Rising Sales and Resilience in the Housing Market

The AZEK Company Inc. (AZEK) is experiencing a surge in sales as residential construction demand rebounds. This Zacks Rank #1 (Strong Buy) is poised to achieve robust double-digit earnings growth in Fiscal 2024 and Fiscal 2025. The company specializes in creating low-maintenance, sustainable outdoor living products, such as TimberTech decking and railing, Versatex and AZEK Trim, and StruXure pergolas. Notably, these products are engineered using up to 85% recycled material, offering eco-friendly alternatives that replace wood in home exteriors.

Strong Fiscal Performance and Upbeat Guidance

In its fiscal first quarter 2024, AZEK posted an earnings beat, surpassing the Zacks Consensus Estimate by $0.05. Earnings stood at $0.10, outstripping the Zacks Consensus of $0.05. This marked the company’s fifth consecutive earnings beat, demonstrating a resilient track record.

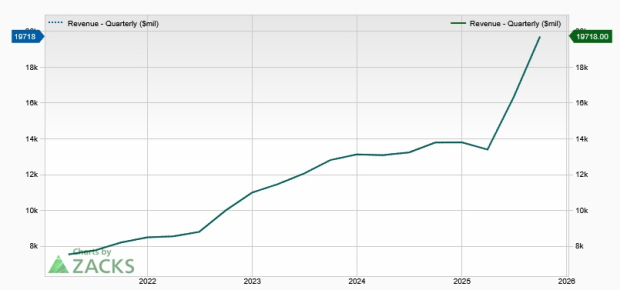

The company reported a notable 11% increase in net sales to $240.4 million, attributed primarily to a surge in volume in the Residential segment. The Deck, Rail & Accessories category, as well as the Exteriors category, drove a 24% year-over-year sales jump in the Residential segment. However, the Commercial segment experienced a decline of 53% to $19.3 million, primarily due to the divestment of AZEK’s Vycom business.

With a strong performance in sight, AZEK raised its fiscal 2024 sales guidance, now targeting a range of $1.385 to $1.425 billion, up from the previous guidance of $1.335 to $1.395 billion. This positive revision underscores the company’s confidence in its growth prospects and the broader residential building market.

Market Response and Investor Outlook

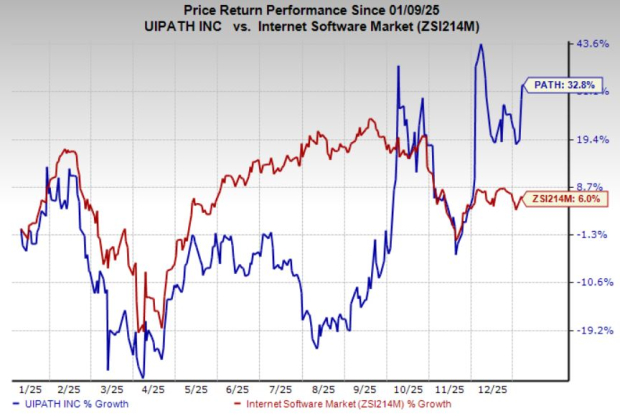

Amid a bullish sentiment in the housing, building, and remodeling sectors in 2024, AZEK’s share price has soared by an impressive 45.8% over the last three months. This surge significantly outpaces the tech-heavy Invesco QQQ ETF, reflecting strong investor confidence in AZEK’s growth trajectory and market positioning.

While the company’s forward price-to-earnings ratio stands at 39.4 and its price-to-sales ratio at 4.7, indicating a premium valuation, AZEK’s commitment to shareholder value is evident in its share repurchase activities. In the last quarter, AZEK bought back approximately 2.3 million shares under a $100 million accelerated share repurchase agreement, highlighting its dedication to maximizing shareholder returns.

For investors seeking exposure to the thriving residential housing market without directly investing in homebuilders, AZEK emerges as a compelling choice. Its strong fundamentals and market traction make it a noteworthy candidate for those looking to capitalize on the sector’s growth potential.