The Rise of Encompass Health

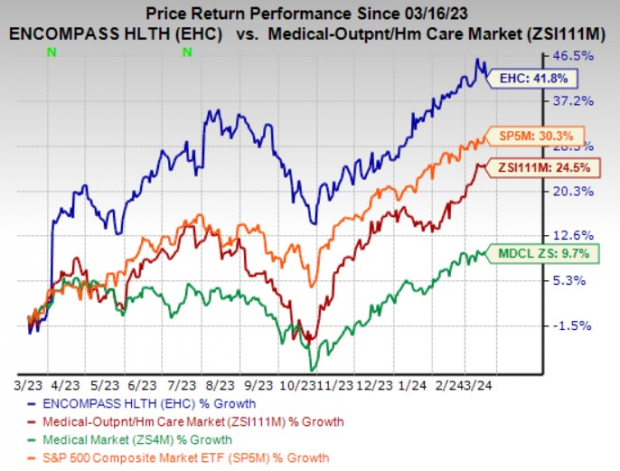

Encompass Health Corporation (EHC) has seen its shares surge by an impressive 41.8% over the past year, outperforming the industry’s growth of 24.5%. This success story stands out even more against the backdrop of the Medical sector’s 9.7% growth and the S&P 500’s 30.3% rise during the same period. With a market capitalization of $7.5 billion and an average trading volume of 0.6 million shares, Encompass Health’s upward trajectory is indicative of its growing significance in the market.

Driving Forces Behind Encompass Health

Encompass Health’s growth can be attributed to several key factors, including increasing patient volumes, strategic joint ventures with healthcare organizations, a positive outlook for 2024, and a strong financial position. As the leading rehabilitation hospital operator, Encompass Health has consistently surpassed earnings estimates, with an average beat of 20.06% over the last four quarters.

Looking Towards the Future

Projections for Encompass Health’s 2024 earnings and revenues indicate a continued upward trend. With the Zacks Consensus Estimate forecasting a 8.2% increase in earnings and a 9.5% growth in revenues from the previous year, the company’s momentum seems set to persist. Moreover, the 13-year Compound Annual Growth Rate (CAGR) of 7.4% in revenues alludes to a steady climb for Encompass Health.

Expansion and Financial Strength

Encompass Health’s strategic expansion plans, such as the recent partnership with Piedmont Healthcare, demonstrate a commitment to broadening its presence and enhancing its service offerings. The company’s solid financial standing, marked by growing cash reserves and robust cash-generating capabilities, provides a strong foundation for continued investment and growth.

The Road Ahead

Looking ahead, Encompass Health is poised to benefit from an aging U.S. population and increasing demand for rehabilitative services. By focusing on inpatient rehabilitative care and leveraging partnerships for regional insights, the company is well-positioned to capitalize on evolving healthcare needs.

Stocks to Keep an Eye On

For investors interested in the Medical sector, stocks like LeMaitre Vascular, Inc., Addus HomeCare Corporation, and DexCom, Inc. present compelling opportunities. Each of these companies boasts strong performance indicators and positive growth outlooks, making them worth considering for a diversified portfolio.