Labcorp, also known as Laboratory Corporation of America Holdings (LH), recently unveiled its financial results for the fourth quarter of 2023, painting a mixed picture for investors. While the company reported adjusted earnings and revenues exceeding expectations, its margins suffered a setback.

Robust Earnings Performance

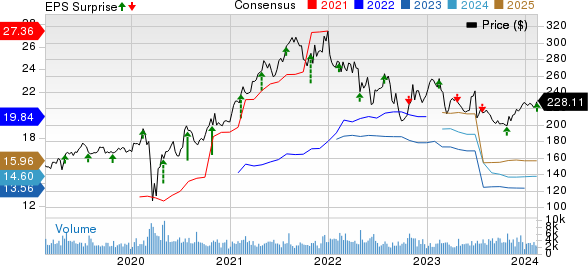

LH reported adjusted earnings per share (EPS) of $3.30 in Q4 2023, representing an 8.2% increase from the same period last year. However, on a GAAP basis, the company recorded a net loss of $1.95 per share compared to an EPS of 42 cents in the year-ago quarter.

For the full year, adjusted earnings were $13.56 per share, marking an 18.6% decline from the previous year. Despite the year-over-year drop, it managed to beat the Zacks Consensus Estimate.

Revenues Exceed Estimates

In the fourth quarter, Labcorp generated revenues of $3.03 billion, reflecting a 3.4% increase compared to the same period in the prior year. The growth can be attributed to organic revenue, acquisitions, and foreign currency translation. For the full year, the company’s total revenues amounted to $12.16 billion, up 2.5% from the previous year.

Segment Performance

The company’s Diagnostics Laboratories reported a 2.6% increase in revenues, with organic revenues up 0.8%. The total volumes saw a 2.4% increase, driven by both acquisition volumes and organic volumes. Labcorp’s Biopharma Laboratory Services witnessed a 7.1% climb in revenues, primarily propelled by organic growth.

Margin Contraction and Cash Position

However, Labcorp’s gross margin contracted, declining by 16 basis points to 27.1% in the fourth quarter. The adjusted operating income also fell by 15.8% year over year, while the adjusted operating margin shrank by 219 basis points.

On a positive note, the company’s cash position strengthened, with cash and cash equivalents reaching $536.8 million by the end of 2023. Long-term debt saw a reduction, dropping to $4.05 billion from $5.04 billion in the previous year.

2024 Outlook

Labcorp provided its 2024 guidance, forecasting growth in its enterprise revenues and the Diagnostics Laboratories and Biopharma Laboratory Services segments. The company also projected its full-year adjusted EPS and cash flow from continued operations for 2024.

Positive Momentum and Setbacks

Despite its strong performance in several areas, Labcorp faced challenges due to the reduction in COVID-19 testing revenues and the contraction of margins. It also highlighted its execution of strategic initiatives, including new partnerships and advanced test launches, signaling positive momentum.

Analyst Assessment

Currently carrying a Zacks Rank #3 (Hold), Labcorp’s performance has attracted attention from analysts and investors. Comparatively, some other stocks in the medical space, such as Stryker Corporation (SYK), Cencora, Inc. (COR), and Cardinal Health (CAH) have been identified as potential opportunities for investment.

The Rise of Cardinal Health in Fiscal Quarter 2024

Cardinal Health (CAH), a stalwart in the financial world, brought about a seismic stir in the market with its second-quarter fiscal 2024 report. The company’s adjusted earnings of $1.82 blew past the Zacks Consensus Estimate by a whopping 16.7%. This triumph in earnings was coupled with a surge in revenues, which catapulted to $57.45 billion, marking an 11.6% increase year-over-year and surpassing the Zacks Consensus Estimate by 1.1%.

The zealous success of CAH’s earnings can be attributed to its long-term estimated earnings growth rate of 15.3%, a significant number significantly higher than the industry’s 11.8% growth rate. CAH has dominated earnings estimates in the last four quarters, leaving analysts breathless with an average surprise of 15.6%.

The Explosive Potential of Cardinal Health

From rags to riches, Cardinal Health has metamorphosed into a juggernaut, charting a trajectory that has caused heads to turn. The stock was considered part of the bygone era of “bear market lows” but has gloriously emerged from the shadows with a captivating narrative.

With an ambitious pipeline of groundbreaking projects that promise a revolution in the medical realm, the company is heralding a new era. Revolutionary developments associated with liver, lungs, and blood diseases are potentially game-changing. Its meteoric rise has the potential to rival or even surpass recent stocks which made waves with significant surges – Boston Beer Company, which skyrocketed +143.0% in little over 9 months, and NVIDIA, which experienced an astronomical +175.9% boom in the span of a year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Labcorp (LH) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.