Insulet Corporation’s relentless rally, propelled by its groundbreaking Omnipod 5 Automated Insulin Delivery (“AID”) system, stands out as a strong contender in the burgeoning diabetes market. The company’s steadfast financial position further adds to its allure, although hurdles like rising costs and macroeconomic strains persist.

The Upsides of Omnipod 5

Insulet’s revolutionary Omnipod Horizon, now known as Omnipod 5, continues to pave a disruptive path in the diabetes technology landscape. Its groundbreaking features have been widely embraced, earning it the distinction of being the only FDA-approved, fully disposable, pod-based automated insulin delivery system. The company’s strategic maneuvering is evident in its successful penetration of the U.S. market and its diligent efforts to extend its reach to preschoolers and expand globally to countries like the United Kingdom and Germany.

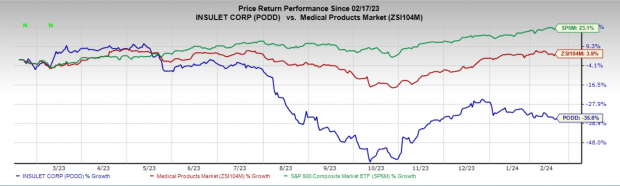

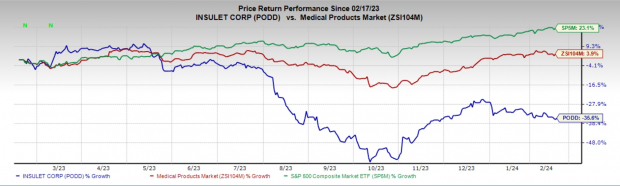

Image Source: Zacks Investment Research

Market researchers at Seagrove Partners have tipped Omnipod 5 as the potential game-changer among respondents, setting forth a promising trajectory for the product. Such strides indicate a promising road ahead for Insulet in the diabetes technology arena.

Fiscal Fortitude and Expansion Strategies

Insulet’s financial fortitude is underscored by its healthy balance sheet, with the company exiting the third quarter of 2023 with substantial cash reserves of $685.4 million. The company’s strategic moves to strengthen its position in the global diabetes market are palpable through its expansion into new territories such as Europe, the Middle East, the Asia Pacific, Australia, and Turkey. These calculated investments, including the acquisition of assets from Automated Glucose Control LLC and Bigfoot, further underscore Insulet’s dedication to advancing its presence in the diabetes domain.

Concerns and Projections

Insulet’s ascendancy is not without its share of tribulations. Among the prominent headwinds are the escalating production costs associated with Omnipod 5, amplified further by global inflation, supply chain disruptions, and labor shortages, thereby squeezing profit margins. Consequently, concerns loom over its profitability, accentuating the need for strategic cost management measures.

Furthermore, the specter of a sluggish global economy presents a potential hurdle. Economic downturns could impede consumer demand, intensify market competition, and ripple into weakened pricing dynamics, supply constraints, and prolonged sales cycles. European countries, in particular, grapple with economic duress, heightening the risks for Insulet’s global operations.

Analyst Projections and Market Response

Analysts paint an optimistic picture, with the Zacks Consensus Estimate for Insulet’s 2023 earnings per share (EPS) on an upward trajectory, pointing to the company’s resilience and growth potential. Forecasts for 2023 revenues are equally promising, with an anticipated 26.2% surge compared to the previous year.

Exploring Top Stocks in the Medical Arena

While Insulet’s journey is riddled with challenges, there are other notable contenders within the medical space. The likes of Cardinal Health, Stryker, and DaVita have emerged as key players, offering investors an alternative avenue for potential growth and stability. Each of these companies presents a unique value proposition, complementing Insulet’s stance in the broader medical domain.

Cardinal Health exudes resilience, with a stellar track record of surpassing earnings estimates and promising long-term growth prospects. Similarly, Stryker and DaVita present compelling narratives, characterized by robust earnings performance and substantial market advances. These players serve as viable options for investors seeking diversification within the medical segment.

Insulet’s narrative, intertwined with challenges and victories, is a reminder of the dynamic nature of the medical landscape. As the company steers ahead with the revolutionary Omnipod 5, investors are poised to witness an enduring saga of resilience and adaptability in the face of adversities, a timeless tale that resonates in the ever-evolving financial markets.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Top 7 Stock Picks Beating the Market: A Closer Look

The stock market can be likened to a turbulent sea, with investment opportunities ebbing and flowing like the tide. Amidst this tumultuous environment, astute investors constantly seek a lighthouse— a beacon of hope guiding them through the stormy waters of volatility. In this pursuit, Zacks Investment Research has unveiled its hand-picked selection of 7 stocks that have outperformed the market by a staggering margin of more than 2X, boasting an awe-inspiring average gain of +24.0% per year.

Furthermore, for those looking to stay ahead of the curve, Zacks Investment Research offers the latest recommendations, including the 7 Best Stocks for the Next 30 Days. Don’t miss out on this free report.

Download 7 Best Stocks for the Next 30 Days

In the quest for profitable investments, it is often the case that individual stock analysis can steer investors toward favorable opportunities. Therefore, complimentary stock analysis reports for the following companies are available:

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

When it comes to making informed, data-driven investment decisions, access to comprehensive stock analysis reports can shed light on the potential courses of action. On that note, it is worth delving deeper into the article on Insulet Corporation’s stock to gain valuable insights.

Learn more about Insulet Corporation (PODD) here

It is important to remember that the views and opinions expressed are those of the author and may not align with those of Nasdaq, Inc. Despite this, the information provided can offer valuable perspectives to aid in making well-informed investment decisions.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.