Investing in Revenue Growth

Consistent sales growth is crucial for sustainable profits. A company’s ability to generate strong revenue not only drives scaling efficiencies but also creates continuous value for shareholders. Therefore, it is imperative for growth-oriented investors to consider companies with robust top-line performance.

Company Analysis

Three companies – MercadoLibre MELI, Amazon AMZN, and OneSpaWorld OSW – have showcased significant sales growth over recent years. These companies also carry a favorable Zacks Rank, indicating positive sentiment among analysts towards their prospects. Let’s delve deeper into each of these firms.

MercadoLibre

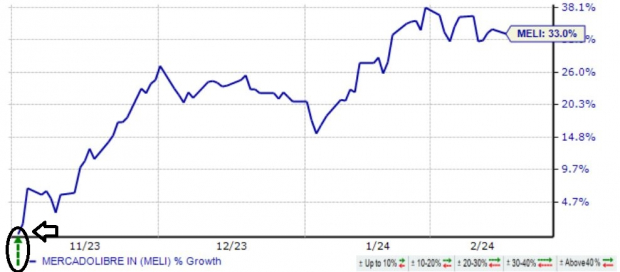

MercadoLibre, which holds a Zacks Rank #1 (Strong Buy), is a dominant force in Latin America’s e-commerce and technology sector. The company’s stock witnessed a substantial uptick following its latest quarterly release, soaring 33% since the announcement.

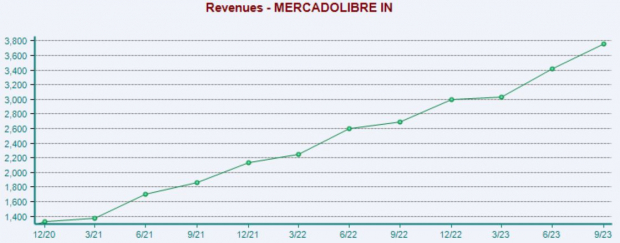

The company’s remarkable share performance has been fueled by its impressive revenue-generating capabilities. MercadoLibre has consistently achieved double-digit year-over-year sales growth in its last 15 releases. In the most recent quarter, the e-commerce behemoth reported revenue of $3.8 billion, marking a remarkable 40% surge from the same period last year.

While the stock is trading at elevated multiples, its forward price-to-sales (F1) ratio stands at 5.0X, below the five-year median of 10.3X and its five-year highs of 22.2X, hinting at a potential buying opportunity.

Amazon

As a member of the elite ‘Mag 7’, Amazon’s shares have demonstrated robust performance, surging 70% over the past year. The company holds a Zacks Rank #1 (Strong Buy), with upbeat earnings expectations.

Amazon remains an attractive pick for growth-focused investors, underlined by its Style Score of ‘A’ for Growth. Consensus estimates point towards 40% earnings growth and an 11% increase in sales for its current fiscal year (FY24), with further growth anticipated in FY25.

Investors cheered the company’s latest quarterly results, particularly the 13% year-over-year growth in AWS net sales. Amazon’s Q4 operating income also witnessed a substantial improvement, reaching $13.2 billion compared to $2.7 billion in the preceding period.

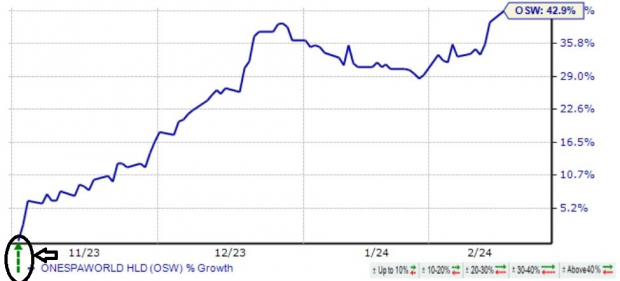

OneSpaWorld

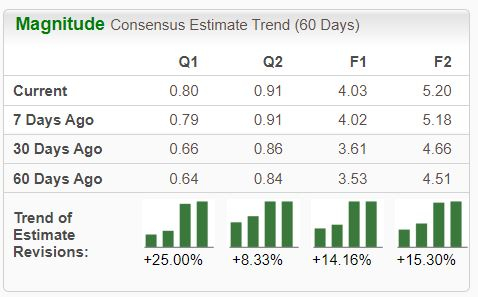

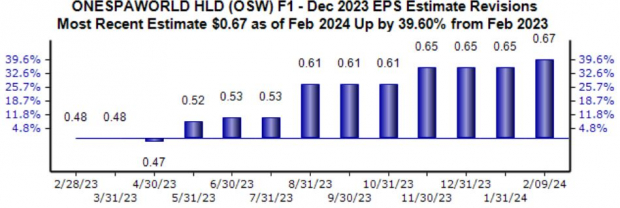

OneSpaWorld, a leader in wellness, beauty, and transformation services on cruise ships and land, holds a Zacks Rank #2 (Buy), with strong upwards revisions in earnings estimates for the current fiscal year.

Similar to its counterparts, OneSpaWorld has achieved remarkable revenue growth, with quarterly revenue of $216 million in its latest period marking a 33% year-over-year increase driven by sustained business momentum. Sales for the current fiscal year (FY23) are expected to witness a substantial 46% surge compared to FY22.

Final Thoughts

The ability to generate robust revenue not only fosters scaling efficiencies but also drives meaningful earnings growth. In this regard, MercadoLibre, Amazon, and OneSpaWorld perfectly align with the criteria for companies poised for strong top-line growth.

In addition to impressive revenue generation, all three companies have witnessed favorable earnings estimate revisions, reflecting bullish sentiment among analysts.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.