Lowe’s Stock Post Q4 Earnings

Lowe’s (NYSE: LOW), a prominent player in the home-improvement retail realm, is gearing up to unveil its fiscal fourth-quarter results on Tuesday, February 27. However, the outlook for the company post-fourth-quarter results is less than rosy, with revenue and earnings poised to fall short of consensus estimates. In a twist of events, Lowe’s has been grappling with a customer mix that has significantly impacted its financial performance in 2023. The allure of the do-it-yourself (DIY) customer base waned in the face of factors such as inclement weather and inflation, causing a dip in remodel and upgrade spending compared to FY’22. These challenges prompted Lowe’s to revise its annual forecasts in light of lackluster DIY sales in Q3, with a projected 5% decline in comparable sales for the full year 2023 compared to an earlier anticipated -2% to -4% decrease. The company is looking at an estimated $86 billion in total sales for the year, with an adjusted EPS outlook of $13.00, down from the prior range of $13.20 to $13.60.

Stock Performance Rollercoaster

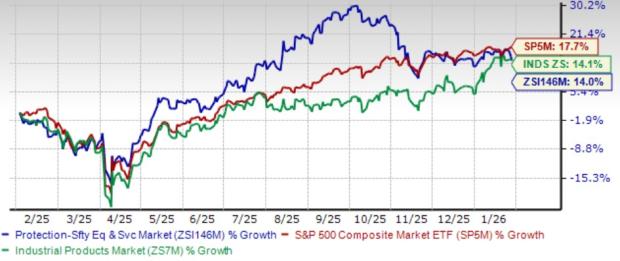

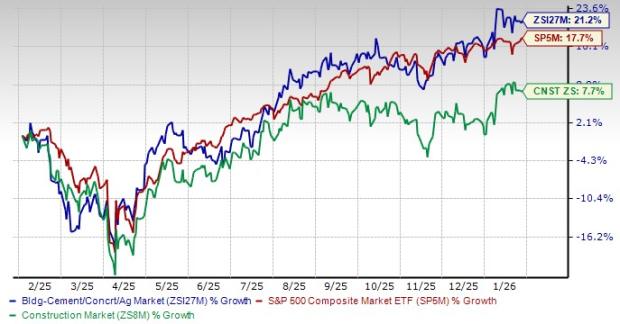

The Lowe’s stock journey has been nothing short of a rollercoaster ride, witnessing a staggering 45% surge from the early January 2021 levels of $160 to its current stance. Despite this impressive uptrend, the trajectory of LOW stock has been anything but consistent. The stock delivered a remarkable 61% return in 2021, experienced a challenging -23% performance in 2022, and rebounded with a modest 12% gain in 2023. Comparatively, the S&P 500 experienced a 27% rise in 2021, a downturn of -19% in 2022, and a solid 24% climb in 2023. This volatile journey underscores the challenges faced by individual stocks, including Lowe’s, in outperforming the S&P 500 consistently. Even stalwarts in the Consumer Discretionary sector like AMZN, TSLA, and TM, as well as tech giants like GOOG, MSFT, and AAPL, have struggled to maintain a stellar track record against the benchmark index in recent years.

On a brighter note, the Trefis High Quality (HQ) Portfolio, housing a curated selection of 30 stocks, boasts a track record of outperforming the S&P 500 annually over the years – a feat that has eluded many individual stocks. The rationale behind this success formula lies in the ability of HQ Portfolio stocks to deliver superior returns with reduced risk exposure compared to the benchmark index, exemplifying a smoother financial journey as evidenced by the HQ Portfolio performance metrics. As Lowe’s navigates through the choppy waters of the current macroeconomic landscape characterized by soaring oil prices and elevated interest rates, the burning question remains: will LOW chart a course similar to its underperformance in 2022 and 2023 vis-a-vis the S&P 500, or is a significant upturn on the horizon?

Analyzing Q4 Projections

Insights from Trefis suggest that Lowe’s valuation stands at $201 per share, presenting a nearly 14% decline from the prevailing market price. For a detailed breakdown of Lowe’s Earnings Preview and what to anticipate in Q4, refer to the interactive dashboard analysis on the subject matter.

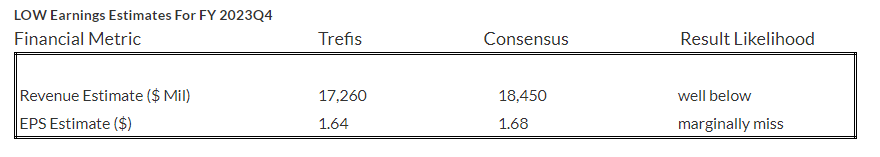

(1) Revenues Below Consensus

Trefis forecasts Lowe’s Q4 2023 revenues to hover around $17.3 billion, anticipated to fall short of the consensus estimate. The company witnessed a 13% decline in revenue year-over-year (y-o-y) in Q3, with revenue standing at $20.5 billion. In the same quarter, Lowe’s saw a 7.4% drop in comparable sales in Q3 2023, attributed to reduced DIY discretionary spending partially offset by positive Pro customer comp sales. The revised estimate for Lowe’s Revenue for fiscal 2023 now points to an 11% y-o-y decrease, settling at approximately $86 billion.

(2) EPS Potential Miss

Projections indicate that Lowe’s Q4 2023 earnings per share (EPS) could land around $1.64, marginally missing the consensus expectation. In Q3, Lowe’s net earnings climbed to $1.8 billion, translating to $3.06 per share, a stark improvement from the prior-year quarter figure of $154 million or 25 cents per share.

(3) Price Estimate Versus Market Price

Based on the Lowe’s Valuation analysis, with an EPS estimate of $13.05 and a P/E multiple of 15.4x in fiscal 2023, the price projection stands at $201, marking a near 14% dip from the current market value.

For a comparative analysis on how Lowe’s Peers stack up against crucial metrics, dive into the Peer Comparisons section for a comprehensive overview.

| Returns | Feb 2024 MTD [1] |

Since start of 2023 [1] |

2017-24 Total [2] |

| LOW Return | 9% | 17% | 227% |

| S&P 500 Return | 5% | 33% | 127% |

| Trefis Reinforced Value Portfolio | 3% | 41% | 625% |

[1] Returns as of 2/26/2024

[2] Cumulative total returns since the end of 2016

Embark on your investment journey with Trefis’ Market-Beating Portfolios for optimal financial outcomes.

Discover additional Trefis Price Estimates here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.