Picking long-term winners doesn’t have to be hard or require a ton of legwork. Instead of trying to figure out which tech company is going to be the next best thing, a better route may be to instead invest in economically essential companies that produce steady and lasting cash flows while they are trading on the cheap.

This brings me to Enbridge (NYSE:ENB), which I last covered back in December with a ‘Buy’ rating, noting its growth tailwinds in traditional and renewable natural gas. Like many income stocks, ENB has since fallen out of favor with the market since December as most investors have turned to growth stocks, with ENB stock declining by 4.5% since my last piece.

In this article, I revisit ENB including its Q4 results and discuss why savvy income investors may want to consider ENB at its current discounted price for high income, so let’s get started!

The Strength of Enbridge

Enbridge is a giant North American natural gas, oil, and renewable energy company that also has a growing portfolio of European offshore wind assets. Unlike upstream companies, which are more susceptible to swings in energy prices, ENB’s moat-worthy collection of midstream and terminal storage assets enables a much smoother cash flow stream.

This is reflected by the fact that 98% of ENB’s EBITDA is generated by cost-of-service or contracted assets and over 95% of its customers are investment grade rated. Moreover, ENB has adequate economic buffers in place, as 80% of its EBITDA has inflation protections that are derived from assets with revenue inflators or assets with regulatory mechanisms for recovering rising costs.

As shown below, ENB has had a 20-year track record of growing its EBITDA by 816%, and this includes both macroeconomic risks such as the Great Financial Crisis in 2008-2009 as well as the oil commodity price collapse in 2014-2015 and COVID of 2020.

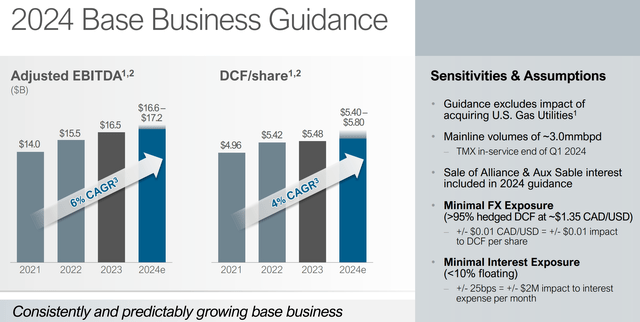

Meanwhile, ENB has demonstrated continued growth in its latest full-year 2023 results, including adjusted EBITDA growth of 6% YoY to $16.5 billion and achieving financial guidance for the 18th year in a row, reflecting the stability and predictable nature of the business. This was supported by high utilization rates across its liquids pipelines, setting multiple throughput records over the past year. ENB has also added to its Gas Transmission business with over 100 bcf of combined gas storage between its Aitken Creek asset in British Columbia and Tres Palacios in the U.S. Gulf Coast. Moreover, ENB’s gas utility business is performing well, with 46K new customers added to its network in Ontario.

Looking ahead, I see ENB’s growth thesis as being intact, considering the growing global demand for liquefied natural gas. This includes the aforementioned Tres Palacios storage asset that ENB acquired in March of last year, which supports the growing demand for LNG from Mexico with exports and pipeline capacity to the country, and its Aitken Creek Gas Storage facility supports both local demand in British Columbia as well as Canadian exports to Asia.

According to the International Energy Forum, US LNG exports grew by 135% between 2019 and 2023, and are expected to grow by another 17% by 2025. LNG is a versatile lower carbon energy source and demand is expected to grow at a 4% CAGR through 2035.

ENB is also expanding to renewable natural gas with the acquisition of several high-quality landfill RNG assets in Texas and Arkansas, which enjoy utility-like cashflow streams and are supported by long-term offtake contracts. Management expects for the landfills it acquired to double in size by 2040 with minimal capital investment.

Moreover, ENB’s recently acquired Gas Distribution business from Dominion Energy (D) is expected to be accretive in its full year of ownership and puts ENB on even footing with an earnings mix of 50% Natural Gas/Renewables and 50% Liquids. Importantly, ENB has already secured 85% of the $19 billion required financing for the gas utility acquisitions. This is supported by the recent $3 billion sale of ENB’s interest in Alliance and Aux Sable assets. As shown below, management continues to target 6% and 4% growth in adjusted EBITDA and DCF/share into 2024.

Importantly, ENB is supported by a strong BBB+ credit rating from S&P, which comes in handy during the current higher interest rate environment, and this is underpinned by a debt to EBITDA ratio of 4.1x, sitting below management’s target of 4.5x to 5.0x.

Although ENB isn’t technically a dividend aristocrat since it’s not a member of the S&P 500 (SPY) index, I view it as being a strong equivalent considering its size and 29 consecutive years of annual dividend increases (subject to currency translation for U.S. investors). The dividend is also well-covered at a 65% DCF coverage ratio, sitting within the 60% to 70% targeted range.

Risks to ENB include extreme weather events, which may damage or temporarily incapacitate its assets. ENB is also subject to technological risks should new renewable energy technology that come to market be more cost competitive and efficient to scale compared to traditional fossil fuels. In addition, regulatory risks also exist for ENB as it relates to tolling agreements and construction on new builds.

Turning to valuation, I continue to view ENB as being a solid bargain at the current price of $34.23 with a price-to-cashflow of 7.05x, which as shown below, sits at the low end of its 5-year range. At this valuation, ENB is priced for plenty of risk perhaps in relations to its pending natural gas utilities acquisition, despite having secured the majority of funding (85% as noted earlier) and having leverage below its target range. ENB is also priced for no growth at the current valuation, which also goes counter to management’s guidance for 4% DCF growth this year, and 5% annual growth in the medium term.

As shown below, ENB is also cost competitive with that of its peers, with a valuation that’s slightly cheaper than that of Enterprise Products Partners (EPD) and Canadian peer TC Energy (TRP) while being pricier than Kinder Morgan (KMI).

Investor Takeaway

Enbridge’s strong track record of growth and its stable, predictable business model make it an attractive investment option for income and growth investors alike. The company has successfully navigated through macroeconomic risks in the past and continues to deliver solid financial results. With a growing global demand for LNG as well potential tailwinds from RNG and U.S. Gas Distribution, ENB is well-positioned to opportunistically capitalize on its diverse energy platform. Lastly, with a well-covered dividend and discounted valuation, investors may do well to buy into ENB while income stocks are out of favor with the market. As such, I maintain a ‘Buy’ rating on ENB.