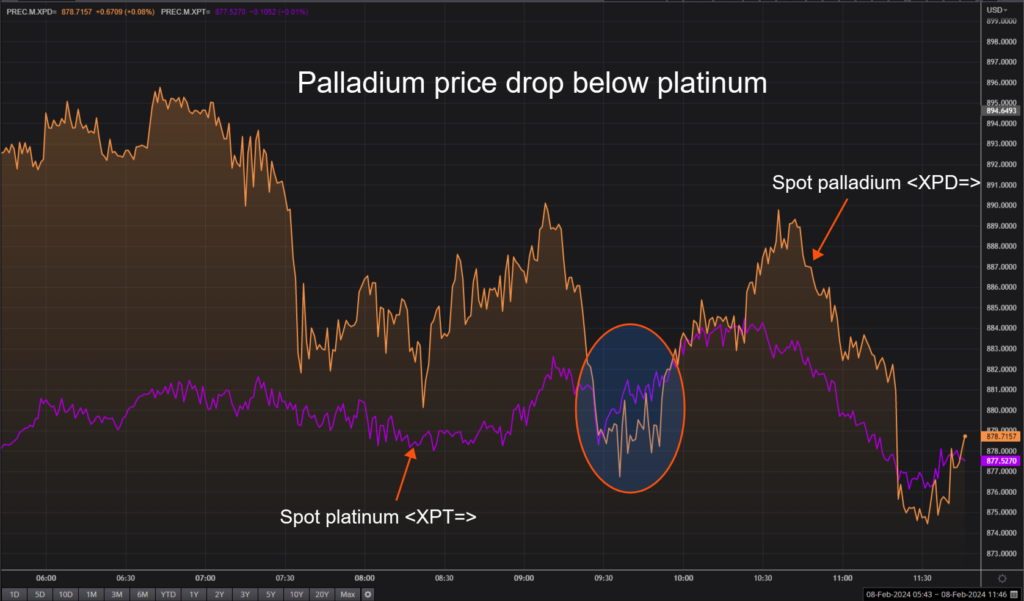

The palladium market is undergoing a seismic shift as prices have dropped below those of platinum for the first time since 2018. This reversal comes after palladium fell by 39% in 2023. The surge in prices from 2018 to 2022 led the auto sector, which accounts for 80% of demand, to begin substituting it with more affordable platinum in autocatalysts.

EVs and Offgas Treatment

The increasing adoption of electric vehicles (EVs), which do not require any offgas treatment system, has further compounded the challenges facing palladium. “That means that demand will shrink while supply will remain more or less stable,” said Henrik Marx, head of precious metals trading at Heraeus.

Market Sentiments and Production

Citi expressed a cautious outlook, stating, “Palladium prices could easily spike on major supply headlines given the thin liquidity. But we consider such rallies as opportunities for producers to add more hedging positions and for speculators to open fresh short positions, as the long-term outlook remains very negative.” The majority of mined palladium production comes as a by-product of mining other metals, which limits producers’ ability to reduce palladium output even when the market price is below their costs. Russia and South Africa together account for 80% of global palladium mined output, with North America contributing the rest. Russia’s main miner, Nornickel, announced that it would produce slightly less palladium this year, but no further reductions are planned.

Impact on Producers

The market downturn has already had a tangible impact on major producers. Two South African companies reported significant declines in earnings following the collapse in prices. Impala Platinum Holdings Ltd. stated that fiscal second-half profit likely fell by more than 85% and wrote down the value of assets in South Africa and Canada. Anglo American Platinum Ltd. highlighted that its 2023 profit plummeted by as much as 79%.

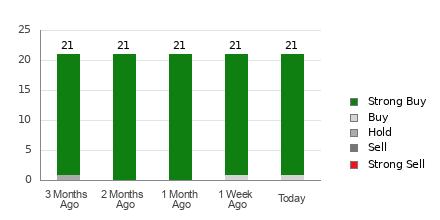

Stock Market Response

The impact also reverberated in the stock market as shares in the four companies that mine most platinum-group metals (PGMs) in South Africa all experienced a notable decline in Johannesburg trading. Amplats dropped 6.8%, Implats slid 1.9%, Northam Platinum Holdings Ltd. declined 5.2%, and Sibanye Stillwater Ltd. was down 4.6% as of 10:43 a.m. local time Thursday.

(With files from Bloomberg and Reuters)