Arm Holdings – A Chip Off the Old Block

Arm Holdings is like a craftsman in the AI chip landscape, designing the masterpieces but leaving the manufacturing to others. Its innovative chip designs cater to the sleek and power-efficient needs of mobile devices, IoT gadgets, servers, and even smart vehicles. The company, acquired by SoftBank in the past, has been a quiet force in the background, with its technology gracing over 95% of the world’s smartphones. Despite facing some headwinds in lucrative markets like China, Arm has maintained a steady trajectory of growth and expansion. The recent surge in revenue and profitability has investors buzzing with anticipation.

AMD – The Sleeper Pick in AI Innovation

Comparatively, Advanced Micro Devices has been the underdog challenging industry titans like Intel and Nvidia. While facing tough competition, AMD’s focus on offering comparable chips at more accessible price points has helped it carve out a niche in the market. Its products, including Epyc CPUs and Instinct GPUs, are gaining traction in the data center realm. Despite enduring a minor setback due to a temporary post-pandemic slowdown, AMD is positioned for a rebound. Analysts foresee a bright future ahead as the company gears up to compete in the AI market with its latest innovations.

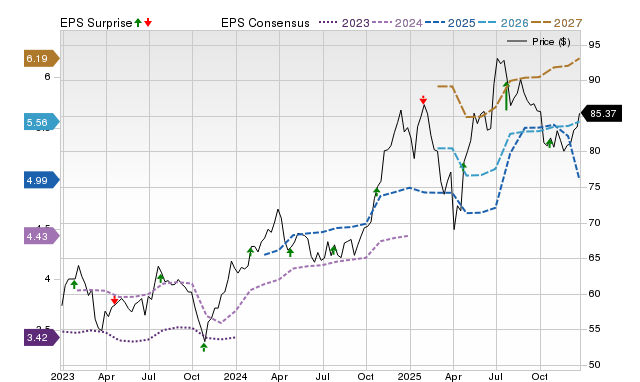

The Dilemma of Choice: Arm vs. AMD

In a market brimming with potential, investors find themselves at a crossroads when considering Arm Holdings and AMD. Both companies offer promising prospects in the flourishing AI sector. The debate on which stock to choose rages on, but one thing is clear – the road to riches may not lie in the obvious choices. While both Arm and AMD present compelling narratives, their valuations hint at a cautionary tale.

As investors weigh their options in this high-stakes game, the allure of AMD’s stability, diversification, and affordability shines through. Choosing the lesser-known path may lead to greater rewards, as the underdog often has more room to grow and surprise the market. SoftBank’s looming shadow over Arm adds an element of uncertainty, making AMD a seemingly safer bet for those seeking a balance of risk and reward.