Revised Price Target Surges to 11.84%: A Rejuvenating Surge

Embark on the exhilarating rollercoaster that is ICON Public Limited (NasdaqGS:ICLR) as the average one-year price target skyrockets to 351.27 per share. This significant increase of 11.84% from the previous prediction of 314.09 on January 16, 2024, paints a promising picture for potential investors. Dive deep into the realm of financial analyses where the latest targets oscillate from a low of 287.85 to a lofty high of 404.25 per share. All in all, the average price target signifies an uplifting 11.81% upsurge from the recent closing price of 314.18 per share.

The Dance of Fund Sentiments: A Symphony of Numbers

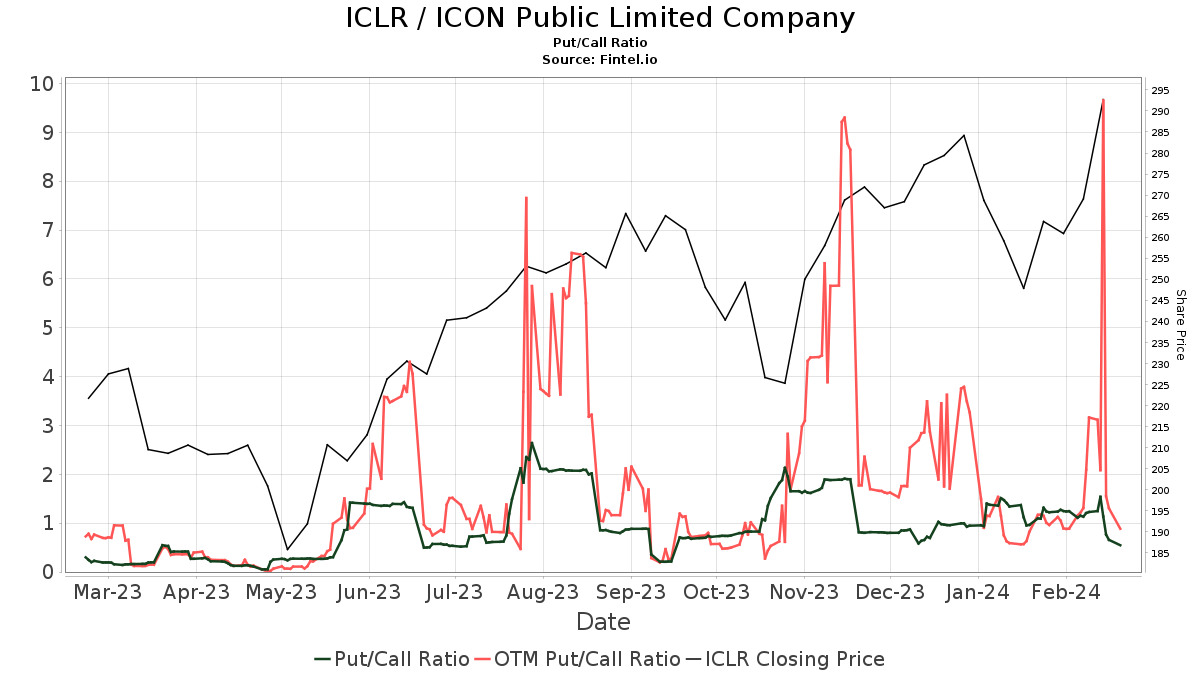

Venture into the pulsating heartbeat of ICON Public Limited where 791 funds or institutions have disclosed their positions, marking a 10.32% increase of 74 owners in the past quarter. The average portfolio weight devoted to ICLR stands at 0.46%, showcasing a slight dip of 1.13%. Witness the surge in total shares owned by institutions over the last three months, escalating by 1.17% to reach a remarkable 88,398K shares. Delve into the mystifying world of put/call ratios at 1.17, suggesting a slightly bearish outlook.

The Shareholder Symphony: A Theater of Ownership

Enter the realm of shareholder strategies as Wcm Investment Management clutches 6,870K shares, equating to an ownership stake of 8.34% in the company. Witness the firm’s strategic move as they shed 10.55% of their prior shares, marking a decrease in portfolio allocation by 1.13% during the last quarter.

Unveil the maneuvers of Massachusetts Financial Services who grasp 5,533K shares, representing a 6.72% ownership slice of the company. With a nimble hand, the firm discards 9.50% of their erstwhile shares, diminishing their portfolio allocation in ICLR by a staggering 85.08% over the last quarter.

Venture forth into the domain of Wellington Management Group Llp, clinching 3,427K shares for a 4.16% stake in the company. Witness the firm’s strategic evolution as they embrace a 2.21% increase in their share count, adjusting their portfolio allocation in ICLR by 84.25% over the last quarter.

Glimpse at the tactical maneuvers of WCMIX – WCM Focused International Growth Fund Institutional Class who grips 2,888K shares, signifying a 3.51% ownership portion of the company. Observe the firm’s strategic transformation as they embrace a 23.45% increase in their share count, boosting their portfolio allocation in ICLR by a substantial 41.75% over the last quarter.

Dive into the strategic decisions of Lazard Asset Management, locking up 2,761K shares to flaunt a 3.35% ownership stake in the company. Observe the firm’s calculated steps as they shed 10.31% of their previous shares, diminishing their portfolio allocation in ICLR by 3.07% over the last quarter.

Insight into ICON: A Glimpse into the Titans

(This insight is graciously provided by the company.)

Embark on a journey with ICON plc, a global powerhouse offering outsourced drug and device development and commercialisation services to pharmaceutical, biotechnology, medical device, and government and public health organizations. Specializing in the meticulous orchestration of programs supporting clinical development, ICON leads the way from compound selection to Phase I-IV clinical studies. Hailing from the emerald isle of Dublin, Ireland, ICON boasts a team of approximately 15,730 employees operating in 93 locations across an astounding 41 countries as of December 31, 2020.

Fintel stands tall as an unparalleled investing research haven for individual investors, traders, financial advisors, and compact hedge funds.

Our expansive data canvas spans the globe, encompassing fundamentals, analyst reports, ownership data, fund sentiments, options sentiment, insider trading, options flow, unusual options trades, and a treasure trove of other invaluable resources. Furthermore, our exclusive stock picks are powered by sophisticated, backtested quantitative models engineered for enhanced profitability.

Immerse yourself further in this enthralling saga!

This captivating narrative initially unfolded on Fintel.

The opinions and viewpoints artistically expressed herein solely belong to the author’s domain and do not necessarily mirror those of Nasdaq, Inc.