The Alerian MLP Infrastructure Index (AMZI) has recently hit a significant marker, ascending to a level not seen in half a decade in terms of price appreciation, a feat last achieved back in February 2019.

The AMZI serves as the foundational index for both the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). This index, a capped, float-adjusted, cap-weighted amalgamation of energy infrastructure MLPs, comprises companies that predominantly derive their cash flow from midstream operations.

Last week, AMZI’s surge to a five-year high in terms of price return coincided with AMLP, the largest MLP ETF accessible to investors, reaching a four-year high in assets under management. The fund surpassed $8 billion in assets for the first time since January 2020, underscoring robust investor appetite for MLPs.

Throughout the year, AMZI has steadily climbed, defying fluctuating crude oil prices to achieve its highest price level in over half a decade, all while oil prices have struggled to break free from a tight range.

MLPs have proven their mettle in the face of volatile oil prices with their defensive nature. Due to their fee-based business models, MLPs exhibit lesser sensitivity to commodity price movements.

What distinguishes midstream enterprises is the enduring, fee-based nature of their operations, lending them cash flow stability across varying commodity cycles. Unlike other sectors within the energy industry, midstream firms can sustain consistent free cash flow irrespective of the prevailing commodity price environment.

Having stable free cash flow affords companies the ability to bolster dividends and execute buyback programs, two attractive avenues for enhancing shareholder value.

Key to the narrative of midstream firms in recent times has been the emphasis on free cash flow, which has paved the way for substantial returns to shareholders.

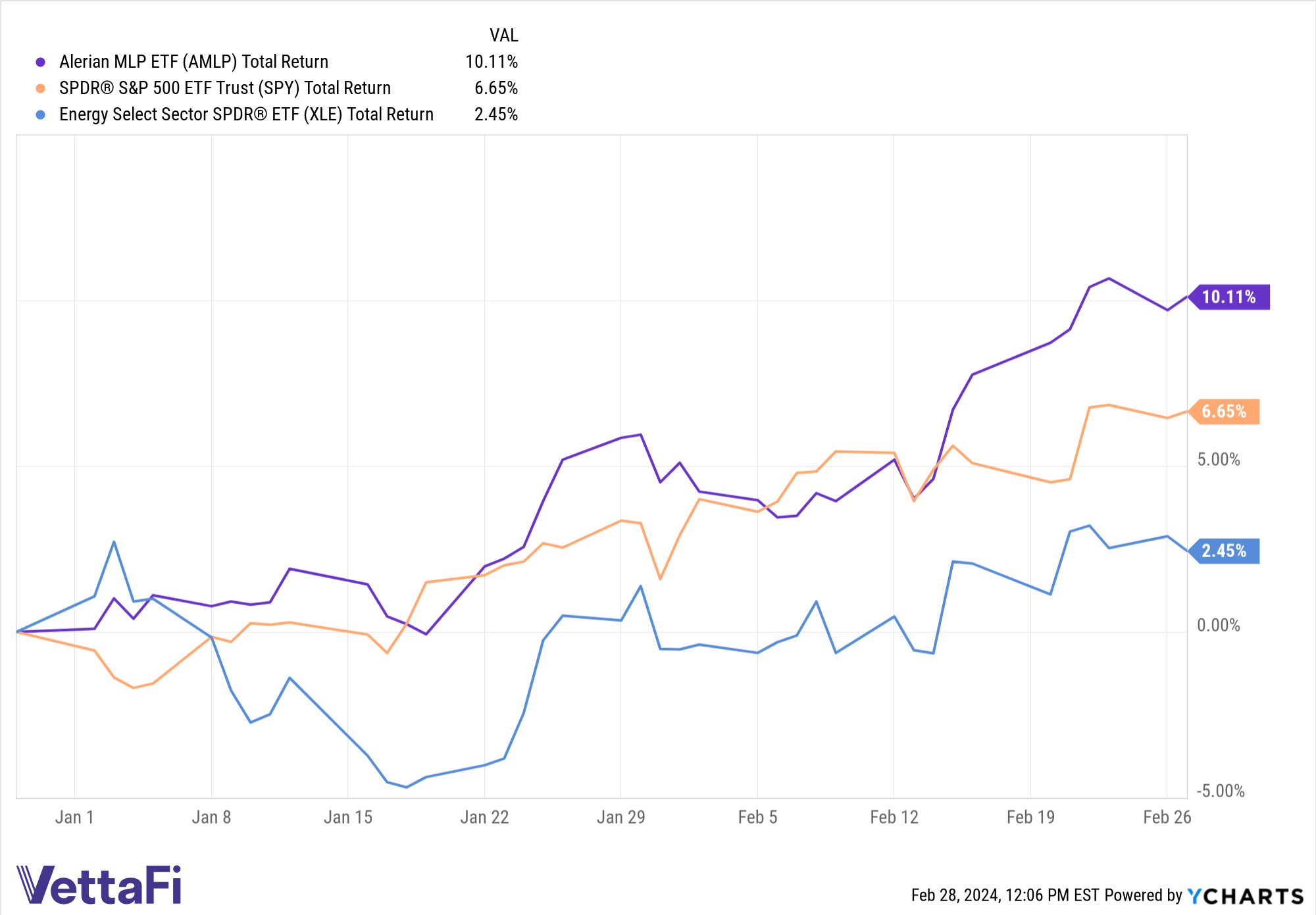

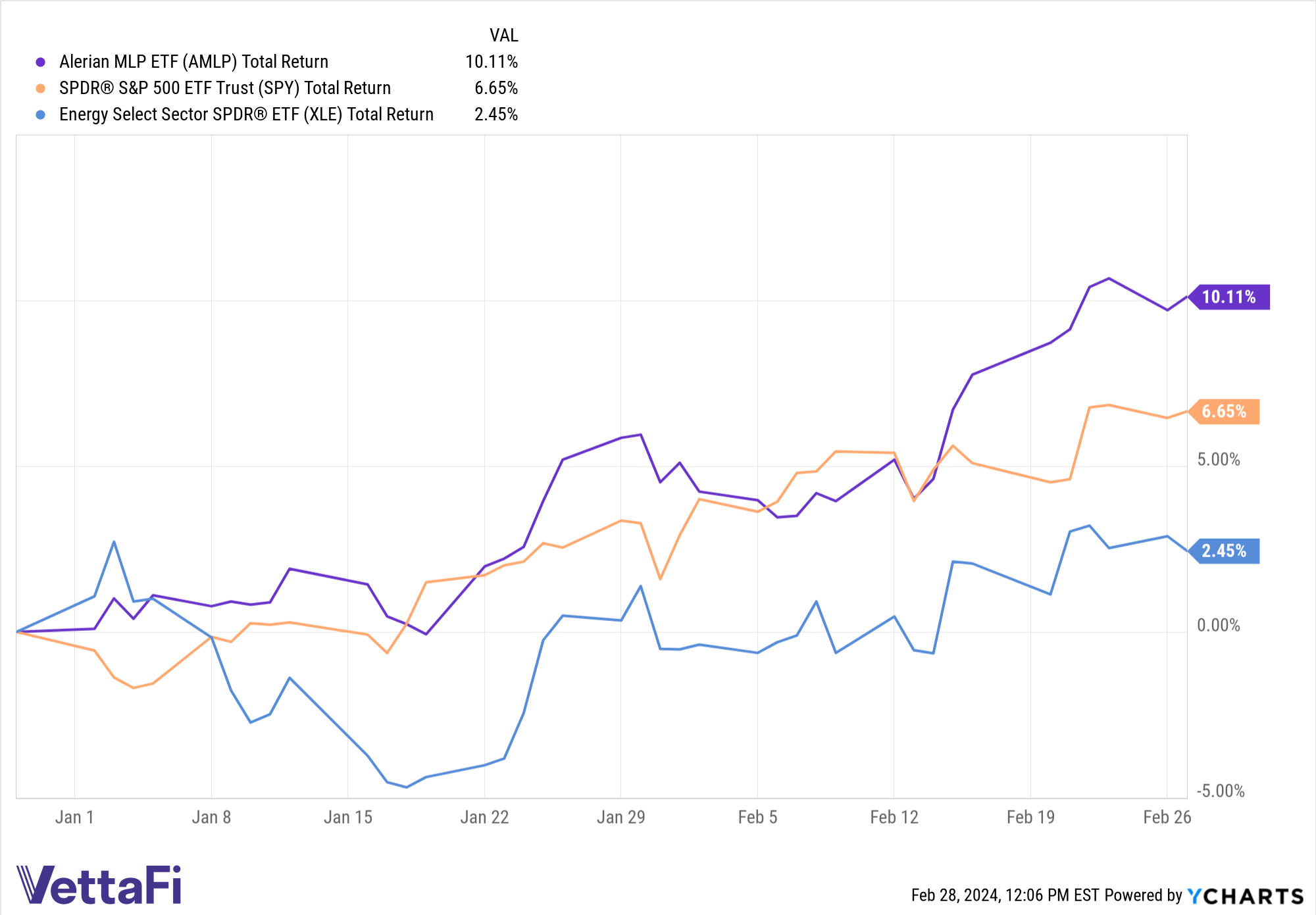

Noteworthy is AMLP’s outperformance compared to the wider energy sector and even the broader equities market represented by the SPDR S&P 500 ETF (SPY) in 2024.

As AMZI Reaches Five-Year High, Valuations Remain Attractive

Despite reaching a five-year pinnacle, the midstream landscape still presents an attractive valuation proposition.

At the conclusion of January, AMZI boasted a forward EV/EBITDA multiple of 8.49x based on 2025 consensus EBITDA estimates, which notably sits below its three-year average of 8.84x.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

Vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi serves as the index provider for AMLP and MLPB, earning an index licensing fee for its services. However, it is essential to note that AMLP and MLPB are not issued, sponsored, endorsed, or sold by VettaFi. VettaFi assumes no obligation or liability concerning the issuance, administration, marketing, or trading of AMLP and MLPB.

The views and opinions expressed herein are solely those of the author and do not necessarily align with those of Nasdaq, Inc.