Chinnapong/iStock Editorial via Getty Images

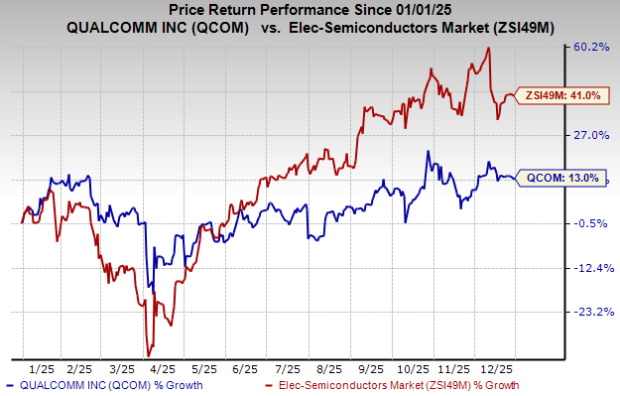

Bitcoin (BTC-USD) has experienced a remarkable surge this week, marking a gain of approximately 11%, its highest level in nearly a month. This notable rally comes amidst renewed concerns regarding the stability of regional banks.

New York Community Bancorp has initiated efforts to mitigate risk associated with a substantial portfolio of residential mortgages and enhance liquidity at its Flagstar Bank unit.

“The conversations surrounding a potential banking crisis and optimistic government data on inflation have been significant catalysts for this surge,” observed Dan Raju, CEO of brokerage Tradier.

Bitcoin (BTC-USD) crossed the $48,000 benchmark on Friday, a resurgence not witnessed in a month, subsequently propelling cryptocurrency-associated stocks to higher levels. After experiencing tepid trading activity last week, the cryptocurrency’s value surged in the week ending February 9, fluctuating in the $42,000 to $48,000 range.

Coin Telegraph reported a substantial influx of $403 million into spot Bitcoin (BTC-USD) ETFs on February 8, marking the third-largest inflow. Notably, the total inflows into these ETFs have surpassed $2.1 billion since their launch last month.

“This time, Bitcoin’s (BTC-USD) price action appears stronger pre-halving and, in our assessment, is likely to sustain momentum throughout the year,” anticipated Bernstein analyst Gautam Chhugani. He advised acquiring crypto mining stocks, with his top recommendations being Riot Platforms (RIOT) and CleanSpark (CLSK).

Notable News

- Crypto custody and trading platform Bakkt (BKKT) expressed doubts about its ability to continue as a going concern in the next year without raising capital.

- CleanSpark (CLSK) unexpectedly posted a quarterly profit, attributable to a 166% surge in Bitcoin (BTC-USD) mining revenue from the previous year, bolstered by the rally in BTC prices.

- Crypto exchange Binance announced the delisting of the monero (XMR-USD) privacy coin on February 20, causing a 28.2% decline in the token’s value. Additionally, plans were unveiled to delist aragon (ANT-USD), multichain (MULTI-USD), and vai (VAI-USD) tokens.

- Former President Donald Trump, a personal investor in crypto, voiced concerns about central bank digital currencies (CBDCs) being “a very dangerous thing.”

- Bitcoin (BTC-USD) miners reported a decline in January production this week, with the output of Marathon Digital (MARA) down 42% month-on-month, Riot (RIOT) down 16% month-on-month, CleanSpark (CLSK) down 19.86% month-on-month, and Argo Blockchain (OTCPK:ARBKF) down 20% month-on-month.

Bitcoin, Ether Prices

Bitcoin (BTC-USD) rose by approximately 4.26% to $47,400 at 4:36 pm ET on Friday, while ether (ETH-USD) inched up by about 2.50% to $2,500.

WisdomTree, a contributing author to Seeking Alpha, believes that multiple signals, including volatility, indicate that Bitcoin (BTC-USD) is maturing as an asset class.

“The availability of spot Bitcoin (BTC-USD) exposure in the ETF structure was a significant milestone, but it was just one of many signs that signify Bitcoin’s journey towards becoming a mature asset class.”

Exploring the World of Cryptocurrencies