Before making a move on a stock, investors often look to the musings of those bespectacled tacticians known affectionately as Wall Street analysts. Navigating between the tempestuous waters of “Buy,” “Sell,” and “Hold” recommendations, one might find it wise to consult these soothsayers. But do these analysts truly hold the keys to the market kingdom? Let’s delve into the world of brokerage recommendations and see what the titans of Wall Street have to say about Meta Platforms (META).

The Wall Street Verdict

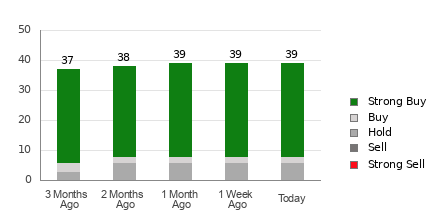

Meta Platforms currently boasts an average brokerage recommendation (ABR) of 1.29, a figure calculated from the “Buy,” “Hold,” “Sell,” and other such edicts of 45 brokerage firms. This numerical nugget almost flits between “Strong Buy” and “Buy” on the categorical scale.

Among the 45 recommendations contributing to this summation, 39 cry “Strong Buy” and one echoes a simple “Buy.” Together, these laudatory cries account for an overwhelming 86.7% and 2.2% of all recommendations, respectively.

Assessing the ABR Trend

So, what are the sages of Wall Street whispering to us regarding Meta Platforms? Do these opinions hold water? While the ABR presupposes a bullish fervor for Meta Platforms, one must tread cautiously. Historical evidence suggests a muted success rate for brokerage recommendations in predicting fruitful stocks.

Brokerage Bias: A Thorn in the Side?

Why must we approach these recommendations with cautious optimism, you ask? Well, the tangled web of vested interests can often tether the roving eye of these brokerage firms, engendering a rose-tinted bias in their analysts’ recommendations. For every “Strong Sell” they martyr, five “Strong Buy” accolades bloom forth, indicating a skewing of their counsel in favor of the stocks they cover.

So perhaps, dear investor, these august institutions may not always have your best interests at heart. It might be wiser to view their chirping as mere background music, relegating the decision to a tool that has proven itself in the stock market arena.

A Reliable Beacon: Zacks Rank

Enter the Zacks Rank, a proprietary stock rating contrivance with a lineage steeped in audited success. Classifying stocks from #1 (Strong Buy) to #5 (Strong Sell), the Zacks Rank offers a promising indicator of a stock’s forthcoming dance with price performance. Thus, validating the ABR through the lens of Zacks Rank could be your ticket to the Emerald City.

Deciphering the ABR-Zacks Rank Dichotomy

If you find yourself entwined in the labyrinth of ABR and Zacks Rank, fear not; they are things apart. While the ABR relies solely on the fulminations of brokerage recommendations, flaunting its decimals with an air of mystery, the Zacks Rank is a creature of a different ilk. It stands as a quantitative model like no other, drawing potency from the currents of earnings estimate revisions and proudly wearing its whole numbers from 1 to 5.

Where Truth Lies: ABR vs. Zacks Rank

In the unfurling tapestry of ratings, where does truth lie best? ABR, suffused with the self-interest of brokerage firms, often gleams with an unsteady light; the Zacks Rank, on the other hand, basks in the glow of earnings estimate revisions. As historical tides have shown, stock price movements waltz hand in hand with these revisions, revealing a correlation that can’t be easily dismissed.

In addition, the Zacks Rank bestows its judgements evenly across the stocks for which brokerage analysts wax poetic about current-year earnings, maintaining an equilibrium of appraisals. With a penchant for timely reflections, it wears its relevance not as a gaudy adornment, but as a steadfast truth-seeker amidst the fickle swirl of market sentiment.

Is META Worth the Penny?

But what of Meta Platforms? Does it merit the investment gambit? Let the numbers speak; the Zacks Consensus Estimate for the current year has swelled by 10.8% over the past month to $19.62.

Rising in concert with this crest of the consensus are the numbers behind the Zacks Rank, which crowns Meta Platforms with a resplendent #1 (Strong Buy). A melody of factors harmonizes this tune, making a compelling case for investors to pay heed.

Just Released: Zacks Top 10 Stocks for 2024

Hark! Do you hear the trumpet call of the Zacks Top 10 Stocks for 2024? Handpicked by the esteemed Zacks Director of Research, Sheraz Mian, these treasures have tamed the steed of financial fortune with a pulse-quickening gain of +974.1% since their inception in 2012. Dare you stall while others press forth?

Vested Interest Disclaimer: Views and opinions expressed herein are those of the author and do not necessarily align with those of Nasdaq, Inc.