The Dawn of a New Era in Wear OS Navigation

Alphabet’s GOOGL Google has breathtakingly unveiled a new Transit feature for Google Maps on Wear OS, a move that is set to revolutionize the way users navigate public transportation realms.

This Transit feature is a beacon of efficiency, seamlessly integrating with Wear OS Tile for swift travel solutions, furnishing users with precise ETAs following driving, walking, or biking excursions.

Embracing this game-changing functionality, users can now access an avant-garde live map view, a panoramic zoomed-out map view, and an exit icon on their watch face while selecting a route on Google Maps.

This monumental leap is poised to catapult the adoption of Wear OS, propelling Alphabet into a trajectory of unparalleled success within the smartwatch domain.

As the company sets sail on this transformative journey, it is primed to harness the growth opportunities that lie within the vast expanse of the global smartwatch market.

An EMR report forecasts this domain to burgeon into a $160.67 billion behemoth by 2032, unfurling a dynamic CAGR of 15.6% between 2024 and 2032.

The Ever-Evolving Google Maps Landscape

As the world gasps in awe at the unveiling of the Transit feature for Wear OS, Alphabet steers its ship towards further innovation with an array of enhancements to Google Maps.

Introducing a feature that beckons users with explicit building entrances within select locales, the company takes strides to solve the labyrinthine dilemma of navigating specific precincts of buildings on the map.

Embracing the essence of swift navigation, Google ushers in “glanceable directions” on Maps for Android and iOS, adorning the lock screens with live ETAs and directions through regular system notifications.

Further, the company refurbishes Google Maps on Android Auto with a bolder drive time display, akin to other platforms, embellished in version 11.119.0100 of Google Maps and version 11.5 of Android Auto.

This virtuoso display of technological prowess positions Alphabet lucratively in the global digital map arena, projected to soar to $73.1 billion by 2033, with a compelling CAGR of 14.8% between 2023 and 2033, as per a Future Market Insights report.

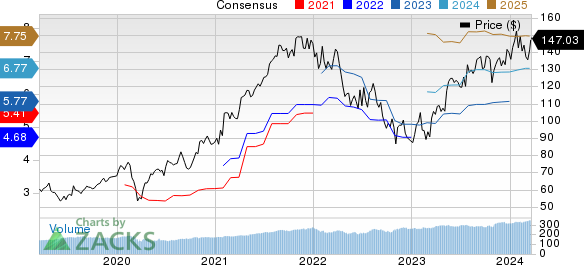

The burgeoning Google Maps efforts are set to fortify its Android repertoire, paving the way for amplified performance within the coveted Google Services segment, a cornerstone of Alphabet’s growth saga. A staggering 45.9% surge in shares over the past year underscores the company’s commanding presence within the Zacks Computer & Technology sector.

The robust Google Services segment is poised to galvanize Alphabet’s financial prowess in the immediate future, with the Zacks Consensus Estimate for 2024 total revenues projecting a formidable 11.7% year-over-year growth.

Navigating the Competitive Tides

As Alphabet charts its course through the digital map seas, it braces for the competitive tempest against stalwarts such as Microsoft and Apple, stalwarts that have entrenched themselves within the digital map milieu.

Apple’s triumphant voyage on the back of its Apple Maps offerings remains a narrative to behold, with the recent launch of Apple Business Connect cementing its standing as a beacon of innovation in the navigation sphere.

Meanwhile, Microsoft rides the surging wave of Bing Maps, amplifying its arsenal with a slew of feature updates, including real-time traffic updates to facilitate efficient voyage planning amidst the tumultuous traffic waters.

Insightful Recommendations and the Market Dynamics

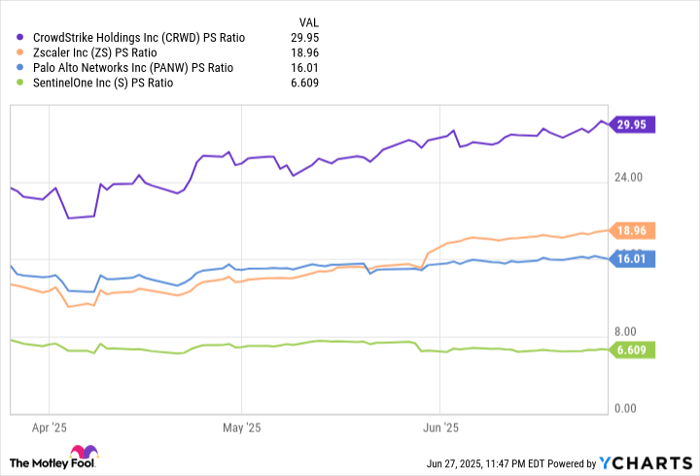

Presently donning a Zacks Rank #3 (Hold), Alphabet mirrors a constellation of technological stars, with CrowdStrike emerging as a powerhouse in the tech sector, adorned with a Zacks Rank #2 (Buy).

With CrowdStrike shares witnessing a 28.7% surge year-to-date, the long-term earnings growth rate of 22.31% adds a glimmer of promise to the investing sky.

As the tech industry witnesses an unprecedented evolution, fueled by the voracious appetite for Artificial Intelligence, Machine Learning, and the Internet of Things, the semiconductor sphere emerges as a potent force, poised to propel from $452 billion in 2021 to a colossal $803 billion by 2028.

The investment horizon beckons with tantalizing possibilities, awaiting intrepid investors to decipher the subtle nuances and unearth the hidden gems within the tech realm.