Hyatt Hotels Corporation H has pushed back the release of its Q4 2023 results, previously set for February 15, 2024. The company has attributed the delay to the need for additional time to finalize the accounting procedures related to the Unlimited Vacation Club deferred cost activity within its Apple Leisure Group segment.

Q4 & 2023 Highlights

In its recent announcement, the company unveiled the standout moments from the fourth quarter and full-year 2023. Notably, system-wide comparable RevPAR indicated a 9.1% surge in Q4, compared to the same period in the prior year. Moreover, the metric soared by 17.0% over the entire 2023, exceeding initial expectations.

Comparable owned and leased hotels RevPAR witnessed a robust 5.9% and 15.5% year-over-year increase in the Q4 and full-year 2023, respectively. Concurrently, the operating margins for comparable owned and leased hotels stood at 26.2% and 25.4% for the fourth quarter and full calendar year, respectively.

The year 2023 also saw the company setting new records, with cash flow from operations hitting $800 million, the highest in its history. Additionally, free cash flow reached $602 million in 2023, also marking a record high for H. Furthermore, the net room growth stood at 5.9% for 2023, in line with the full-year forecast. Hyatt’s pipeline of executed management or franchise contracts contained approximately 127,000 rooms.

The board of directors declared a dividend of 15 cents per share for Q1 2024, payable on March 12, 2024, to Class A and Class B stockholders of record as of February 28, 2024.

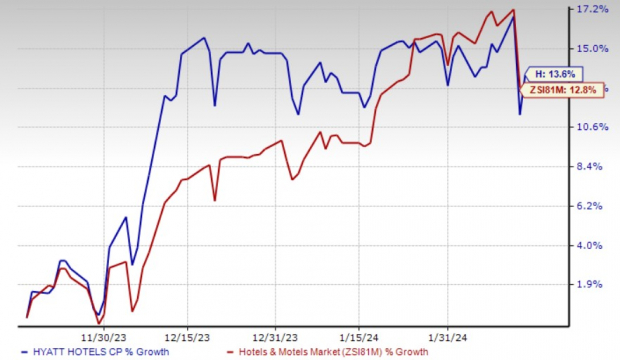

Over the last three months, shares of Hyatt Hotels have surged by 13.6%, outpacing the 12.8% growth of the Zacks Hotels and Motels industry.

Image Source: Zacks Investment Research

Zacks Rank

Currently, H holds a Zacks Rank #3 (Hold).

Key Picks

Better-ranked stocks within the Zacks Consumer Discretionary sector include:

H World Group Limited HTHT, presently sporting a Zacks Rank #1 (Strong Buy). The stock has displayed a trailing four-quarter earnings surprise of 94.5%, on average, and witnessed a 35.4% decline in the past year.

Likewise, Royal Caribbean Cruises Ltd. RCL flaunts a Zacks Rank of 1, with a trailing four-quarter earnings surprise of 10.6% on average, and a 57.8% surge in the past year.

Last but not least, Acushnet Holdings Corp. GOLF, currently carrying a Zacks Rank of 2 (Buy) with a trailing four-quarter earnings surprise of 49.9%, and a 32.7% rise in the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

H World Group Limited Sponsored ADR (HTHT) : Free Stock Analysis Report

Acushnet (GOLF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.