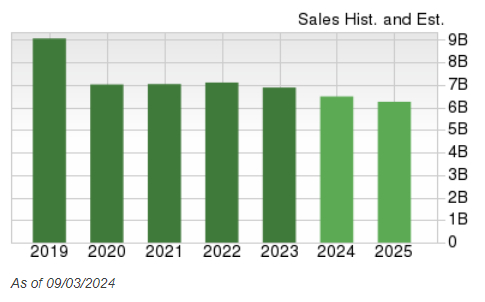

CoStar Group CSGP is getting ready to announce its fourth-quarter 2023 earnings on Feb 20.

The company is bullish about the upcoming quarterly results, with revenue anticipated to land between $630 million and $635 million, showcasing a 12% year-over-year uptick. Earnings are expected to range between 31 and 32 cents per share.

For Q4, the Zacks Consensus Estimate for revenues is at $633.30 million, indicating a 10.46% increase from the year-ago quarter’s figures.

The consensus mark for earnings has steadfastly remained at 32 cents per share over the past 30 days, reflecting stability year over year.

CoStar Group, Inc. Price and EPS Surprise

CoStar Group, Inc. price-eps-surprise | CoStar Group, Inc. Quote

CoStar Group has consistently outshone the Zacks Consensus Estimate in the last four quarters, with an average surprise of 7.77%.

Now, let’s delve into the factors shaping up for this imminent announcement.

Key Drivers to Consider

CoStar Group’s performance in the fourth quarter is poised to gain from a robust portfolio of marketplaces, including Apartments.com, LoopNet, and Homes.com.

The ascendant trajectory of Apartments.com, fueled by surging traffic and amplified ad spending, is likely to have bolstered CoStar’s top-line growth.

The burgeoning international segment and a positive real estate market outlook are expected to have fortified LoopNet’s performance in the current quarter. Notably, LoopNet is anticipated to witness an 11% year-over-year surge in Q4.

The STR product, an industry benchmarking tool for the hospitality sector, is projected to have experienced robust double-digit revenue growth in the impending quarter.

CoStar Group’s ameliorating residential strategies, with a specific emphasis on Homes.com, are likely to have contributed to growth during Q4.

However, the adverse impact of escalating interest rates on consumer confidence and decreased occupancy might have dented CoStar Group’s Q4 results.

What Our Model Indicates

As per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) augments the likelihood of an earnings beat. Unfortunately, such an encouraging scenario is not the case here.

CoStar Group has an Earnings ESP of 0.00% and currently holds a Zacks Rank #4 (Sell). You can discover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Promising Stocks to Watch

Here are some potential investments, as our model suggests these companies possess the right combination of attributes to exceed earnings expectations in their upcoming releases:

Inseego INSG has an Earnings ESP of +4.17% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Inseego shares have gained 64.2% year to date. INSG is poised to disclose its Q4 2023 results on Feb 21.

Vertiv VRT boasts an Earnings ESP of +1.90% and currently holds a Zacks Rank of #2.

Vertiv shares have increased by 30.8% year to date. VRT is slated to report its Q4 2023 results on Feb 21.

NVIDIA NVDA flaunts an Earnings ESP of +5.26% and holds a Zacks Rank #2.

NVIDIA shares have surged by 46.7% year to date. NVDA is set to reveal its Q4 fiscal 2024 results on Feb 21.

Keep track of upcoming earnings announcements with the Zacks Earnings Calendar.

7 Best Stocks for the Next 30 Days

Just released: Experts have distilled 7 premium stocks from the current list of 220 Zacks Rank #1 Strong Buys. These tickers are deemed “Most Likely for Early Price Pops.”

Since 1988, the complete list has outperformed the market by more than double with an average annual gain of +24.0%. So be sure to give these hand-picked 7 your immediate attention.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

CoStar Group, Inc. (CSGP) : Free Stock Analysis Report

Inseego (INSG) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.