The past three years of health crisis have ushered in a veritable renaissance for the Medical Info Systems industry. Bolstered by a surge in demand for contactless services, the sector has experienced an unprecedented boom. The call for remote monitoring and treatment has set the stage for the ascendancy of digital services, with the era post-pandemic witnessing a further upswing in the adoption of artificial intelligence (AI) and the Internet of Medical Things in shaping digital healthcare options across hospitals and healthcare institutions.

Analytics from GlobalData project a remarkable CAGR of 29.1% for the use of AI in the medical device market during the 2023-2027 period. The influx of technologies is not merely a fad but a necessity as healthcare systems seek to streamline operations, reduce costs, and enhance detection capabilities – a vital edge while grappling with diagnosing patients with intricate health profiles.

A striking 80% of health systems are committed to upping their ante in digital health investments over the next five years, as detailed in a HIMSS report, a clear sign of the direction healthcare is headed in this digital age.

The Landscape of the Industry

The Medical Info Systems industry, per Zacks, is a realm where companies create and distribute healthcare information systems. These entities provide software and hardware solutions that empower healthcare providers with real-time access to critical clinical, administrative, and financial data in a time-efficient manner. The narrative today is one steeped in patient satisfaction, data security, and cost control, fueling the uptake of big data, 3D printing, blockchain, and AI. Players like Omnicell and Allscripts bask in the riches garnered from software sales, professional IT services, and maintenance contracts for software and related hardware.

The Trifecta of Trends Reshaping the Sector

Remote Healthcare Surge: The reverberations of the pandemic persist as the hunger for contactless services grows exponentially. The telehealth and remote patient monitoring sectors within medical information systems are on a rapid incline. Articles in Forbes and Startech Up underscore the longevity of telehealth trends and AI advancements in healthcare, enabling quicker diagnoses, streamlined workflows, and innovative AI-driven chatbots. Recent market insights foresee the global Smart Healthcare Products market ballooning from $145.9 billion in 2023 to an estimated $485.71 billion by 2032, a testament to the industry’s trajectory.

AI Reshaping Health: The medical domain stands at the frontier of AI integration, harnessing its power to expedite drug discovery, enhance diagnostic accuracy, and pioneer surgical robotics. From electronic health records to real-time alerting, AI is leaving its indelible mark. The field of clinical decision-making, as per the National Institute of Health, is experiencing a revolution through AI, with breakthroughs in predictive diagnostics, classification, and recommendation systems.

Cybersecurity Imperatives: The expansive reach of digitization in healthcare is not without its perils, with cybersecurity now at the forefront of hospital concerns. The vulnerability of wired healthcare systems to cyber-attacks is a growing menace, with instances like the cyberattacks on Henry Schein in late 2023 underscoring the urgency to fortify systems against digital threats.

Industry Valuation & Outlook

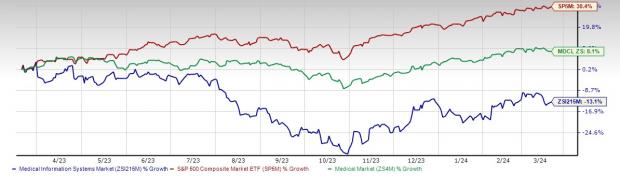

While the industry has faltered against the Zacks S&P 500 Composite and the broader sector in the past year, the landscape is rife with opportunities for rebound. As the sector grapples with an uncertain present, the future teems with potential for the discerning investor keen on tapping into the red-hot prospects of the Medical Information Systems industry.

Revolutionizing Healthcare: A Look at Innovative Medical Technology Stocks

Industry Valuation Metrics

In the realm of financial analysis, the price-to-sales (P/S) ratio carries weight. When evaluating medical stocks, this metric offers valuable insights. Presently, the industry stands at a P/S of 1.3X, a significant difference from the S&P 500’s 3.9X and the sector’s 2.8X.

Valuation Trends Over Time

The past five years have seen interesting fluctuations within the sector’s valuation. From a high of 12.37X to a low of 1.02X, with the median resting at 3.82X, the sector has weathered various market conditions.

The Growth Champions

Inspire Medical, a trailblazing medical technology firm, orchestrates innovative solutions for patients grappling with obstructive sleep apnea (OSA). Armed with the pioneering Inspire system, hailed as the first FDA-approved neurostimulation technology offering safe and effective treatment for moderate to severe OSA, Inspire Medical treads a path of continuous advancement. Their focus on augmenting sales and marketing infrastructure through bolstering the U.S. and European sales force and ramping up direct-to-consumer marketing is emblematic of their commitment to growth.

Projections reflect a promising future, with a Zacks Rank #2 and a forecasted 47.2% surge in 2024 earnings compared to 2023. Sales growth is anticipated at a robust 25% for the same period.

The Vanguard of Virtual Behavioral Healthcare

Talkspace, a pioneer in virtual behavioral healthcare, champions mental wellness through open access to high-quality mental health services. Famed for introducing text therapy with licensed practitioners and extending a wide array of mental health services, including therapy for individuals and couples, psychiatric treatment, and medication management, Talkspace is revolutionizing the mental health landscape.

With a Zacks Rank #2, Talkspace foresees a remarkable 75% earnings growth in 2024 from the previous year. Sales are poised for a notable 28.4% upturn in 2024.

Catalyzing Data-Driven Healthcare

Health Catalyst stands as a stalwart in ushering data and analytics technology to healthcare entities striving for data-driven growth. By leveraging a robust data platform fueled by millions of patient records and comprehensive analytics software, Health Catalyst empowers healthcare organizations to make informed decisions driving measurable improvements in clinical, financial, and operational realms.

Backed by a Zacks Rank #2, Health Catalyst envisions a considerable 113.3% boost in 2024 earnings from 2023. Revenue growth is anticipated at a solid 4.2% for the same year.

Innovations in the Semiconductor Industry

Diving into the realm of semiconductors, a field brimming with promise, we encounter a gem amidst the landscape. With the semiconductor industry projected to surge from $452 billion in 2021 to a colossal $803 billion by 2028, the allure of investing in this sector is palpable.

Amidst giants like NVIDIA, a semiconductor stock has emerged, merely 1/9,000th of its size. Laden with potential for exponential growth due to burgeoning demand for Artificial Intelligence, Machine Learning, and Internet of Things applications, this stock presents a compelling opportunity for investors.

Explore This Stock for Free >>

To stay abreast of the latest recommendations in investments, you can download the report on the 7 Best Stocks for the Next 30 Days, presented by Zacks Investment Research.

Read the full article on Zacks.com here

Explore Zacks Investment Research

The insights presented here reflect the author’s perspective and not those of Nasdaq, Inc.