Who doesn’t love dividends? They’re like the savory aroma of freshly baked chocolate chip cookies, offering a passive income stream and cushioning any blows in other positions. For those with an eye on dividend-paying stocks, companies that consistently hike their payouts are the holy grail – a symbol of commitment to rewarding shareholders. In this realm, three names have stood out: Cigna Group CI, CME Group CME, and The Hershey Company HSY. Let’s journey closer to each of them.

Cigna Group

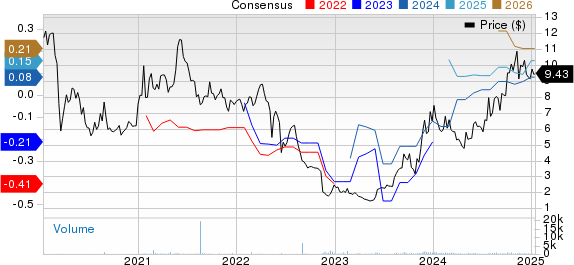

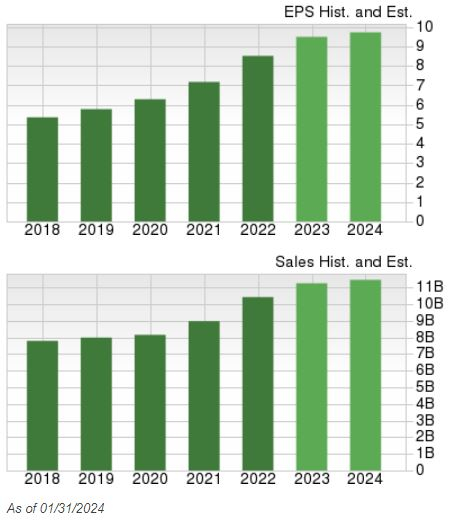

Cigna is like a sturdy oak tree in the forest of health services, offering resolute choices and affordable, quality care to the masses. The company recently adorned its shareholders with a 14% boost in quarterly payouts following a stellar quarterly performance that outdid the Zacks Consensus EPS forecast by 4% and clocked 5% higher revenues. The company has been nurturing its revenues consistently over the years, as seen below.

Image Source: Zacks Investment Research

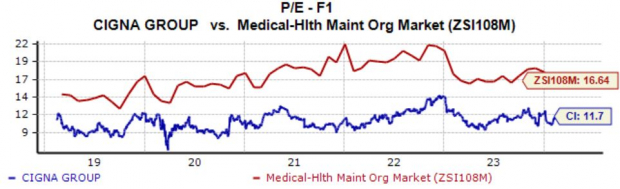

In addition, the stock is garnering attention from value-focused investors, with a forward earnings multiple (F1) of 11.7X, well below the industry average of 16.6X. It’s like finding a rare, overlooked treasure at a garage sale. Who wouldn’t want a piece of that?

Image Source: Zacks Investment Research

CME Group

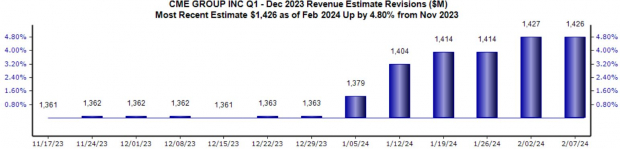

CME Group, the titan of futures exchanges, recently raised its quarterly payout by 4.5% to $1.15 per share, a move that has resonated well with its shareholder base. The company’s 49% payout ratio lends a flavor of sustainability to its dividend policy. Keep your ears to the ground for the next quarterly release slated for February 14th, where the Zacks Consensus EPS estimate of $2.27 paints a picture of robust 18% year-over-year growth in earnings and nearly 5% higher revenues.

Image Source: Zacks Investment Research

The Hershey Company

Hershey, the household name in chocolates and confectionery, has been a beacon of hope for income-minded investors since 1930, dishing out uninterrupted dividends like a steady rain. The recent 15% hike in its quarterly dividend to $1.37 per share is just the cherry on top. The company is poised to continue its steady growth, with consensus expectations for the current fiscal year (FY23) suggesting a delectable 12% earnings growth and an 8% increase in sales. It’s like finding ever-ripening fruit in an orchard.

Image Source: Zacks Investment Research

Bottom Line

Companies that consistently hike their dividend payouts hint at a successful and shareholder-friendly nature, one that is keen on sharing the profits with investors. And for those seeking these prized dividend growth companies, Cigna Group CI, CME Group CME, and The Hershey Company HSY, have recently augmented their payouts. Investors would be wise to keep these names on their radar.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

CME Group Inc. (CME) : Free Stock Analysis Report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Cigna Group (CI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.