AGCO, a leading agricultural equipment manufacturer, has disappointed investors with its underwhelming performance in the fourth quarter of 2023. The company reported an adjusted earnings per share (EPS) of $3.78, falling short of the Zacks Consensus Estimate of $4.03. Furthermore, AGCO’s revenues witnessed a 2.5% decline from the prior year, amounting to $3.8 billion, missing the Zacks Consensus Estimate of $4.06 billion.

Factors Contributing to the Disappointing Results

The fourth quarter results were impacted by several factors such as lower-than-expected sales volumes and adverse currency translation effects. Despite predicting a 4.9% year-over-year increase in net sales, AGCO recorded a decline of 4.3% when excluding the positive influence of currency translation. The company’s performance fell short of market expectations, leading to a downward spiral in investor confidence.

Operational Challenges and Segmental Performance

AGCO faced operational challenges, with its cost of sales decreasing by 4.7% compared to the previous year. Despite an increase in gross profit, the company’s gross margin remained underwhelming at 25.9%. Notably, the regional segments of North America and South America experienced mixed results, with varying changes in net sales and operating income. The EME (Europe/Middle East) and Asia/Pacific segments displayed a similar trend, reflecting AGCO’s inconsistent global performance.

Financial Update and 2023 Performance

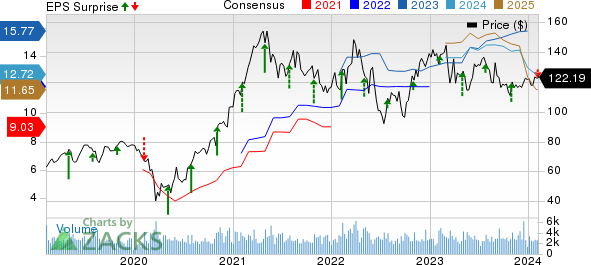

The company reported a decline in its cash and cash equivalents to $596 million, signaling underlying financial constraints. Despite recording a year-over-year increase in 2023 revenues, AGCO faced challenges in meeting market expectations. The company’s projected EPS of $15.55, fell short of the Zacks Consensus Estimate of $15.79, adding to investor concerns.

2024 Guidance and Price Performance

AGCO provided a cautious outlook for 2024, projecting net sales of $13.6 billion. The company anticipates a decline in sales volumes, partially offset by positive pricing and favorable currency translation. AGCO’s shares have also seen a decline of 4.4% in the past year, reflecting the challenges faced by the company in a competitive market environment.

Stock Recommendations and Zacks Rank

Despite AGCO’s challenges, several stocks in the Industrial Products sector have shown promising performance. Companies like Cadre Holdings, Inc. (CDRE), AZZ Inc. (AZZ), and Applied Industrial Technologies (AIT) have garnered favorable rankings and are expected to deliver strong results in the future. Investors are urged to consider alternative investment options within the sector.

The Rise and Rise of AGCO Corporation and Other Astounding Stocks

AGCO Corporation has ascended, marking a staggering +143.0% growth in little over nine months. The electric powerhouse NVIDIA has not just been behind but has sprinted ahead with a boom of +175.9% in just a year.

Free: See Our Top Stock And 4 Runners Up

AGCO Corporation (AGCO) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

AZZ Inc. (AZZ) : Free Stock Analysis Report

Cadre Holdings, Inc. (CDRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.