In a compelling strategic maneuver to broaden its footprint in the dynamic grocery retail landscape, Grocery Outlet Holding Corp. has made waves by announcing its plan to acquire United Grocery Outlet (“UGO”), a leading discount grocery retailer serving the Southeastern United States. This shrewd acquisition, expected to finalize in the early second quarter subject to customary closing conditions, signifies a momentous leap for Grocery Outlet into pivotal markets such as Tennessee, North Carolina, Georgia, Alabama, Kentucky, and Virginia.

UGO, with its 40 stores and a distribution center, perfectly complements Grocery Outlet’s vision of delivering exceptional value to consumers. CEO of Grocery Outlet, RJ Sheedy, exudes confidence in the acquisition, emphasizing the synergies between the two companies’ business strategies and customer-focused approaches.

With over five decades of history, UGO has carved a niche for itself as a purveyor of substantial savings within a distinctive shopping milieu. Leveraging robust partnerships with national and regional brands, UGO has consistently furnished top-notch products at unmatched value. Lisa Bryson, CEO of UGO, echoes the anticipation of a bright future ahead, underscoring the potential for both entities to make a positive impact on the community as a united force.

This acquisition not only fortifies Grocery Outlet’s market presence but also paves the way for further forays into the Southeastern region. The company aims to inaugurate an additional 15 to 20 stores in existing markets in 2024, eyeing a total of 55 to 60 net new stores by year-end. Furthermore, the acquisition is expected to make a modest contribution to the company’s earnings for the fiscal year.

Without a doubt, Grocery Outlet’s acquisition of UGO stands as a monumental milestone in the company’s growth trajectory. Anchored in a shared dedication to offering value to customers and enriching communities, this savvy move sets the stage for sustained triumph and expansion in the fiercely competitive grocery retail sector. Investors have every reason to anticipate a bonanza of opportunities as Grocery Outlet capitalizes on emerging prospects and consolidates its standing in the market.

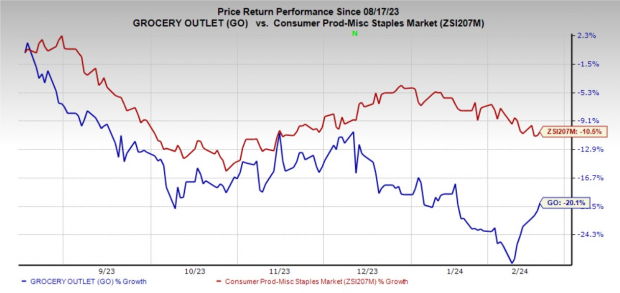

Image Source: Zacks Investment Research

Performance Overview

During the past six months, the shares of Grocery Outlet faced challenges due to operational disruptions stemming from the transition to enhanced systems. These changes led to disruptions in ordering and inventory, negatively impacting comparable store sales by approximately 150 basis points and gross margin by 50 basis points in the third quarter of 2023.

Anticipating a substantial impact on financial results in the fourth quarter compared to the third quarter, the company foresees further headwinds. It expects a 300-basis point drag on comparable store sales and a 150-basis point pressure on gross margin for the final quarter of the year. Consequently, Grocery Outlet revised its 2023 guidance, adjusting the expected adjusted earnings range to $1.04-$1.06 per share from the previously projected $1.04-$1.08 per share range.

Over the past six months, shares of this Zacks Rank #4 (Sell) company have declined by 20.1%, contrasting with the industry’s 10.5% downturn.

High-Performing Stocks

Amidst the arena of stocks, three stand out as stronger candidates: Casey’s General Stores, Vital Farms, and Ollie’s Bargain.

Casey’s General Stores, the nation’s third-largest convenience retailer and fifth-largest pizza chain, holds a Zacks Rank #2 (Buy). With a trailing four-quarter earnings surprise averaging 17.8%, CASY exhibits promising prospects for investors.

Vital Farms, renowned for its range of pasture-raised foods, currently boasts a Zacks Rank #2. VITL has delivered a trailing four-quarter earnings surprise of 145%, on average.

Ollie’s Bargain, the largest retailer of closeout merchandise and excess inventory in America, holds a Zacks Rank #2. With a trailing four-quarter earnings surprise averaging 7%, OLLI presents compelling growth potential.

The consistent Zacks Consensus Estimates portray favorable growth trajectories for Casey’s, Vital Farms, and Ollie’s Bargain, hinting at potential gains in the near future.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

7 Best Stocks for the Next 30 Days

Just released: Experts have distilled 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. These tickers are deemed “Most Likely for Early Price Pops.”

Since 1988, the full list has outperformed the market by more than 2X, with an average gain of +24.0% per year. Therefore, it is prudent to give these hand-picked 7 your immediate attention.

Casey’s General Stores, Inc. (CASY) : Free Stock Analysis Report

Ollie’s Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.