The Gilded Path Ahead

A maintainable uptrend paints the horizon for Rail Vikas Nigam (NSEI:RVNL) investors. The company’s one-year price target has dynamically soared to 207.74 per share, revealing a robust 33.41% surge from the previous valuation marked on January 16, 2024.

Market Musings

Analysts’ collaborative estimates have augmented the price target, with projections spanning from a modest 131.30 to a soaring 260.40 per share. These tracings furnish an illustrative landscape that manifests a 17.43% shortfall from the recent market closure at 251.60 per share.

The Revenue Rumble

The current dividend yield of Rail Vikas Nigam stands tall at 0.85%, accompanied by a concise 0.31 dividend payout ratio. This ratio serves as a beacon illuminating the portion of a company’s earnings divvied out as dividends. A study of yesteryears reveals a steady 0.87% dividend growth rate, instilling confidence in the company’s consistent dividend increments over time.

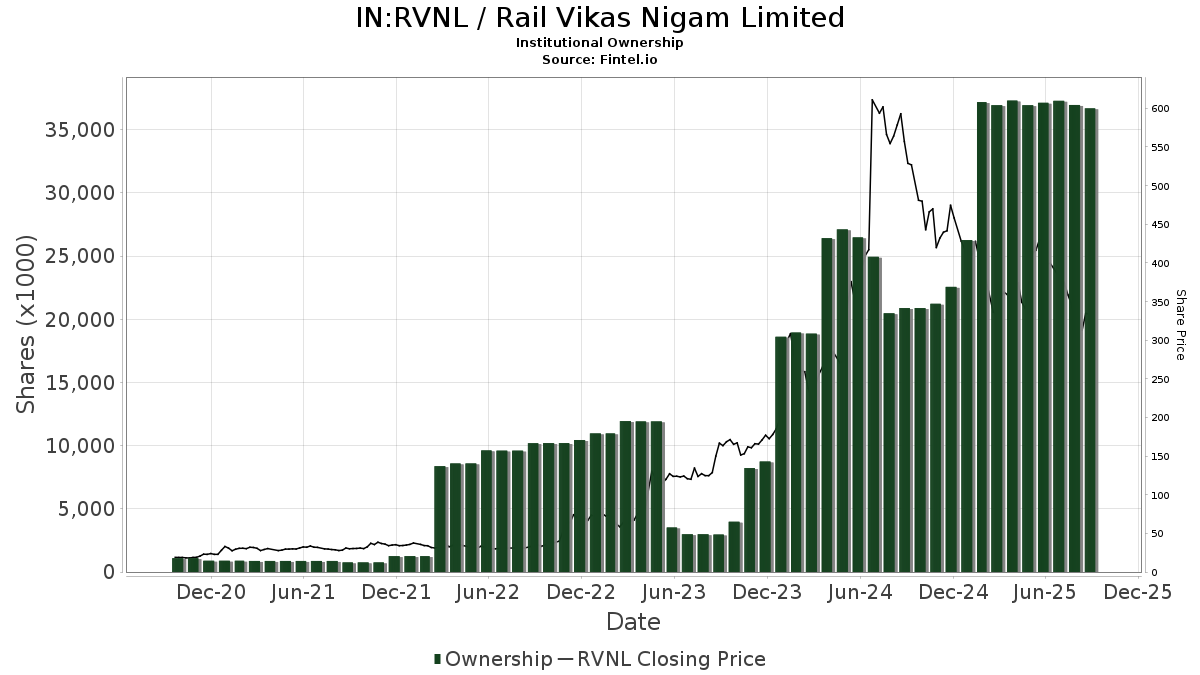

Insights into Institutional Interest

Ownership ripples have surged within Rail Vikas Nigam, attracting the gaze of 24 funds or institutions with recent holdings. This escalation boasts a 71.43% rise in proprietors from the preceding quarter. Delving deeper, we learn that the average portfolio weight dedicated to RVNL across all funds has chiseled to 0.06%, experiencing a notable 43.78% decline. Over the last three months, institutional shares have burgeoned by a remarkable 128.58% tallying 18,950K in total.

Shareholder Symphony

The stalwart VGTSX – Vanguard Total International Stock Index Fund Investor Shares clasps 4,354K shares, securing a 0.21% stake in the company.

VEIEX – Vanguard Emerging Markets Stock Index Fund Investor Shares steadfastly holds 4,287K shares, also leveraging a 0.21% ownership slice in the company.

IEMG – iShares Core MSCI Emerging Markets ETF has a firm grip on 3,893K shares, clinching a 0.19% ownership snippet in the corporation. A promenade through the past holds an enlightening tale as the firm’s RVNL shares escalated by a notable 5.14%, seasoned with a substantial 30.51% augment in RVNL portfolio allocation throughout the previous quarter.

VFSNX – Vanguard FTSE All-World ex-US Small-Cap Index Fund Institutional Shares safeguards 1,175K shares, commanding 0.06% of the company’s ownership.

EPI – WisdomTree India Earnings Fund N safeguards 930K shares, symbolizing a professed 0.04% ownership of the company. A glance at historical filings reveals a riveting narrative of a 48.32% decrease in RVNL holdings, accompanied by a 34.03% reduction in the firm’s RVNL portfolio allocation over the last quarter.

Fintel dons the mantle of one of the most profound investment research platforms available, catering to individual investors, traders, diligent financial advisors, and petite hedge funds.

Our repository delves into a global sprawl inclusive of fundamentals, analyst notes, ownership blueprints, fund sentiments, options chatter, insider activities, options intricacies, peculiar options dealings, and an enchanting ensemble of data. Furthermore, our exclusive stock selections are driven by advanced, rigorously tested quantitative frameworks aimed at fostering enriched yields.

Immerse yourself in the wealth of knowledge. Dive in for more.

This narrative originally surfaced on Fintel.

The gazes and echelons articulated herein echo the ponderings and sagas of the author and not essentially mirror those of Nasdaq, Inc.