Embracing Shareholders with Enhanced Returns

Amidst the unpredictability of the market, NewtekOne, Inc. NEWT has emerged as a beacon of stability for investors. The company has just announced a 5.5% increase in its quarterly cash dividend, setting it at a robust 19 cents per share. This signals a remarkable gesture towards shareholders, reinforcing their trust and commitment.

It’s crucial to note that within the last five years, NEWT has uplifted its dividend payout a total of 12 times. This consistent upward trajectory speaks volumes about the company’s strategic financial management and unwavering dedication to its investors.

With a current payout ratio of 44% of earnings, NewtekOne strikes a harmonious balance between rewarding its shareholders and retaining sufficient earnings for future growth. This delicate equilibrium showcases the company’s foresight and commitment to long-term sustainability.

Financial Evolution and Strategic Acquisitions

On Jan 6, 2023, the acquisition of the National Bank of New York City marked a significant milestone for NewtekOne. This strategic move, valued at $20 million, not only bolstered the company’s assets but also heralded a transformational shift in its operating structure. Transitioning from a Business Development Company to a financial holding company, NEWT showcased its adaptability and foresight in evolving market landscapes.

Despite a temporary dip in dividend payout back in February 2023, from 70 cents to 18 cents, NewtekOne has demonstrated resilience and agility in navigating turbulent waters. The company swiftly realigned its strategy, safeguarding its financial health while laying the groundwork for sustained growth.

Strength in Financial Foundations

As of Dec 31, 2023, NewtekOne boasted a remarkable total of $184 million in cash and cash equivalents – a notable 46.5% increase from the previous year. This bolstered liquidity not only underscores the company’s financial fortitude but also hints at its capacity for strategic investments and expansion.

Moreover, with a common equity Tier-1 capital ratio of 16.5%, a total capital ratio of 19.6%, and a leverage ratio of 15.6%, NewtekOne stands on solid ground. These robust capital metrics not only ensure financial stability but also lay a strong foundation for continued dividend payouts and shareholder value enhancement.

Future Prospects and Investor Confidence

Against the backdrop of a challenging market environment, NewtekOne’s resilience and commitment to shareholders shine through. With a 7.45% dividend yield based on yesterday’s closing price, NEWT continues to deliver attractive returns to its investors, further solidifying their trust and confidence in the company.

Looking ahead, NewtekOne’s strong capital position and rising liquidity bode well for sustained growth and continued value creation for shareholders. The company’s proactive approach to financial management and strategic investments positions it as a reliable partner for investors seeking stability and growth potential.

Conclusion

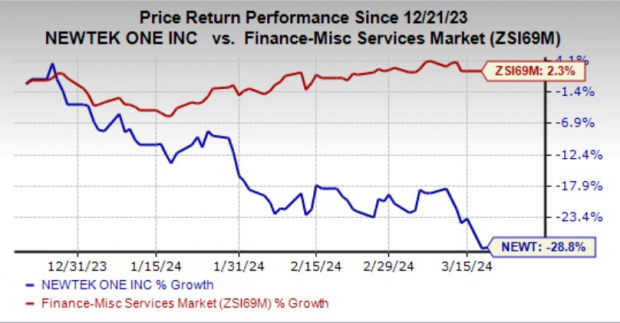

Despite a recent 28.8% decline in share value over the past three months, NewtekOne’s resilience and unwavering commitment to shareholders paint a promising picture for the future. With a Zacks Rank #3 (Hold), the company’s steady performance and strategic decisions underscore its potential for long-term growth and investor satisfaction.