Arch Resources reported fourth-quarter 2023 operating earnings per share (EPS) of $6.07, missing the Zacks Consensus Estimate of $6.90 by 12%. The bottom line also declined 73.81% from the year-ago quarter’s figure of $23.18.

Revenues Fall Short Despite Beating Estimates

Total revenues were $774 million, beating the Zacks Consensus Estimate of $654 million by 18.3%. However, the top line decreased 9.9% from $859 million in the year-ago quarter. For the entire year of 2023, total revenues were $3.14 billion, reflecting a year-over-year decline of 15.6% from $3.72 billion in 2022.

Performance Highlights

In the Metallurgical segment, ARCH sold 2.3 million tons of coal, which was on par with the previous year’s figure. Cash margins were $82.91 per ton compared with $93.15 in the year-ago quarter. In the Thermal segment, the company sold 15.5 million tons of coal, down 3.7% from the prior year. Cash margins were $1.64 per ton compared with $3.85 in the prior-year period.

While the company remained active in share repurchase, using $3 million to repurchase approximately 20,000 shares, it ended the year with $217.7 million remaining authorization under its existing $500-million share repurchase program. ARCH also extended its market reach of the metallurgical segment, securing six new Asian steelmaking customers during 2023, with nearly 40% of its total coking coal output shipped into the Asian market last year.

Financial Position and Guidance

As of December 31, 2023, the company’s cash and cash equivalents were $287.8 million, while long-term debt was $105.2 million. Cash provided by operating activities for the year ended December 2023 was $635.3 million compared with $1.2 billion in the year-ago period.

For 2024, ARCH expects coking coal sales in the band of 8.6-9 million tons and a total thermal coal sales volume of 58.6-65 million tons. The company also anticipates corporate capital expenditure between $160 million and $170 million in 2024.

Industry Comparison

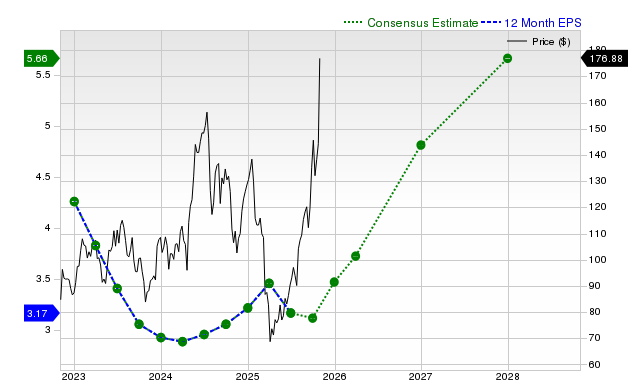

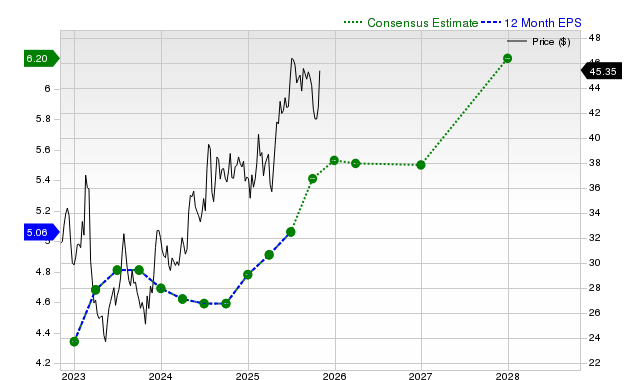

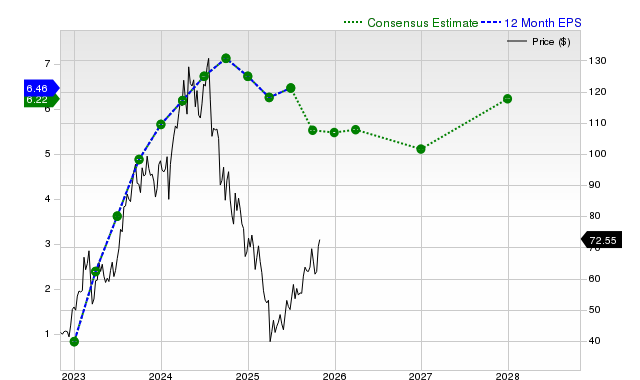

In a comparative analysis, Warrior Met Coal reported a 21.2% lag in adjusted earnings, while Alliance Resource Partners LP and Peabody Energy reported lags of 22.8% and 5.6% respectively in their adjusted earnings for the fourth quarter of 2023. Projections for 2024 also signal a decline in earnings for these companies.

Analyst Insights

ARCH is presently rated a Zacks Rank #1 (Strong Buy), suggesting a positive outlook for the company’s performance. Notably, investors who are keen on reliable market predictions have access to Zacks #1 Rank stocks, offering a valuable insight into potential stock market winners.

While the industry is facing challenges, it might not be all doom and gloom. According to Zacks analysts, there are promising stocks that are projected to outdo many others. By doing thorough research, investors can seize the opportunity to invest wisely.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.