The agriculture industry has been navigating through a tempestuous terrain. The Zacks Agriculture – Operations industry encompasses a myriad of challenges that impact productivity, sustainability, and the overall well-being of industry participants. Factors such as fluctuating commodity prices, rising input costs, trade uncertainties, and elevated operational expenses have been casting a shadow over the realm. As inflation hits the industry, companies within this critical sector are grappling with challenges that are impacting their operations, profitability, and long-term sustainability.

About the Industry

The Zacks Agriculture – Operations industry encompasses companies that produce or procure, transport, store, process, and distribute agricultural commodities to consumers. These commodities are sold in grocery stores or exported overseas. In addition, they are used as feedstock for other industries such as clothing and ethanol.

Shaping the Future of Agriculture Operations

Agricultural Export Projections: Per the U.S. Department of Agriculture, agricultural export projections for fiscal 2024 have witnessed a decline, primarily due to reductions in grain and feed, as well as livestock, poultry, and dairy exports. Overall, various agricultural exports are expected to be impacted, signaling a period of change within the industry.

Elevated Costs: Industry participants have been grappling with higher costs due to fluctuating commodity prices, rising input costs, and trade uncertainties. The surge in input costs, as inflation escalates the prices of essential resources, has significantly squeezed profit margins for agricultural companies, necessitating them to implement pricing strategies to counter rising raw material costs.

In addition, companies in the industry continue to face increased SG&A expenses due to higher performance-related compensation, project-related costs, and investments in technology to stay ahead of the curve in a rapidly evolving environment.

Robust Demand Trends for Organic Products: The industry has experienced a surge in demand for healthier food, resulting in a shift towards organic production techniques and a reduction in the use of chemicals and pesticides. Investments in acquisitions and joint ventures to meet the demand for healthy products have been a focal point.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Agriculture – Operations industry is currently placed in the bottom 8% of more than 250 Zacks industries, as per the Zacks Industry Rank #229. This ranking is reflective of a negative aggregate earnings outlook for the constituent companies, with analysts gradually losing confidence in the group’s earnings growth potential.

Industry vs. Broader Market

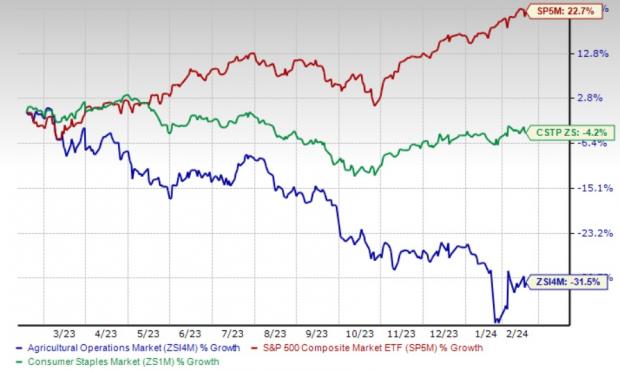

In the past year, the Zacks Agriculture – Operations industry has underperformed the S&P 500 and the Zacks Consumer Staples sector, with stocks collectively falling 31.5%, while the sector has declined 4.2%.

One-Year Price Performance

Agriculture – Operations Industry’s Valuation

The forward 12-month price-to-earnings (P/E) ratio for the agriculture – Operations industry currently stands at 11.78X, compared to the S&P 500’s 20.74X and the sector’s 17.17X.

Over the last five years, the industry has traded as high as 17.51X, as low as 10.6X and at the median of 14.52X, exemplifying a dynamic valuation landscape.

Three Agriculture Operations Stocks to Keep an Eye On

None of the stocks in the Zacks Agriculture – Operations universe currently sport a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy). However, three stocks with a Zacks Rank #3 (Hold) from the same industry have showcased potential, appealing to investors. Amidst these challenging times, the industry braces for lasting change, pivoting towards sustainable practices and innovations to weather the storm.

Thriving in the Fields: A Look at Agribusiness Stocks

Corteva: Hailing from Wilmington, DE, this pure-play agriculture company is set to soar above market growth through its top-notch product pipeline and unwavering dedication to innovation and operational discipline. Poised to accelerate innovation and maintain its leading position in the high-value sector, Corteva has inked three new collaboration agreements to meet the rising demand for natural products. Boasting strong price execution in seed, supply-chain flexibility, and robust market demand for its innovative product portfolios, CTVA’s performance is in the fast lane.

The Zacks Consensus Estimate for Corteva’s 2024 earnings has dipped 4.6% in the past 30 days. Reporting figures from the year-ago period indicate expected growth of 1.7% in sales and 7.4% in earnings. With a track record of averaging an impressive earnings surprise of 46.9% in the last four quarters, CTVA stock may have taken a hit, with a decline of 11.5% in the past year.

Price and Consensus: CTVA

Dole: Operating out of Dublin, Ireland, this global leader in fresh produce is positioned to reap the rewards of enhanced logistical efficiencies, bringing greater stability to its core fruit business. With a diverse sourcing network and advanced farming practices in its arsenal, Dole is geared up to navigate potential weather challenges in various regions. Benefiting from a healthier supply and demand balance, the company has experienced improved pricing conditions in Europe and non-core markets.

The Zacks Consensus Estimate for Dole’s 2024 earnings has remained unchanged, with expected sales and earnings growth of 2.5% and 14.6%, respectively, compared to the previous year. The company has a strong track record, delivering an average earnings surprise of 78.3% in the trailing four quarters, despite a 3.3% stock decline over the past year.

Price and Consensus: DOLE

Alico: From Fort Myers, FL, this agribusiness and land management company stands to gain from the robust consumption of not-from-concentrate orange juice by retail consumers. Market prices for Early and Mid-Season, and Valencia season fruit have benefited significantly from the strong consumption, with lower-than-normal levels of processor inventories. Alico projects market prices to remain near or above recent levels in the coming year.

The Zacks Consensus Estimate for the current fiscal-year loss remains unchanged, with an anticipated sales growth of 89.5% compared to the year-ago reported quarter. Expected to narrow down the loss to 34 cents, from $3.23 in the year-ago period, Alico has experienced a 9.9% rise in the past year.

Price and Consensus: ALCO

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

Corteva, Inc. (CTVA) : Free Stock Analysis Report

Dole PLC (DOLE) : Free Stock Analysis Report

Alico, Inc. (ALCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.