The future of the tobacco industry may not be as bright as it once was, considering the public’s heightened awareness of the health risks associated with smoking. Over the past decade, one of the giants in this realm, British American Tobacco (NYSE: BTI), has seen its stock plummet by a staggering 38% – a disconcerting trend indeed.

Nevertheless, before you dismiss BAT as a sinking ship, you may want to consider these six compelling reasons why it could be an astute investment:

1. A Well-Diversified Business

British American Tobacco has strategically diversified its operations across the tobacco landscape, offering a mix of traditional cigarettes and emerging smokeless alternatives on a global scale. Unlike its peers Altria and Philip Morris International, which are narrowly focused on specific geographical regions, BAT’s wide-ranging presence renders it less susceptible to regulatory threats, thereby bolstering its resilience in the face of market fluctuations.

2. Embracing Smokeless Products

Amidst the shifting dynamics of the tobacco industry, the spotlight is increasingly shining on smokeless alternatives – namely electronic cigarettes, heat-not-burn tobacco devices, and oral nicotine pouches. BAT’s innovative products under these categories – Vuse, Glo, and Velo – have gained substantial traction, with sales reaching 3.3 billion pounds ($4.16 billion) in 2023, encompassing 23.9 million consumers. With an ambitious target to balance its revenue streams between combustible and smokeless options by 2035, BAT is positioning itself for sustained growth in the evolving tobacco landscape.

3. Generous and Growing Dividends

Investors have always had a soft spot for substantial dividends. British American Tobacco, with its low-cost production structure, currently offers a dividend yield exceeding 9%. Moreover, a recent 6.1% increase in dividend payout conveys a resounding vote of confidence from the company’s management, underscoring the stability and growth potential of its dividends.

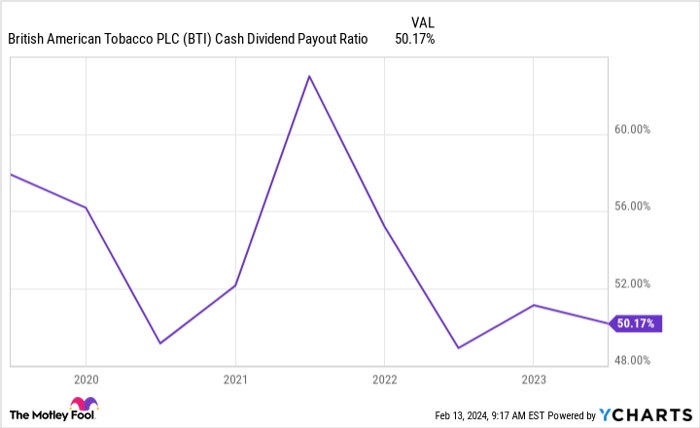

4. Secure Dividend Payouts

Despite the allure of high dividends, their sustainability is often a cause for concern. On this front, BAT appears to be in a robust financial position, with its dividend payout consuming only about half of the company’s cash flow. This consistency in the payout ratio, combined with the renowned resilience of the tobacco industry, bodes well for investors seeking a steady income stream.

BTI cash dividend payout ratio, data by YCharts.

These factors cumulatively position BAT as a potentially lucrative income-generating asset for long-term investors.

5. Valuable Ownership Stake

What many may not know is that British American Tobacco holds a 29% stake in ITC, a significant yet relatively unknown player in the eyes of U.S. investors. ITC, India’s largest tobacco company, boasts a diversified portfolio spanning various consumer products, including food, healthcare, and hotels. With BAT’s stake valued at $17.75 billion – roughly a quarter of its own market capitalization – this strategic asset serves as a substantial buffer for the company. Additionally, reports indicate that management is contemplating selling a portion of this holding to raise $2.5 billion, which could further fortify BAT’s financial position.

6. Attractive Valuation

Amidst the prevailing decline in its stock price, British American Tobacco’s forward price-to-earnings (P/E) ratio stands at a modest 6.4. While this valuation may typically be associated with a business in dire straits, the management’s pursuit of long-term single-digit growth in operating profit underscores a promising trajectory for the company. Combined with the allure of a burgeoning dividend, the stock presents an enticing opportunity for investors to capitalize on.

Considering these factors collectively, British American Tobacco emerges as a compelling investment proposition that demands serious consideration from discerning investors.

Should you invest $1,000 in British American Tobacco right now?

Before you buy stock in British American Tobacco, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and British American Tobacco wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and Philip Morris International and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.