Wedbush Analyst’s Optimistic Take

Nvidia Corp NVDA is poised to unveil its fourth-quarter results on February 21, and analysts are rallying behind the semiconductor giant as they share promising forecasts.

Wedbush analyst Matt Bryson has maintained an Outperform rating on Nvidia and raised the price target from $600 to $800, underscoring his strong confidence in the company’s performance.

According to Bryson, Nvidia is expected to exceed estimates once again and provide optimistic future guidance, with component suppliers and Original Design Manufacturers (ODMs) in Asia signaling robust quarter trends during his mid-December travels.

Additionally, the analyst noted that memory vendors foresee sustained high demand for High Bandwidth Memory (HBM), with Nvidia poised to emerge as the leading consumer of these components in 2024.

Bryson’s buoyant outlook is further supported by significant capital raises for AI startups and the notable sales acceleration reported by Super Micro Computer Inc SMCI during the quarter, driven by AI sales.

Other Analysts’ Upbeat Prognoses

Oppenheimer analyst Rick Schafer reiterated an Outperform rating for Nvidia, setting a new price target at $850, heralding the company’s potential upside in the fiscal fourth quarter and first quarter results, driven by data center investments from Cloud Service Providers (CSPs) and enterprises.

BofA analyst Vivek Arya reaffirmed a Buy rating for Nvidia, with a price target of $800, attributing any potential discrepancies with these bullish expectations to supply issues, rather than demand or competition.

Market Cap and Future Prospects

Nvidia’s market cap skyrocketed to $1.8 trillion, trailing only Microsoft Corp MSFT and Apple Inc AAPL in the S&P 500 index, reflective of investors’ fervor for AI.

Furthermore, the company’s alignment with U.S. Department of Commerce restrictions on shipments to China has effectively dispelled significant uncertainties, cementing its position in the market.

Arya highlighted four factors fueling AI Total Addressable Market (TAM) growth towards the $250-$500 billion range, painting a promising picture for Nvidia’s future revenue opportunities.

Looking Ahead

The sustained structural growth, particularly in data center AI, underpins Nvidia’s dominant position in the data center AI ecosystem, boding well for generative AI adoption.

As Nvidia’s stock trades higher, the impending GPU Tech Conference (GTC) in March is poised to offer essential updates on Nvidia’s pipeline, partners, and AI TAM, which could further bolster investor confidence.

Stock Performance

At the last check on Wednesday, NVDA shares traded higher by 1.90% at $740.38, reflecting the positive sentiment surrounding the company ahead of its earnings report.

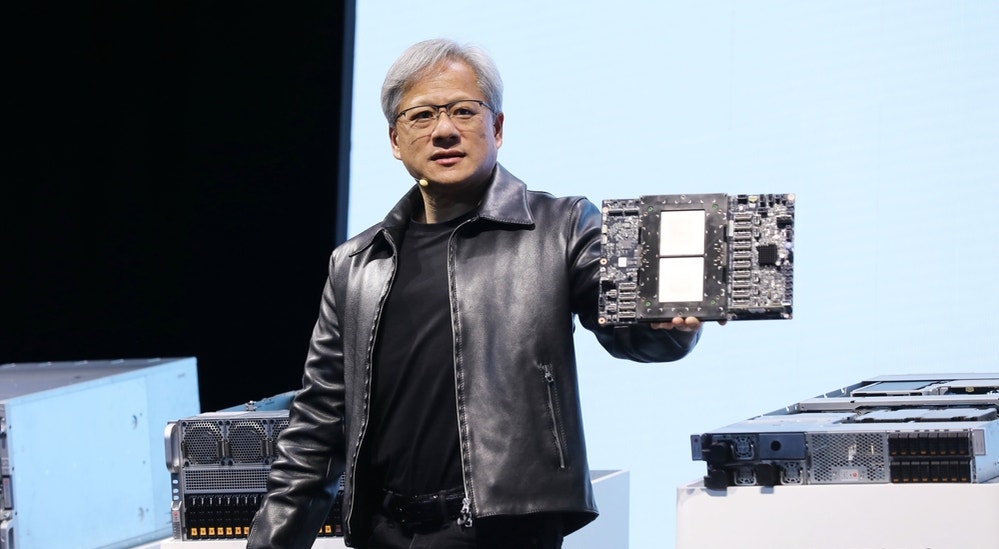

Photo via Shutterstock