L’Air Liquide S.A AIQUY and Dow recently renewed their industrial gas supply arrangement at Stade, Germany, one of Lower Saxony’s largest chemical production facilities.

Per the deal, Air Liquide will supply industrial gases under a long-term deal while investing nearly 40 million euros in asset modernization to improve operating efficiency and reduce CO2 emissions. Air Liquide has been supplying industrial gases to Dow in Stade for more than 20 years.

As part of the arrangement, Air Liquide will upgrade its existing production assets – two Air Separation Units and one Partial Oxidation facility – as well as add a new CO2 recycling solution. This will allow the circular use of the CO2 produced, resulting in a 15% gain in energy efficiency and a reduction in emissions of around 15,000 tons per year, accounting for 80% of the Air Liquide site’s direct CO2 emissions. The renovation of these assets will be finished by 2024.

The required industrial transformation will need not only ground-breaking greenfield projects but also step-by-step modifications and modernization of existing plants. This is why, as part of Air Liquide’s long-term extension of the supply deal with Dow, the company has opted to invest in modernizing its Stade assets.

The solution applied will recycle CO2 from an existing production plant, allowing the company to improve energy efficiency while also lowering CO2 emissions. This investment aligns with Air Liquide’s ADVANCE strategic plan, which includes the goal of lowering the Group’s carbon emissions by one-third by 2035.

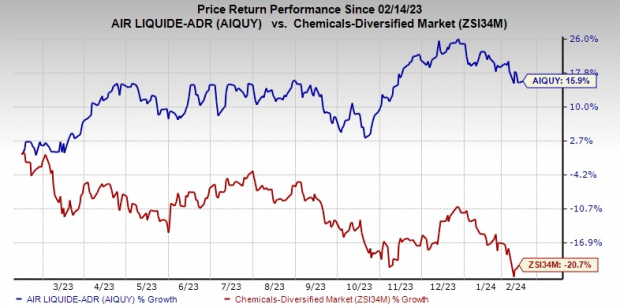

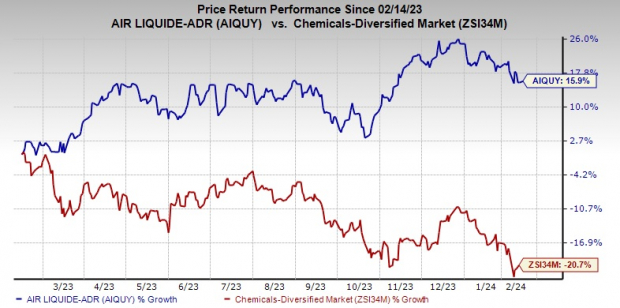

Shares of Air Liquide have gained 15.9% over the past year against a 20.7% decline of its industry.

Image Source: Zacks Investment Research

Air Liquide’s Current Ranking and Top Picks in the Industry

Air Liquide currently carries a Zacks Rank #4 (Sell).

Other stocks in the basic materials space include United States Steel Corporation X, Carpenter Technology Corporation CRS and Alpha Metallurgical Resources Inc. AMR.

United States Steel carrying a Zacks Rank #1 (Strong Buy). X beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 54.8%. The company’s shares have soared 61.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have soared 26.4% in the past year.

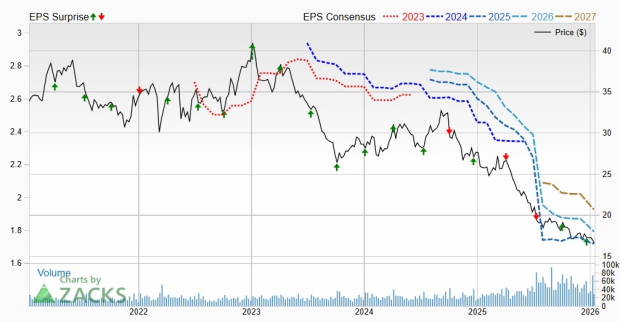

The Zacks Consensus Estimate for AMR’s current-year earnings has been revised upward by 69% in the past 60 days. It currently carries a Zacks Rank #1. AMR delivered a trailing four-quarter earnings surprise of roughly 9.6%, on average. AMR shares are up around 135.8% in a year.

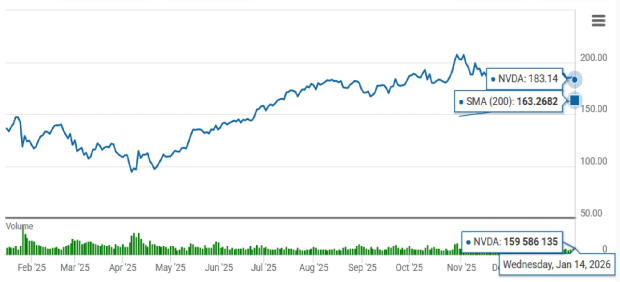

Strong earnings growth and an expanding customer base have positioned a new top chip stock to feed the demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028. The vital statistics and robust outlook hint at the exciting growth prospects within the semiconductor industry.

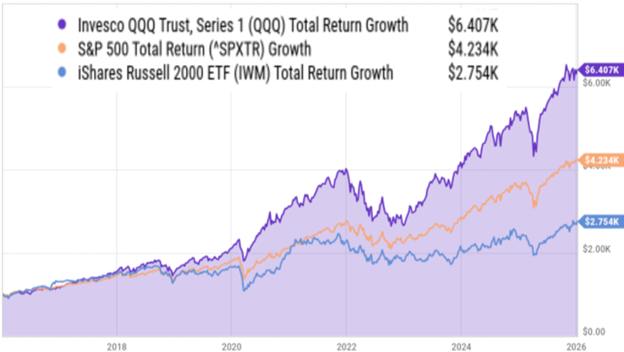

Excited for what the future holds in store? Explore smart investment choices and shape your portfolio. Don’t miss out on the latest recommendations from Zacks Investment Research! Download 7 Best Stocks for the Next 30 Days and gaze into the future of smart investing.

Interested in the future of young and innovative semiconductor stocks? Get ahead in the game by claiming your free stock analysis report for Alpha Metallurgical Resources, Inc. (AMR), United States Steel Corporation (X), and Carpenter Technology Corporation (CRS).

For more insightful analysis, perspective and information, read the full article here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.