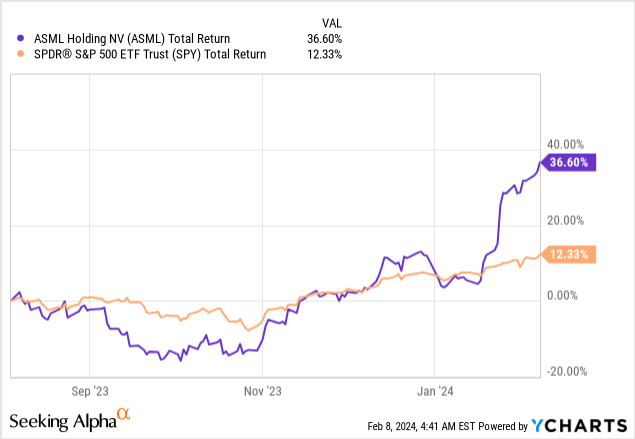

Against a backdrop of fiscal tumult, ASML Holding N.V. (NASDAQ:ASML) has defied expectations to conclude its fiscal year on a high note, trumping the S&P. Despite its prior annual lackluster performance, the company has astoundingly surpassed Wall Street’s projections.

In a previous article last August titled “ASML’s Mixed Outlook: Near-Term Headwinds, Long-Term Promise,” I underscored ASML’s stronghold as a monopoly company with a compelling long-term investment rationale, in spite of a lukewarm second-quarter performance in 2023.

Reflecting on my prior piece, “ASML: Near-Term Headwinds Weigh On Q3 Results,” it was apparent that Q3 encountered significant challenges.

Now, let’s delve into the company’s fourth-quarter outcome, measure against my forecast vis-a-vis the consensus, and scrutinize the enduring strength of the investment thesis.

Investment Thesis

ASML presents a beguiling long-term investment proposition, underpinned by a proven track record of growth and an enviable position to capitalize on the burgeoning semiconductor market. Nonetheless, its current valuation appears somewhat stretched. Hence, I advocate a Hold rating until the company’s near-term challenges are resolved.

Backstory

Analyzing ASML’s performance since August revealed a nascent recovery until the fourth quarter results were disclosed, where it managed to outshine the (SPY) indices.

This achievement calls for an examination of the catalysts propelling this feat and an evaluation of their sustainability. Moreover, a comprehensive inquiry into the impetus behind the 10% surge in ASML’s stock price post its financial results is indispensable.

Q4-23 Highlights

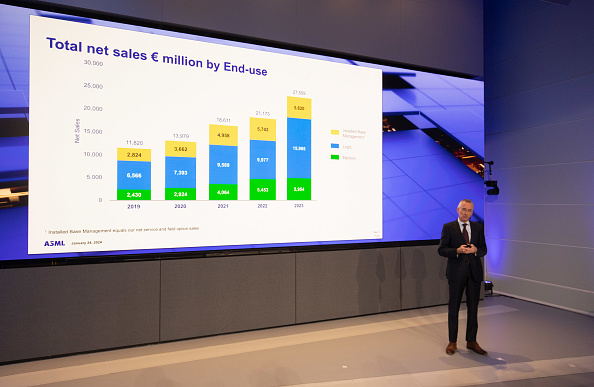

In Q4-23, ASML reported consolidated revenue of €7.2 billion, marking a robust 12.6% year-over-year growth. Its revenue for the entire 2023 stood at €27.5 billion, reflecting a substantial 30.2% year-over-year upswing. Particularly noteworthy was the stellar 30% growth in EUV system sales, underpinned by the fervent demand for lithography machines from the preceding year.

ASML’s monopoly in the market, chiefly owing to its prowess in crafting EUV lithography, confers a formidable advantage, given the absence of alternative technologies from other companies.

In a press release in Q2-2023, Peter Wennink, CEO, conceded to pending demand deceleration precipitated by prevailing macroeconomic uncertainties, projecting a protracted convalescence in their markets, brimming with ambiguity as to the trajectory of this recovery.

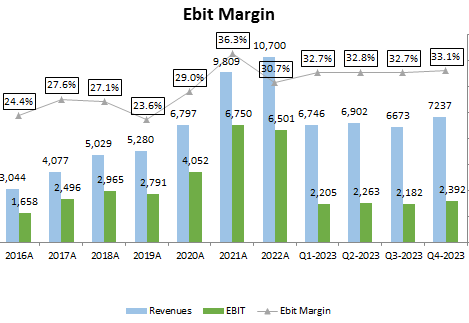

Despite foreseeing a modest demand downturn due to macroeconomic vicissitudes and a more sluggish convalescence than anticipated, ASML, as a monopolistic entity with potent pricing prowess and robust demand, should strive to undergird its cost structure and heighten product prices. Yet, this has yet to materialize.

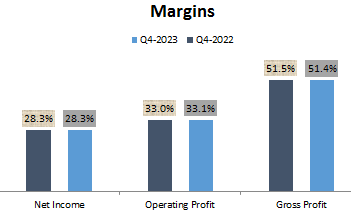

In the preceding piece on ASML, I intimated the company’s acknowledgment of an imminent demand slump. Notwithstanding, the company’s impregnable competitive advantage, evinced through its consistent margins, steadfastly maintained at a 32% to 33% range, evinced in the adjoining graph, highlights its unwavering mettle.

In defiance of the prevalent unsettled macroeconomic milieu and languid recovery pace, ASML has adeptly upheld its margins, a testament to the robustness of their moat, underscoring its acumen in weathering adversities.

Future Prospects

Based on diverse scenarios presented at our Investor Day in November 2022, we have modeled a prospect to achieve annual revenue in 2025 ranging from approximately €30 billion to €40 billion and a gross margin between roughly 54% and 56%. By 2030, a projected annual revenue between approximately €44 billion and €60 billion, with a gross margin ranging from approximately 56% to 60% is envisaged.

Recent communications from ASML’s management indicate a sustained upbeat outlook, buoyed by robust demand for its lithography machines. ASML continues to spearhead the semiconductor industry as the preeminent supplier of advanced lithography systems, indispensable for manufacturing high-performance computer chips.

Evaluation

Using a DCF methodology for ASML’s valuation, my analysis indicates a projected CAGR of 11% for its revenue from 2024 to 2031, factoring its monopolistic standing and potent pricing power. Furthermore, I estimate a 2.4% FCF yield for the 2025 exit.

Currently, ASML’s Fwd PEG ratio hovers at 2.22x, marginally elevated, underscoring emergent near-term trepidations. Despite a 10% upswing post earnings, I remain buoyant about its long-term investment mettle. While near-term demand vicissitudes could be imminent, its performance is expected to remain robust in the long haul. However, it may not surpass SPX in the near term.

Risks

It is imperative to acknowledge potential pitfalls that could impact my thesis:

Macroeconomic headwinds: Ongoing global economic uncertainty, inflation, and the specter of a recession could dampen semiconductor demand, thereby impinging on ASML’s sales and profitability.

Technological advancements: Notwithstanding ASML’s current EUV technology supremacy, rivals might devise alternative lithography solutions or catch up in EUV development, eroding ASML’s monopoly power.

Geopolitical risks: Trade tensions and disruptions in key markets, notably China, could pose exigent challenges for ASML’s supply chain and customer base.

Execution risk: Failure to meet production targets, technological advancement delays, or organizational mismanagement could deleteriously impact ASML’s performance.

Final Verdict

ASML has masterfully navigated a turbulent year to emerge triumphant in the fourth quarter, eclipsing the S&P 500 and outstripping expectations. Its unassailable dominance in EUV lithography remains a potent moat, borne out by unwavering margins despite macroeconomic headwinds. While a near-term demand slowdown looms, the company’s long-term future appears luminous, brimming with potential revenue and margin expansion.