Price Target Upgrade Unlocks Potential

In a bold move indicative of market optimism, analysts have dialed up the one-year price target for Jindal Saw (NSEI:JINDALSAW) to 565.08 per share. This palpable surge of 8.91% from the previous mark of 518.84 set on January 16, 2024, signifies a growing momentum in the company’s underlying value.

Diverse Analyst Insights

The revised price target amalgamates insights from numerous analysts, revealing a spectrum of projected values ranging from a low of 485.81 to a high of 682.50 per share. This composite target figure represents an uplift of 8.72% from the most recent closing price of 519.75 per share.

Market Sentiments and Investment Cohesion

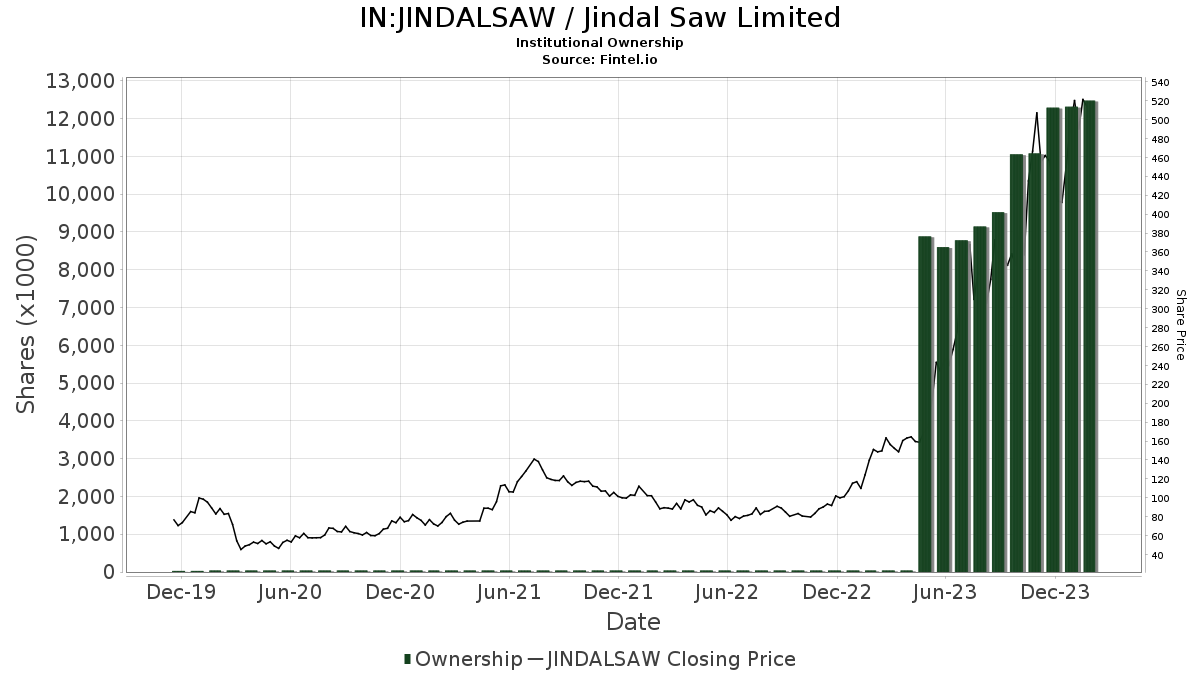

Forty-five funds or institutions have published their positions in Jindal Saw, elucidating a 18.42% upsurge of 7 owners in the last quarter alone. A compelling 0.07% average portfolio weight spanning all funds dedicated to JINDALSAW reflects a substantial 46.50% escalation. Notably, institutions boast a 12.61% spike in total shares owned, amounting now to 12,475K shares.

Strategic Moves Among Shareholders

VEIEX, with the Vanguard Emerging Markets Stock Index Fund Investor Shares, continues to steadfastly hold 1,668K shares, constituting 0.52% ownership – a figure that has remained static in recent times.

VGTSX, managed by the Vanguard Total International Stock Index Fund Investor Shares, retains 1,619K shares (0.51% ownership). Noteworthy is the revelation that the prior filing of the firm reported ownership of 1,707K shares, indicating a decrement of 5.39%. In a strategic pivot, the firm bolstered its portfolio allocation in JINDALSAW by a notable 41.93% over the last quarter.

DFCEX, spearheading the Emerging Markets Core Equity Portfolio – Institutional Class, maintains 1,517K shares (0.48% ownership) stably, without alterations in the recent quarter.

QCSTRX, governing the Stock Account Class R1, holds 1,311K shares (0.41% ownership) with a significant surge from the previous 207K shares, exhibiting an impressive increment of 84.23%. The firm exhibited a remarkable 791.93% surge in their portfolio allocation concerning JINDALSAW during this timeframe.

TAISX, represented by the TIAA-CREF Quant International Small-Cap Equity Fund Advisor Class, possesses 1,100K shares (0.35% ownership). A recent comparison with the prior filing indicates an upswing to 1,059K shares, marking a discernible increase of 3.74%. The firm has elevated its portfolio allocation in JINDALSAW by a commendable 60.47% in the last quarter.

Fintel, a beacon of investment research prowess, extends its wealth of knowledge to individual investors, traders, financial advisors, and small hedge funds.

Our expansive data repository encompasses global fundamentals, analyst reports, ownership insights, fund sentiments, options outlooks, insider dealings, options flow, unique trades, and much more. Further, our exclusive stock recommendations leverage advanced quantitative models that have been rigorously backtested for optimized returns.

Click to Learn More

This narrative was originally featured on Fintel.

The insights and viewpoints expressed herein represent the author’s own perspective and do not necessarily align with those of Nasdaq, Inc.