Challenging Start to 2024

The U.S. auto industry began 2024 on a challenging note, with January vehicle sales falling short of expectations. The daily selling rate for the month witnessed a significant decline, dampening initial forecasts. This underwhelming performance is a far cry from the industry’s heyday and marks the lowest January sales since the aftermath of the 2008-09 financial crisis, offering a sobering historical context.

Quarterly Results Breakdown

General Motors, Group 1 Automotive, and Oshkosh Corp’s latest quarterly results were a mixed bag. While GM surpassed earnings estimates and LAD missed, both companies experienced declines in annual sales. Oshkosh’s earnings exceeded predictions, although its revenues fell short of consensus estimates, leaving investors with a varied financial landscape to navigate.

Lithia Motors Acquires Pendragon and Its Implications

Lithia Motors took a bold stride into the UK market by acquiring Pendragon PLC’s motor and fleet management divisions. This acquisition broadens Lithia’s reach and establishes it as a formidable player in the UK automotive industry, a move that signifies commitment to growth and innovation amidst a challenging global automotive landscape.

Recall Woes for Tesla

Tesla faced a setback with the recall of 2.2 million vehicles in the United States due to concerns about the font size of warning lights on the instrument panel. This misstep raises safety concerns and marks the latest in a series of recalls for the electric vehicle titan, denting its reputation and leaving investors with skepticism about the company’s ability to navigate regulatory challenges.

Auto Industry Giants Reveal Impressive Financials and Projections

Two of the titanic names in the global auto industry—General Motors and Group 1 Automotive—have unveiled their financial statements, and the numbers are nothing short of awe-inspiring. Both companies have reported stellar performance, giving investors a positive nudge. Let’s dive into the financials to see where they stand.

General Motors’ Surge

General Motors (GM) has boldly smashed its fourth-quarter earnings estimates, outperforming predictions by a substantial margin. The automobile behemoth’s revenue clocked in at an astonishing $39 billion for the quarter. The new vehicle retail sales rose 17.2% to a staggering $2.3 billion, surpassing projected figures. On the used-vehicle front, the company also exhibited robust growth, with sales climbing 1.1% from the year-ago period to hit $1.33 billion. Even the Parts and Service business witnessed a significant upsurge, experiencing a 5.1% rise from the year-ago quarter. In the Finance and Insurance (F&I) segment, General Motors raked in $187.1 million, marking an 8.4% increase from the previous year.

Furthermore, Group 1 Automotive, Inc. (GPI) delivered an exceptional performance, demonstrating resilience and strength in navigating the challenging auto market landscape. The company’s used-vehicle wholesale sales surged a whopping 19.3% year over year, significantly exceeding expectations and showcasing an unparalleled market acumen. Their financial prowess is only outshone by their incredible vision for the future.

Oshkosh Corporation’s Triumph

Let’s steer our attention towards Oshkosh Corporation’s remarkable rise. The company revealed adjusted earnings of $2.56 per share, gracefully triumphing over the Zacks Consensus Estimate of $2.17. This victory was coupled with a 12% year-over-year surge in consolidated net sales, reaching a staggering $2,466.8 million—a feat that far surpasses its previous performance. Oshkosh’s various segments showcased remarkable strength, with the Accesssegment’s net sales rising 7.1% to $1.15 billion and the Defense segment registering a robust 7.2% revenue growth, reaching $586.9 million.

The refreshingly good news doesn’t end there—Oshkosh’s vocational unit sales soar by an awe-inspiring 26.1% year over year, topping out at $735.3 million. Their projected full-year 2024 sales are estimated to soar to $10.4 billion, accompanied by expectations of earnings reaching $9.45 per share and adjusted earnings hovering around $10.25 per share.

Financial Landscape and Anticipated Future Developments

As these companies revealed their financial underpinnings to the market, the result was nothing short of exhilarating. General Motors had cash and cash equivalents of $57.2 million as of Dec 31, 2023, whilst maintaining total debt of $2.1 billion as of the same period. On the other hand, Group 1 Automotive, Inc displayed robust financial maneuvering by repurchasing shares and demonstrating solid liquidity with significant cash reserves. It’s fascinating to see how both companies are navigating through rough market terrains with adept financial strategies and shrewd moves.

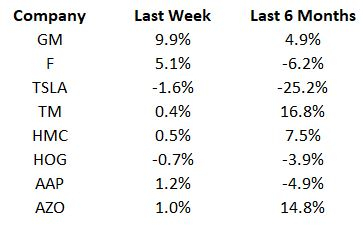

Industry watchers will keep an eager eye on vehicle sales in China for the month of January, and anticipate a wave of sensational earnings releases from major players. There’s an air of anticipation as names like Ford, Toyota, Cummins, O’Reilly and BorgWarner gear up to reveal their quarterly reports, further stirring the already simmering pot in the auto industry.

As the automobile industry races ahead, these financial reports are a compelling reminder of the adage “fortune favors the bold.” The financial statements from these industry titans strongly hint at a future brimming with optimism—a future where the roads seem to be paved with profitability and promise.

It is indeed a delightful prospect to witness these juggernauts trailblazing in their respective domains, showing off their strength, and charting out a path toward what could only be described as a golden horizon. Their financial prowess not only tells a story of resilience and adaptability, but also points to a future that is ripe with opportunities and possibilities. As investors brace themselves for the next set of earnings releases, they can’t help but wonder—will these companies continue to shine brightly or will the road ahead be filled with unexpected turns and thrilling challenges?