Investor Sentiment Analysis

Renowned investor Warren Buffett once advised that when the masses are gripped by fear, it is opportune to display courage in the stock market. This philosophy rings true, as showcased by a technical indicator known as the Relative Strength Index (RSI), gauging momentum from zero to 100. Stocks are deemed oversold when the RSI dips below 30.

Relay Therapeutics in the Spotlight

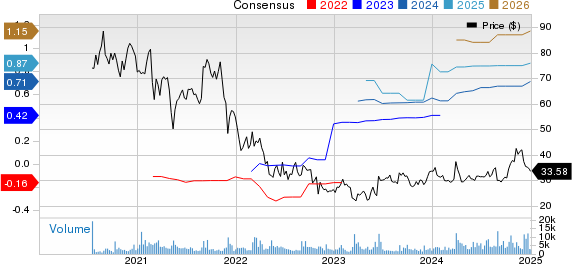

On a recent trading day, shares of Relay Therapeutics Inc (Symbol: RLAY) descended into oversold terrain as the RSI plummeted to 29.9, reaching as low as $7.61 per share. For comparison, the current RSI for the S&P 500 ETF (SPY) stands at 64.9. This dip could entice bullish investors, interpreting RLAY’s RSI reading of 29.9 as an indication of waning selling pressure, potentially signifying opportunities to enter the market on the buying side.

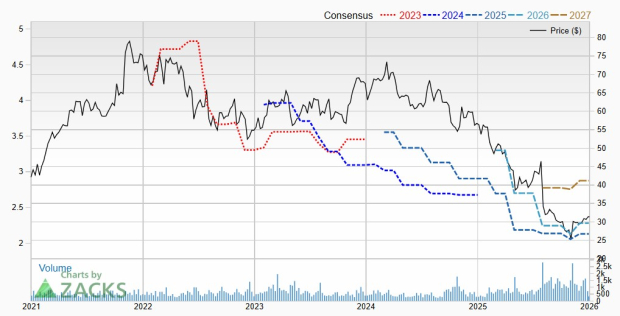

The visual data portrays the year-long journey of RLAY shares, peaking at $19.23 and dropping to its nadir at $5.95 per share while closing at $7.71.

Exploring Further

For further insight into oversold stocks poised for potential rebounds, there are nine other options worth exploring. Amidst the market fluctuations, understanding the dynamics and seizing advantageous positions becomes paramount.

Also see:

Top Ten Hedge Funds Holding ABR

ABCB Dividend Growth Rate

Institutional Holders of POLY

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.