For investors seeking promising opportunities to unearth rich returns, three stocks merit discerning attention on this exceptional February 29:

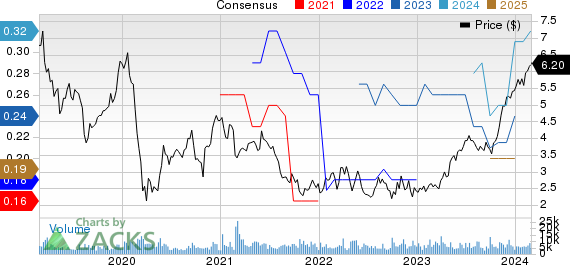

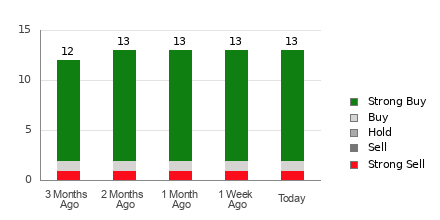

Discovering Ultrapar Participações S.A. UGP: Positioned as an energy and infrastructure entity, the vibrancy of this company shines through its distinguished Zacks Rank #1, showcasing a monumental 31.8% surge in the Zacks Consensus Estimate for its current year earnings over the past 60 days.

Exploring the Radiance of Ultrapar Participacoes S.A.

Ultrapar Participacoes S.A. price-consensus-chart | Ultrapar Participacoes S.A. Quote

The P/E ratio of Ultrapar Participações stands at a compelling 19.66, a standout figure when aligned against the S&P’s 22.57. Garnering an estimable Value Score of B, this gem gleams in the competitive market.

The Luminary PE Ratio of Ultrapar Participacoes S.A.

Ultrapar Participacoes S.A. pe-ratio-ttm | Ultrapar Participacoes S.A. Quote

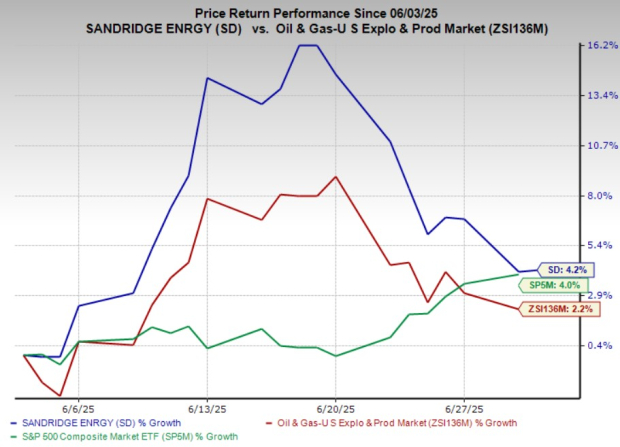

Embarking on the Legend of Honda Motor Co., Ltd. HMC: Driven by innovation, this automotive mogul proudly carries a distinguished Zacks Rank #1, reflecting a 4.3% surge in the Zacks Consensus Estimate for its current year earnings over the past 60 days.

Delving into the Splendor of Honda Motor Co., Ltd.

Honda Motor Co., Ltd. price-consensus-chart | Honda Motor Co., Ltd. Quote

Graced with a modest P/E ratio of 8.45, Honda Motor Co. shines brightly compared to the S&P’s 21.50. Its esteemed Value Score of A underscores its charm amidst investors.

The Eminent PE Ratio of Honda Motor Co., Ltd.

Honda Motor Co., Ltd. pe-ratio-ttm | Honda Motor Co., Ltd. Quote

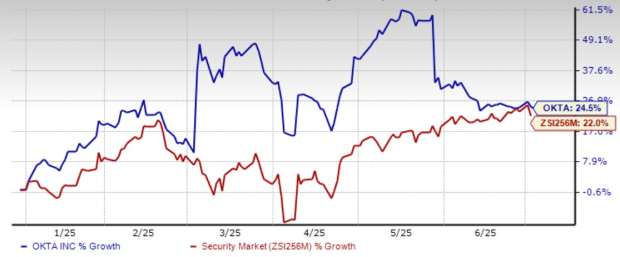

Unveiling the Radiance of Collegium Pharmaceutical, Inc. COLL: Nurturing the healthcare landscape, this pharmaceutical powerhouse proudly bears the illustrious Zacks Rank #1, witnessing a commendable 6.7% upsurge in the Zacks Consensus Estimate for its upcoming year earnings over the past 60 days.

Embracing the Splendor of Collegium Pharmaceutical, Inc.

Collegium Pharmaceutical, Inc. price-consensus-chart | Collegium Pharmaceutical, Inc. Quote

Courting a modest P/E ratio of 6.19, Collegium Pharmaceutical exudes brilliance amidst the industry, gleaming brightly against the S&P’s 21.50. Its prestigious Value Score of A serves as a beacon to savvy investors.

The Revered PE Ratio of Collegium Pharmaceutical, Inc.

Collegium Pharmaceutical, Inc. pe-ratio-ttm | Collegium Pharmaceutical, Inc. Quote

For your discerning perusal of more illustrious picks, explore this exclusive list of top-ranking stocks.

Curious about the Value score and its intricate calculations? Let’s delve into this enlightening terrain.

Embark on the Top 5 ChatGPT Stock Revelations

Embrace the wisdom shared by Zacks Senior Stock Strategist, Kevin Cook, who unveils five meticulously selected stocks birthing immense growth potential within the captivating realm of Artificial Intelligence. By the awe-striking year of 2030, the AI landscape promises a seismic economic impact likened to the revolutionary scales of the internet and iPhone, standing tall at $15.7 Trillion.

Today, immerse in the wave of tomorrow, where automation adorns itself with a persona that embodies responsiveness, integrity, discernment, and impeccable reasoning. As one visionary company articulates, “Automation liberates individuals from the mundane chores, setting them free to perform astounding marvels.”

Download the Enlightening ChatGPT Stock Report Now >>

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Ultrapar Participacoes S.A. (UGP) : Free Stock Analysis Report

Collegium Pharmaceutical, Inc. (COLL) : Free Stock Analysis Report

To indulge in this article on Zacks.com, venture forth here

Drink from the well of wisdom at Zacks Investment Research

Remember, these opinions of the author are pearls of wisdom that may not always mirror the stances of Nasdaq, Inc.