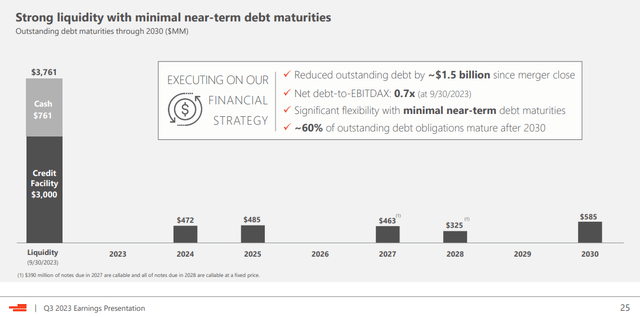

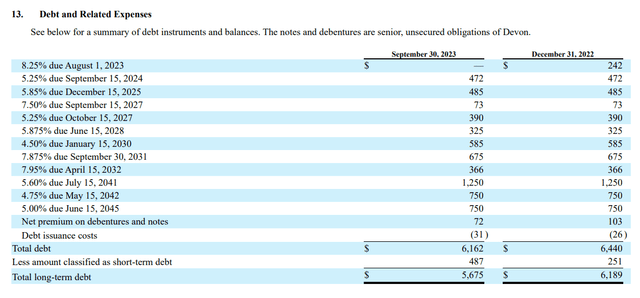

The company’s balance sheet indicates relative strength, with total liabilities at $12.46 billion, $3.3 billion of which is short-term liabilities. A graphic displays the company’s long-term debt maturities, followed by a table presenting the total long-term debt schedule from the company’s Q3 10Q.

Asset Inventory

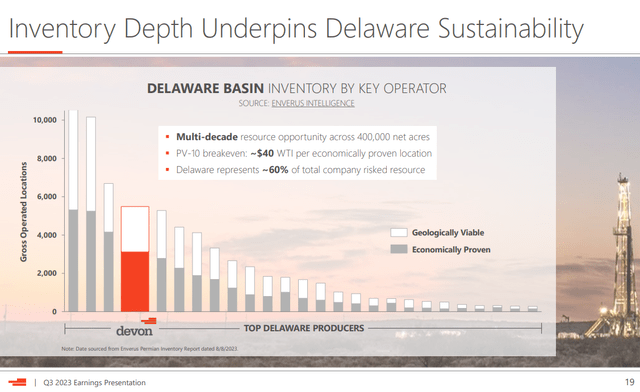

Devon Energy maintains 1.2 million net acres in United States resource plays, continually evaluating their potential. With an estimated minimum of 12 years of profitable drilling inventory at current prices, the company anticipates an eventual inventory exceeding 20 years as assessment of their assets progresses. Notably, Devon Energy stakes claim to the fourth-largest inventory in the Delaware Basin, positioning them favorably alongside other prominent players in the basin.

While EOG Resources (EOG) and Chevron (CVX) are believed to hold larger positions in the basin, Devon Energy’s substantial inventory in the region is promising for the company’s future prospects.

Cash Flow Trends

| 2021 | 2022 | 2023 TTM | |

| Operating Cash Flow | 4,899 | 8,530 | 6,718 |

| Capital Expenditure | (2,007) | (5,125) | (3,848) |

| Free Cash Flow | 2,892 | 3,405 | 2,870 |

The company has exhibited noteworthy trends in cash flow, with operating cash flow at $6.718 billion in 2023. Capital expenditure has been effectively managed to maintain healthy free cash flow, indicating a disciplined approach to managing resources.

The Road Ahead for Devon Energy in 2024

As oil prices fluctuate in the $70 to $80 range, Devon Energy has demonstrated resilience, maintaining robust cash flows through 2023 despite market challenges. The company, along with its counterparts, has been diligently exploring avenues to enhance capital efficiency in this period of temperate oil prices, aiming for more sustainable cost-effectiveness.

An explicit snapshot showcases the company’s strides in improved capital efficiency. Although Devon Energy does not anticipate escalating production in 2024, it foresees substantial growth in free cash flow, propelled by augmented capital efficiency. Amid unchanging production expectations, achieving amplified free cash flow alongside sustained production and significantly curtailed capital efficiency would mark an extraordinary feat for Devon Energy.

Production Progression

Quarter-by-quarter production growth for the company is outlined below:

| Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 Projected | |

| Oil (Mbod) | 288 | 300 | 294 | 316 | 320 | 323 | 321 | NA |

| NGL (Mbod) | 136 | 156 | 154 | 148 | 149 | 164 | 166 | NA |

| Natural Gas (Mmcf) | 906 | 961 | 1,000 | 1,034 | 1,030 | 1,054 | 1,070 | NA |

| Combined (Mboed) | 575 | 616 | 614 | 636 | 641 | 662 | 665 | ~650 |

Despite the projected stagnation in production for the upcoming year, the company anticipates an increase in production per share, as a part of its free cash flow will be directed towards share buybacks.

With expectations of sustained production in 2024, the company temporarily scaled back its frac crew in the Delaware Basin in Q3, aiming to bolster its drilled and uncompleted (DUC) inventory. This reduction in activity accounts for the flat production outlook for the Delaware Basin in 2024. Given more favorable oil prices, the company would likely prioritize augmenting drilling activity instead of reducing a completion crew to bolster its DUC inventory. Consequently, if Devon’s Delaware Basin production remains unaltered in 2024, the company-wide production is anticipated to remain relatively constant.

Risk Evaluation

The primary risk for Devon Energy, akin to any commodity-based firm, is the potential decline in the market prices and demand for its primary products, oil, and natural gas. While further substantial decreases in energy prices may not be imminent, this risk is inherent in investing in such enterprises. Devon Energy’s relatively higher leverage on its balance sheet compared to similar industry peers implies that it would be more susceptible to negative repercussions arising from a downturn in energy prices. To mitigate this risk, investors should seek avenues to hedge against the continual devaluation of the dollar, with energy investment serving as a viable approach. The intrinsic link between currency and energy is indisputable – a historical exploration of the petrodollar and, more recently, bitcoin, substantiates this interconnection.

Conclusive Insights

In summary, Devon Energy’s production trajectory is forecasted to remain relatively static in 2024. Nonetheless, the company is poised to allocate capital for share buybacks and dividends, ensuring investor returns that are grounded in a robust return on capital expenditure. However, from an investment perspective, a preference could be attributed to companies that actively pursue projects enabling concurrent production expansion, sustained capital return to shareholders, and a resilient balance sheet. At present, Devon Energy seems inclined to uphold its production levels and channel more capital towards share repurchases and dividends. Given the prevailing oil prices, striking a balance of this sort is likely a challenge confronting numerous entities in the sector. Resonating strongly, I advocate a buy rating for Devon Energy.