For 84 years, Social Security has dutifully provided monthly benefit checks to eligible retired workers, serving as a critical financial lifeline for current and future retirees. Despite the modest average monthly benefit of just over $1,900 as of January 2024, it remains a vital source of income for millions of aging Americans.

Regrettably, the financial foundation of this vital program is becoming increasingly precarious.

Image source: Getty Images.

The Expanding Funding Shortfall of Social Security

Every year since 1940, the Social Security Board of Trustees has published a report evaluating the financial health of the retirement program. This report outlines short- and long-term financial projections, factoring in various monetary, fiscal, and demographic variables. Since 1985, the Trustees have consistently recognized a long-term funding shortfall, with the 2023 shortfall amounting to a staggering $22.4 trillion.

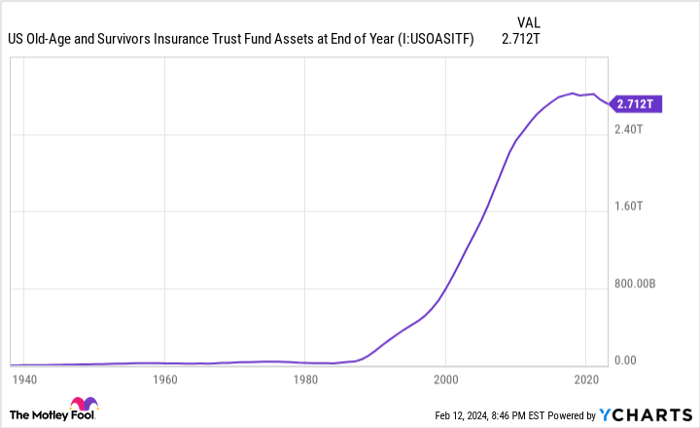

Of more immediate concern is the potential depletion of the Old-Age and Survivors Insurance Trust Fund (OASI) reserves by 2033, which could necessitate benefit cuts of up to 23% to ensure solvency through 2097.

The program’s financial strain can be attributed to demographic shifts such as the retirement of baby boomers, increased longevity, and a declining net migration rate. Additionally, rising income inequality has further exacerbated the situation.

Image source: Getty Images.

Congress Grapples With Unfixable Demographic Challenges

Congress can address some demographic issues affecting Social Security, but the looming birth rate decline poses a substantial challenge. With fertility rates falling to historic lows, the future worker-to-beneficiary ratio is anticipated to dwindle, potentially exacerbating the program’s fiscal strain.

The 2023 Trustees’ Report forecasts trillions of dollars in unfunded obligations through 2097 due to sustained lower birth rates, signaling dire consequences for Social Security’s financial viability.

While reasons for declining birth rates vary, surveys indicate that personal choice, medical issues, and financial constraints weigh heavily in the decision to have fewer children.

The OASI’s asset reserves could be exhausted by 2033. US Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

Congress’ Contribution to Social Security’s Downfall

Congress shares culpability for Social Security’s deteriorating financial health. The lawmakers’ failure to address underlying issues and partisan gridlock further compounds the future challenges awaiting working Americans and retirees.

Democrats and Republicans have proposed divergent solutions, with Democrats aiming to bolster the program through increased taxation on the wealthy. Conversely, Republicans seek to raise the full retirement age to reduce long-term outlays.

While each party’s proposal has its merits, neither fully addresses the program’s widening funding shortfall. The impasse in Congress only exacerbates the predicament, foreshadowing the potential hardship for future retirees.

The $22,924 Social Security Bonus Most Retirees Overlook

If you’re like most Americans, you’re behind on your retirement savings. However, understanding little-known “Social Security secrets” could significantly enhance your retirement income. Learning how to maximize your Social Security benefits could pave the way to a more secure retirement. Discover more about these strategies here.

View the “Social Security secrets”

The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.