Investing guru Warren Buffett’s advice rings true in the case of United States Cellular Corp (Symbol: USM), as the stock dipped into oversold territory on Friday with a Relative Strength Index (RSI) reading of 29.4. The RSI measures momentum on a scale of zero to 100 and is a widely used technical analysis indicator. When the RSI falls below 30, a stock is considered oversold, signaling a potential buying opportunity.

While USM’s RSI reading dipped to 29.4, the RSI reading of the S&P 500 ETF (SPY) currently stands at 63.7. This sharp contrast indicates that USM has been heavily sold off, potentially reaching a point of exhaustion in its downtrend. For bullish investors, this could signify an opportune moment to consider entry points on the buy side.

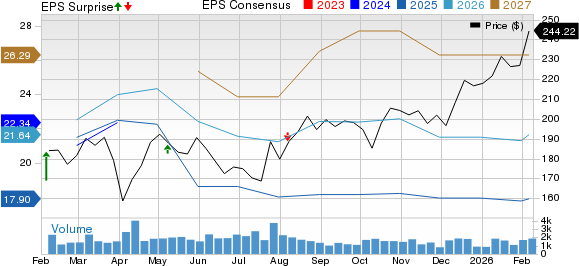

The chart above outlines the one-year performance of USM shares. The stock’s 52-week range reflects a low of $13.79 per share and a high of $48.47. The closing price on Friday stood at $34.53 per share, showcasing the impact of recent selling pressure.

Find out what 9 other oversold stocks you need to know about here.

Related Content:

ARK Investment Management Top Holdings

AGC Videos

VIS Options Chain

The perspectives shared are solely the author’s and do not necessarily represent those of Nasdaq, Inc.