Gearing Up For a Strategic Move

For investors hesitant about securing Valaris Ltd (Symbol: VAL) stock at the current market price of $63.88/share, there may be a promising alternative – selling puts. The December put at the $50 strike, with a bid of $3.10, offers a compelling opportunity. Gathering this bid as premium amounts to a 6.2% return against the $50 commitment or a 7.3% annualized rate of return, which we, at Stock Options Channel, aptly term the YieldBoost.

Risk and Reward in the Options Market

While selling a put may not grant an investor access to VAL’s potential upside seen by owning shares, if the contract is exercised, the put seller will end up owning shares. The potential benefit of exercising the $50 strike lies in achieving a better outcome than selling at the current market price. The upside for the put seller rests in collecting the premium for the 7.3% annualized rate of return, unless Valaris Ltd experiences a 22% decline, resulting in a cost basis of $46.90 per share before broker commissions.

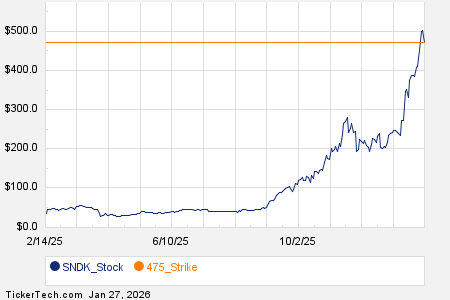

Assessment Through Historical Lenses

Integrating the chart demonstrating the trailing twelve-month trading history for Valaris Ltd with the stock’s historical volatility can aid in evaluating whether selling the December put at the $50 strike for the 7.3% annualized rate of return entails a favorable risk-reward proposition. Calculating the trailing twelve-month volatility for Valaris Ltd, considering the last 251 trading day closing values along with today’s price of $63.88, yields a 38% volatility. For more put options contract ideas at various expirations, visit the VAL Stock Options page of StockOptionsChannel.com.

Exploring Opportunities Beyond the Ordinary

The market is rife with uncertainties, yet amidst this chaos, Valaris Ltd holds potential. With an astute investment approach, replete with thoughtful analysis and strategic moves, investors may find themselves in a favorable position, poised to capitalize on the inherent rigors of the market. The undulating waves of the market beckon for a steady hand, and Valaris Ltd offers a viable opportunity to navigate these tumultuous waters.

Also see:

Highest Yield Monthly Preferreds

GRIL shares outstanding history

Top Ten Hedge Funds Holding SPVU

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.