Rollins, Inc.’s ROL fourth-quarter 2023 earnings meet the Zacks Consensus Estimate and revenues beat the same.

The company’s adjusted earnings of 21 cents per share increased by a robust 23.5% year over year. Meanwhile, revenues hit $754.1 million, surpassing the consensus mark by 0.5% and reflecting an impressive 14% year-over-year improvement. Organic revenues, coming in at $708.4 million, witnessed a steady 7.3% year-over-year upturn.

Impressive Performance Despite Challenges

Rollins’ robust performance in the quarter was significantly influenced by a healthy demand environment for its services. The management expressed confidence in the company’s well-positioned stance for both organic and inorganic growth. They also noted a strong acquisitions pipeline that underpinned the company’s footing in the industry.

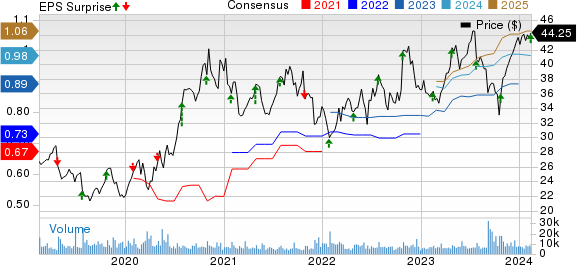

In the past year, Rollins’ shares have witnessed a commendable 22.3% surge, outperforming the 17.7% rally of the industry it belongs to.

Quarter Details and Financial Health

Amid the quarter’s details, residential revenues soared by 17.7% year over year to reach $340.5 million, comfortably exceeding the projected $325.5 million. Similarly, commercial revenues increased by 10.6% year over year, amounting to $256.7 million, surpassing the anticipated $252.5 million. Termite and ancillary revenues also experienced a notable upturn of 13.4% year over year, reaching $147.9 million, exceeding the expected $145.8 million.

Moreover, Rollins reported adjusted EBITDA of $166.7 million, marking an impressive 14.2% year-over-year increase and surpassing the estimated $154.8 million, up 7.4% year over year. The company also demonstrated a strong balance sheet, exiting the quarter with $103.8 million in cash and cash equivalents. The long-term debt stood at $490.8 million compared with $596.6 million at the end of the prior quarter.

Future Prospects and Investment Outlook

Looking ahead, Rollins remains focused on capitalizing on the robust demand for its services. The company’s unwavering confidence in its potential for both organic and inorganic expansion bodes well for its future performance. Furthermore, the strong acquisitions pipeline sets the stage for sustained growth and shareholder value creation.

In a bid to enhance shareholder returns and demonstrate financial discipline, the company paid dividends worth $73 million during the quarter. Despite a current Zacks Rank of #4 (Sell), Rollins’ outlook remains promising, backed by its solid financial performance and strategic initiatives.

Comparative Earnings Analysis

In a broader context, several key players in the industry, including Robert Half (RHI), Aptiv (APTV), and S&P Global (SPGI), changed tides in the market on reporting their recent earnings. While each company’s performance varied, the collective outlook for the industry underscores the dynamic nature of the business environment.

Investors are advised to remain vigilant and undertake a comprehensive analysis of each company’s performance, operational strategies, and market positioning to make informed investment decisions.

Click here to read the article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.