In a surprising move, renowned activist investor Carl Icahn has seized a 9.91% ownership stake in the low-cost carrier JetBlue Airways (JBLU), propelling their shares into an upward trajectory following the announcement. Meanwhile, Joby Aviation (JOBY) has sealed a historic pact with Dubai’s Road and Transport Authority to herald the era of air taxi services in the Emirate by early 2026. On a different note, Copa Holdings (CPA) reported downticks in traffic and capacity for January.

For further information, refer to the last Airline stock roundup here.

Highlights of Recent Developments

1. Carl Icahn has justified his acquisition of the 9.91% stake in JetBlue by expressing his belief in the undervaluation of JBLU shares, deeming them as an “attractive investment opportunity”. Furthermore, Icahn intends to engage in discussions with the airline’s management and board of directors to explore potential representation on the company’s board. As of now, JBLU holds a Zacks Rank #3 (Hold). You can access the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2. The momentous agreement, inked at the World Governments Summit in Dubai, bestows upon Joby Aviation the exclusive rights to operate air taxis in Dubai for six years. This strategic move uniquely positions Dubai at the vanguard of ushering in swift, eco-friendly, and noiseless air travel, courtesy of Joby Aviation’s revolutionary technology. JoeBen Bevirt, the founder and CEO of Joby Aviation, expressed his elation, stating, “It is an honor to partner with the government of Dubai to demonstrate the value of sustainable air travel to the world.”

3. Alaska Air Group’s subsidiary, Alaska Airlines (ALK), is actively preparing to entice more customers in Portland with enticing offers. ALK is set to provide an elevated travel experience to its patrons in Portland and across its expanding network. Passengers can anticipate First Class and Premium Class services, diverse fare offerings, and additional perks.

4. In January, Copa Holdings reported a 5.9% decline in revenue passenger miles, signifying reduced traffic compared to the previous year. Additionally, available seat miles, a measure of capacity, witnessed a 3.8% year-over-year decrease. With traffic contraction outpacing the capacity decline, the load factor, which represents the percentage of seats occupied by passengers, dropped to 85.3% from 87.1% in January 2023.

Stock Performance

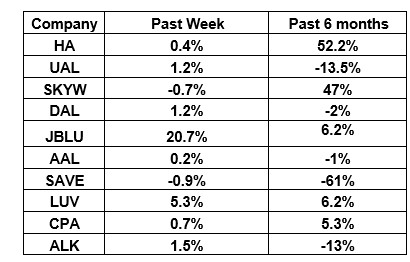

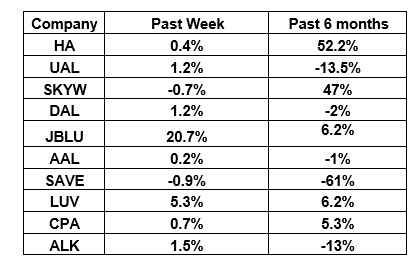

The table below showcases the price movements of major players in the airline industry over the past week and the preceding six months.

Image Source: Zacks Investment Research

The chart indicates that all airline stocks experienced gains in the past week, resulting in the NYSE ARCA Airline Index climbing 1.1% to $65.82. Over the last six months, the NYSE ARCA Airline Index has shown a 4.8% increase.

Looking Ahead in the Airline Sector

Stay tuned for further updates from the airline industry.

7 Best Stocks for the Next 30 Days

Just released: Our experts have handpicked 7 elite stocks from the extensive list of 220 Zacks Rank #1 Strong Buys. These stocks are deemed as “Most Likely for Early Price Pops.”

Since 1988, the full list has outperformed the market with an average annual gain of +24.0%, surpassing the market by more than 2X. Make sure to give these selected 7 stocks your immediate attention.

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Joby Aviation, Inc. (JOBY) : Free Stock Analysis Report

Read this article on Zacks.com by clicking here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.